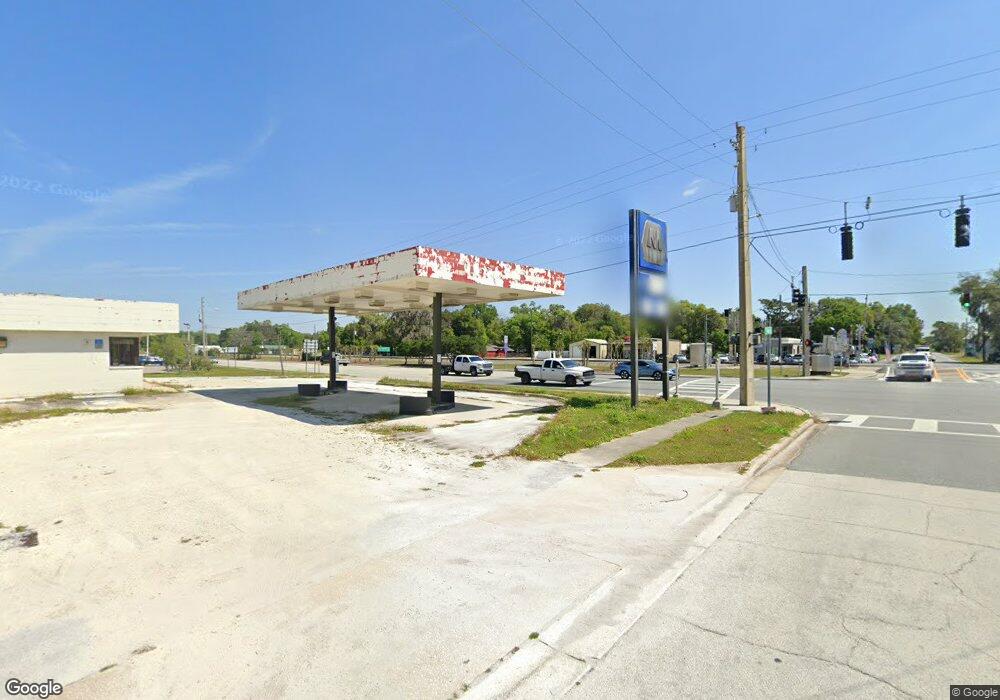

6540 Cr 552n Bushnell, FL 33513

Estimated Value: $265,000 - $284,413

--

Bed

--

Bath

1,104

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 6540 Cr 552n, Bushnell, FL 33513 and is currently estimated at $274,707, approximately $248 per square foot. 6540 Cr 552n is a home located in Sumter County with nearby schools including Bushnell Elementary School, South Sumter High School, and South Sumter Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 27, 2025

Sold by

Dorsey Darlene and Simmons Marsha

Bought by

Sanders Bronson and Sanders Judy

Current Estimated Value

Purchase Details

Closed on

Aug 1, 2024

Sold by

Sanders Judy

Bought by

Dorsey Darlene

Purchase Details

Closed on

Jul 22, 2024

Sold by

Dorsey Darlene

Bought by

Sanders Bronson and Sanders Judy

Purchase Details

Closed on

Sep 13, 2021

Sold by

Dorsey Darlene

Bought by

Dorsey Darlene and Simmons Marsha

Purchase Details

Closed on

Apr 16, 2018

Sold by

Henderson Everlena

Bought by

Henderson Everlena and Dorsey Darlene

Purchase Details

Closed on

Jan 4, 2008

Sold by

Randall Darren

Bought by

Randall Judy

Purchase Details

Closed on

Jul 21, 2006

Sold by

Henderson Everlena

Bought by

Randall Darren and Randall Judy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sanders Bronson | $100 | None Listed On Document | |

| Sanders Bronson | $100 | None Listed On Document | |

| Dorsey Darlene | $100 | None Listed On Document | |

| Sanders Bronson | $100 | None Listed On Document | |

| Dorsey Darlene | -- | Attorney | |

| Henderson Everlena | -- | Attorney | |

| Randall Judy | -- | None Available | |

| Randall Darren | -- | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,461 | $131,790 | $40,900 | $90,890 |

| 2023 | $1,461 | $128,660 | $40,900 | $87,760 |

| 2022 | $1,532 | $135,400 | $32,720 | $102,680 |

| 2021 | $1,688 | $135,400 | $32,720 | $102,680 |

| 2020 | $1,698 | $130,610 | $32,720 | $97,890 |

| 2019 | $124 | $90,740 | $0 | $0 |

| 2018 | $124 | $89,050 | $0 | $0 |

| 2017 | $124 | $87,220 | $28,970 | $58,250 |

| 2016 | $124 | $87,220 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 0 Cr 552

- 0 SE Parcel Id # N15-181 Terrace Unit MFRTB8350394

- 6698 SE 5th Terrace

- 275 Cr 552

- 520 Boitnott Ln

- 352 S Justice St

- 0 Cr 763

- 413 N Florida St

- 132 E Belt Ave

- 5562 S Us 301

- 975 Cr 542e

- 408 Etheredge St

- 112 Cr 551

- 214 W Dade Ave

- 000 W Belt Ave Sr 48

- 309 N Westwood St

- 5551 S West St Unit 426

- 403 W Palm Ave

- 503 N West St

- 392 Cr 542e