66 Twisted Cliff Ln Leavenworth, WA 98826

Estimated Value: $1,267,927 - $1,543,000

4

Beds

3

Baths

2,591

Sq Ft

$535/Sq Ft

Est. Value

About This Home

This home is located at 66 Twisted Cliff Ln, Leavenworth, WA 98826 and is currently estimated at $1,385,642, approximately $534 per square foot. 66 Twisted Cliff Ln is a home located in Chelan County with nearby schools including Cascade High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 11, 2015

Sold by

Miller Kimberly Sloan and Urbano Dominic

Bought by

Stein Desiree L and Trujillo Eric J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$460,000

Outstanding Balance

$350,233

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$1,035,409

Purchase Details

Closed on

Nov 15, 2011

Sold by

Buttress Ginie A

Bought by

Miller Kimberley Sloan and Urbano Dominic

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$325,000

Interest Rate

3.87%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 12, 2011

Sold by

Buttress Joe W

Bought by

Buttress Ginie A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stein Desiree L | $575,000 | North Meridian Title & Escro | |

| Miller Kimberley Sloan | $434,000 | North Meridian Title & Escro | |

| Buttress Ginie A | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stein Desiree L | $460,000 | |

| Previous Owner | Miller Kimberley Sloan | $325,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2021 | $6,866 | $719,012 | $231,830 | $487,182 |

| 2020 | $6,247 | $620,188 | $187,612 | $432,576 |

| 2019 | $8,070 | $592,113 | $168,809 | $423,304 |

| 2018 | $6,775 | $749,129 | $138,374 | $610,755 |

| 2017 | $6,582 | $583,654 | $176,406 | $407,248 |

| 2016 | $4,591 | $602,379 | $165,554 | $436,825 |

| 2015 | $4,591 | $568,876 | $122,633 | $446,243 |

| 2013 | $4,591 | $433,164 | $104,850 | $328,314 |

Source: Public Records

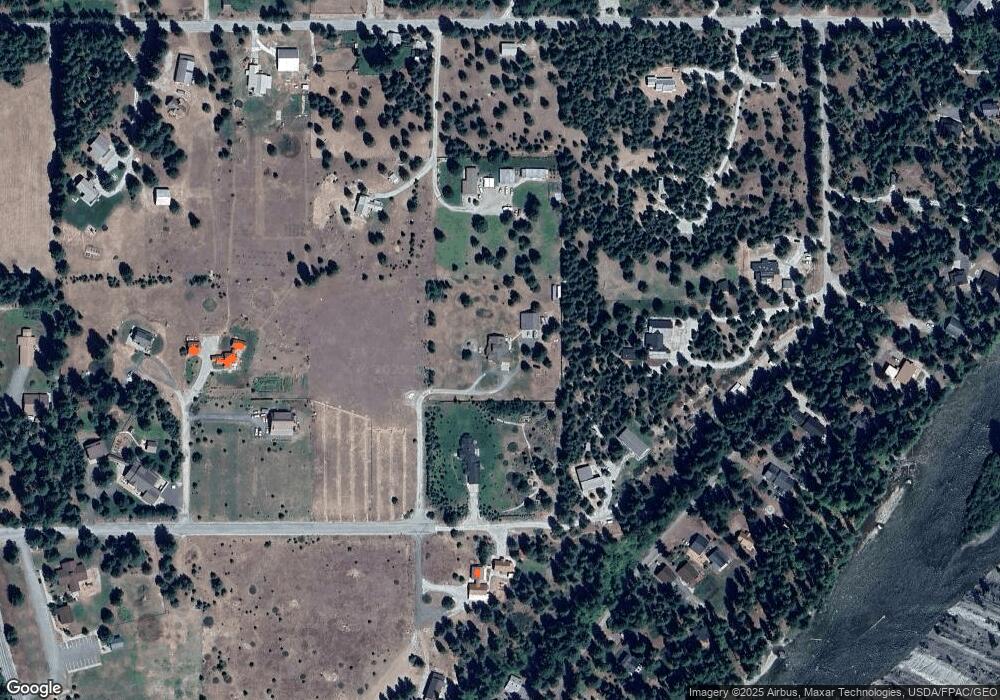

Map

Nearby Homes

- 19374 Westside Dr

- 19160 Westside Dr

- 0 S Shugart Flats Rd

- 12469 W Shugart Flats Rd

- 12360 W Shurgart Flats Rd

- 18725 River Rd

- 19990 S Shugart Flats Rd

- 18527 Hazel St

- 20106 Shugart Flats Rd

- 152 Wilcox Ln

- 18350 Beaver Valley Rd

- 11411 Shugart Flats Rd

- 2628 Cottonwood Ln

- 2514 Kinnikinnick Dr

- 2620 Wenatchee Pines

- 0 Forrest Service 6601-550 Rd Unit NWM2393095

- 2316 Pine Tree Rd

- 197 Swiftwater Ln

- 25813 Bridle Ln

- 25711 Bridle Ln

- 65 Twisted Cliff Ln

- 12440 Hill St

- 19364 Bratton Ln

- 81 Nighthawk Ln

- 12088 Bretz Rd

- 12303 Bretz Rd

- 12441 Hill St

- 12065 Bretz Rd

- 12057 Bretz Dr

- 12130 Bretz Dr

- 12335 Bretz Rd

- 12073 Bretz Rd

- 12089 Bretz Rd

- 12393 Bretz Rd

- 12081 Bretz Rd

- 12057 Bretz Rd

- 12097 Bretz Rd

- 12049 Bretz Rd

- 12033 Bretz Rd

- 12041 Bretz Rd