6563 State Route 132 Goshen, OH 45122

Estimated Value: $339,000 - $514,703

4

Beds

3

Baths

2,000

Sq Ft

$206/Sq Ft

Est. Value

About This Home

This home is located at 6563 State Route 132, Goshen, OH 45122 and is currently estimated at $411,176, approximately $205 per square foot. 6563 State Route 132 is a home located in Clermont County with nearby schools including Marr/Cook Elementary School, Spaulding Elementary School, and Goshen Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 2, 2020

Sold by

Ransom Cheryl R and Schmidt Constance R

Bought by

Roesch Scott

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$214,051

Outstanding Balance

$189,740

Interest Rate

3.2%

Mortgage Type

FHA

Estimated Equity

$221,436

Purchase Details

Closed on

Feb 23, 1998

Sold by

Phyllis J Morgan Trst

Bought by

Ransom Charles K and Ransom Cheryl R

Purchase Details

Closed on

Aug 29, 1995

Sold by

Morgan Phyllis J

Bought by

Al Charles K Ransom and Al Constance R Schm T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,600

Interest Rate

7.43%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Roesch Scott | $218,000 | First Ohio Title Insurance | |

| Ransom Charles K | $25,000 | -- | |

| Al Charles K Ransom | $134,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Roesch Scott | $214,051 | |

| Previous Owner | Al Charles K Ransom | $120,600 | |

| Closed | Ransom Charles K | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,958 | $132,690 | $56,420 | $76,270 |

| 2023 | $5,775 | $132,690 | $56,420 | $76,270 |

| 2022 | $4,694 | $94,930 | $40,080 | $54,850 |

| 2021 | $4,721 | $94,930 | $40,080 | $54,850 |

| 2020 | $4,413 | $94,930 | $40,080 | $54,850 |

| 2019 | $4,246 | $87,570 | $38,080 | $49,490 |

| 2018 | $4,266 | $87,570 | $38,080 | $49,490 |

| 2017 | $3,993 | $87,570 | $38,080 | $49,490 |

| 2016 | $3,993 | $76,790 | $33,390 | $43,400 |

| 2015 | $3,606 | $76,790 | $33,390 | $43,400 |

| 2014 | $3,606 | $76,790 | $33,390 | $43,400 |

| 2013 | $3,018 | $75,880 | $31,430 | $44,450 |

Source: Public Records

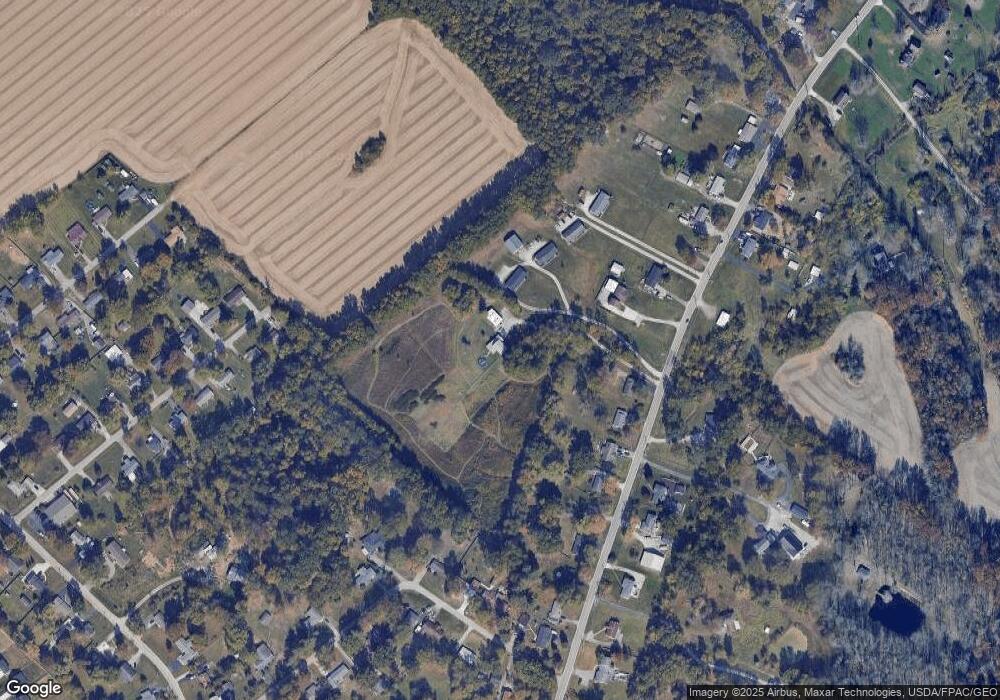

Map

Nearby Homes

- 1811 Louis Ln

- 6538 Glen Eagle Way

- 6536 Glen Eagle Way

- Cedar with Full Basement Plan at Barclay Woods

- Birch with Full Basement Plan at Barclay Woods

- Elder with Full Basement Plan at Barclay Woods

- Aspen with Full Basement Plan at Barclay Woods

- Tupelo with Full Basement Plan at Barclay Woods

- 6565 Hillside Dr

- 6563 Hillside Dr

- 1786 Broadstone Cir

- 6442 Charles Snider Rd

- 1019 Canterbury Ln

- 1788 Heritage Woods Dr

- 2045 Irwin Cemetery Ln

- 6677 Wood St

- 2016 Woodville Pike

- 6484 Springhouse Ave

- 6747 Wood St

- 3009 Abby Way

- 6567 State Route 132

- 6569 State Route 132

- 6561 State Route 132

- 6571 State Route 132

- 6557 State Route 132

- 6575 State Route 132

- 6571 Ohio 132

- 6559 State Route 132

- 6573 State Route 132

- 6555 State Route 132

- 6577 State Route 132

- 6551 State Route 132

- 6547 State Route 132

- 6570 State Route 132

- 1825 Lois Ln

- 6579 State Route 132

- 108 Oakview Dr

- 6556 State Route 132

- 6543 State Route 132

- 100 Oakview Dr