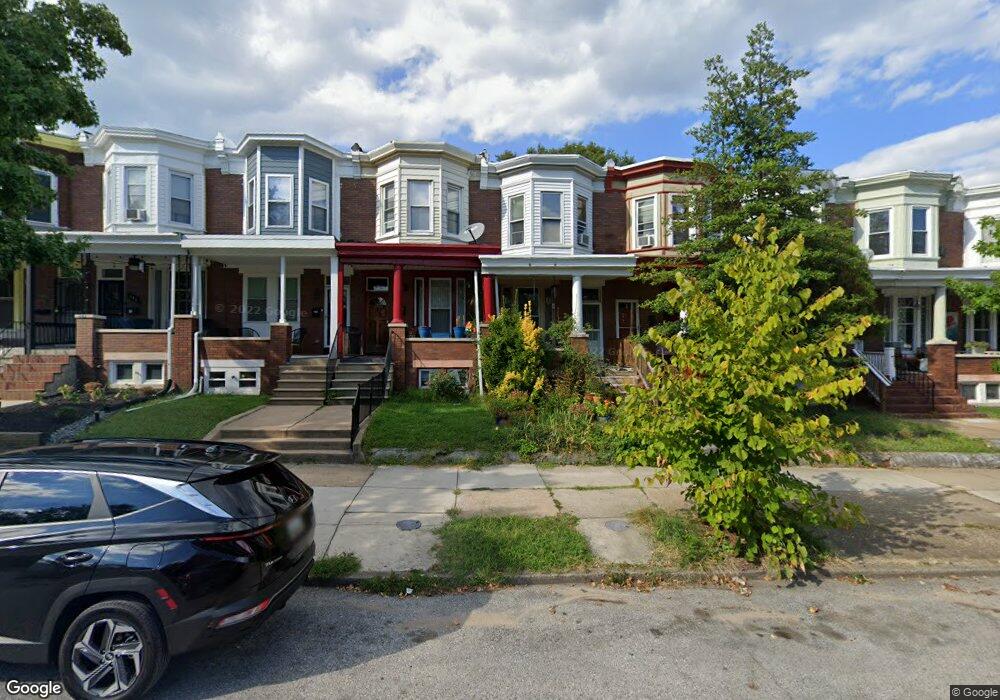

652 E 35th St Baltimore, MD 21218

Waverly NeighborhoodEstimated Value: $134,000 - $162,886

3

Beds

2

Baths

1,260

Sq Ft

$118/Sq Ft

Est. Value

About This Home

This home is located at 652 E 35th St, Baltimore, MD 21218 and is currently estimated at $148,443, approximately $117 per square foot. 652 E 35th St is a home located in Baltimore City with nearby schools including Waverly Elementary School, Booker T. Washington Middle School, and Paul Laurence Dunbar High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 13, 2008

Sold by

U S Bank National Association

Bought by

Pennington Scott A and Webb Melissa M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,040

Outstanding Balance

$50,993

Interest Rate

5.91%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$97,450

Purchase Details

Closed on

Dec 23, 1994

Sold by

Becker Elizabeth L

Bought by

Jones Ralph L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,818

Interest Rate

9.19%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pennington Scott A | $87,000 | -- | |

| U S Bank National Association | $50,000 | -- | |

| Jones Ralph L | $45,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | U S Bank National Association | $80,040 | |

| Closed | Pennington Scott A | $80,040 | |

| Previous Owner | Jones Ralph L | $46,818 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,929 | $98,000 | $30,000 | $68,000 |

| 2024 | $1,929 | $92,900 | -- | -- |

| 2023 | $1,841 | $87,800 | $0 | $0 |

| 2022 | $1,806 | $82,700 | $30,000 | $52,700 |

| 2021 | $1,952 | $82,700 | $30,000 | $52,700 |

| 2020 | $1,803 | $82,700 | $30,000 | $52,700 |

| 2019 | $2,123 | $102,700 | $30,000 | $72,700 |

| 2018 | $2,071 | $101,433 | $0 | $0 |

| 2017 | $2,010 | $100,167 | $0 | $0 |

| 2016 | $1,728 | $98,900 | $0 | $0 |

| 2015 | $1,728 | $98,600 | $0 | $0 |

| 2014 | $1,728 | $98,300 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 3521 Old York Rd

- 806 E 35th St

- 739 E 36th St

- 744 E 36th St

- 3526 Ellerslie Ave

- 3536 Ellerslie Ave

- 631 E 37th St

- 616 E 33rd St

- 3303 Westerwald Ave

- 729 E 37th St

- 409 Southway

- 724 E 37th St

- 3610 Greenmount Ave

- 815 E 33rd St

- 608 Chestnut Hill Ave

- 712 Chestnut Hill Ave

- 831 E 33rd St

- 611 Parkwyrth Ave

- 605 Parkwyrth Ave

- 3748 Old York Rd