6603 Elmhust Way Hoschton, GA 30548

Estimated Value: $446,000 - $475,000

2

Beds

2

Baths

1,684

Sq Ft

$275/Sq Ft

Est. Value

About This Home

This home is located at 6603 Elmhust Way, Hoschton, GA 30548 and is currently estimated at $462,412, approximately $274 per square foot. 6603 Elmhust Way is a home located in Hall County with nearby schools including Chestnut Mountain Elementary School, Cherokee Bluff Middle School, and Cherokee Bluff High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 22, 2025

Sold by

Diesner Karen

Bought by

Tobias Ronald William and Tobias Bonnie Marie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$360,000

Outstanding Balance

$356,881

Interest Rate

6.85%

Mortgage Type

New Conventional

Estimated Equity

$105,531

Purchase Details

Closed on

Aug 25, 2022

Sold by

Diesner Dean

Bought by

Diesner Karen

Purchase Details

Closed on

Feb 16, 2018

Sold by

Symasek Patricia

Bought by

Diesner Dean and Diesner Karen

Purchase Details

Closed on

Jun 6, 2013

Sold by

Pulte Home Corp

Bought by

Symasek Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$213,692

Interest Rate

3.42%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tobias Ronald William | $450,000 | -- | |

| Diesner Karen | -- | -- | |

| Diesner Dean | $326,000 | -- | |

| Symasek Patricia | $267,115 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tobias Ronald William | $360,000 | |

| Previous Owner | Symasek Patricia | $213,692 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,778 | $194,720 | $38,480 | $156,240 |

| 2024 | $1,692 | $190,960 | $38,480 | $152,480 |

| 2023 | $1,432 | $171,560 | $35,160 | $136,400 |

| 2022 | $1,572 | $161,880 | $29,000 | $132,880 |

| 2021 | $1,433 | $138,240 | $26,360 | $111,880 |

| 2020 | $1,463 | $138,240 | $26,360 | $111,880 |

| 2019 | $1,419 | $131,520 | $28,640 | $102,880 |

| 2018 | $3,668 | $128,400 | $28,640 | $99,760 |

| 2017 | $3,253 | $114,840 | $28,640 | $86,200 |

| 2016 | $3,036 | $109,720 | $28,640 | $81,080 |

| 2015 | $2,962 | $109,720 | $28,640 | $81,080 |

| 2014 | $2,962 | $109,720 | $28,640 | $81,080 |

Source: Public Records

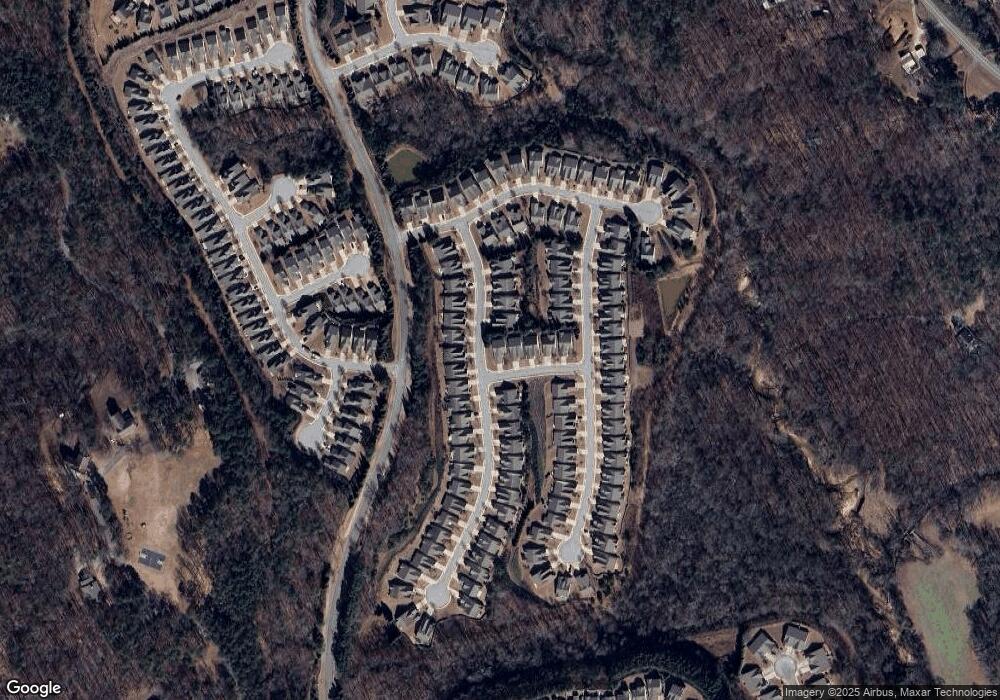

Map

Nearby Homes

- 6525 Bradford Ct

- 6247 Longleaf Dr

- 6407 Lantern Ridge

- 6745 Mill Rock Ct

- 6484 Lantern Ridge

- 6218 Longleaf Dr

- 6212 Longleaf Dr

- 6288 Ivy Stone Way

- 6208 Longleaf Dr

- 6407 Autumn Crest Ln

- 5634 Union Church Rd

- 5745 Union Church Rd

- 6184 Longleaf Dr

- 6443 Autumn Crest Ln

- 6242 Ivy Stone Way

- 6221 Greenstone Cir

- 6039 Hickory Creek Ct

- 6503 Grove Park Dr

- 6220 Ivy Stone Way

- 6233 Greenstone Cir

- 6603 Elmhurst Way Unit 975

- 6639 Fawn Meadow Ln

- 6607 Elmhurst Way

- 6611 Elmhust Way

- 6632 Fawn Meadow Ln

- 6636 Fawn Meadow Ln

- 6611 Elmhurst Way

- 6628 Fawn Meadow Ln

- 6640 Fawn Meadow Ln

- 6621 Fawn Meadow Ln

- 6624 Fawn Meadow Ln Unit 883

- 6624 Fawn Meadow Ln

- 6615 Elmhurst Way

- 6644 Fawn Meadow Ln

- 6647 Fawn Meadow Ln

- 6620 Fawn Meadow Ln

- 6742 Black Fox Dr

- 6648 Fawn Meadow Ln

- 6746 Black Fox Dr

- 6651 Fawn Meadow Ln Unit 4