6611 Brigham Square Unit 5 Dayton, OH 45459

Estimated Value: $168,826 - $173,000

2

Beds

2

Baths

1,077

Sq Ft

$159/Sq Ft

Est. Value

About This Home

This home is located at 6611 Brigham Square Unit 5, Dayton, OH 45459 and is currently estimated at $171,207, approximately $158 per square foot. 6611 Brigham Square Unit 5 is a home located in Montgomery County with nearby schools including Primary Village North, Driscoll Elementary School, and Tower Heights Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2006

Sold by

Baer Christine and Martin Christine

Bought by

Baer Christine and Baer Darrell E

Current Estimated Value

Purchase Details

Closed on

Jan 31, 2005

Sold by

Baer Donald E

Bought by

Baer Christine and Martin Christine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$7,063

Outstanding Balance

$3,599

Interest Rate

5.79%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$167,608

Purchase Details

Closed on

Jun 29, 1999

Sold by

Powell Judd T and Powell Melissa A Shigley

Bought by

Martin Christine and Baer Donald E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$66,350

Interest Rate

7.29%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Baer Christine | -- | None Available | |

| Baer Christine | -- | None Available | |

| Martin Christine | $67,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Baer Christine | $7,063 | |

| Previous Owner | Martin Christine | $66,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,836 | $40,540 | $12,400 | $28,140 |

| 2023 | $1,836 | $40,540 | $12,400 | $28,140 |

| 2022 | $1,306 | $26,360 | $8,050 | $18,310 |

| 2021 | $1,310 | $26,360 | $8,050 | $18,310 |

| 2020 | $1,308 | $26,360 | $8,050 | $18,310 |

| 2019 | $1,071 | $21,570 | $8,050 | $13,520 |

| 2018 | $951 | $21,570 | $8,050 | $13,520 |

| 2017 | $940 | $21,570 | $8,050 | $13,520 |

| 2016 | $1,182 | $24,030 | $8,050 | $15,980 |

| 2015 | $1,184 | $24,030 | $8,050 | $15,980 |

| 2014 | $1,170 | $24,030 | $8,050 | $15,980 |

| 2012 | -- | $23,910 | $8,050 | $15,860 |

Source: Public Records

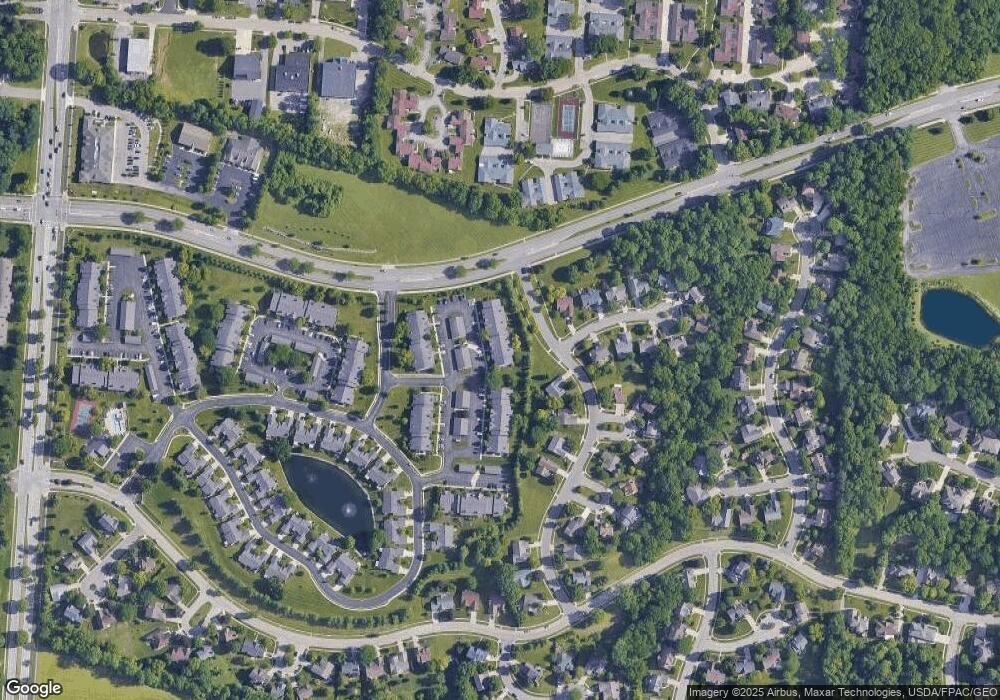

Map

Nearby Homes

- 1973 Home Path Ct

- 6350 Gwinnett Ln Unit 1326

- 6650 Wareham Ct Unit 5

- 1511 Lake Pointe Way

- 1511 Lake Pointe Way Unit 2

- 6610 Green Branch Dr

- 1310 Hollow Run Unit 3

- 1311 Hollow Run Unit 11

- 1311 Hollow Run Unit 6

- 1740 Piper Ln

- 1770 Piper Ln Unit 208

- 1820 Piper Ln Unit 103

- 1316 Daventry Ct Unit 25D3131

- 6102 Singletree Ln

- 6780 Montpellier Blvd

- 2278 Millwood Rd

- 1237 Chevington Ct Unit 1515

- 1457 Carriage Trace Blvd Unit 4

- 6046 N Quinella Way Unit 51246

- 6067 Hackamore Trail Unit 20

- 6611 Brigham Square Unit 6611661

- 6611 Brigham Square Unit 6611661

- 6611 Brigham Square Unit 6611661

- 6611 Brigham Square Unit 6611661

- 6611 Brigham Square Unit 6611661

- 6611 Brigham Square Unit 6611661

- 6611 Brigham Square Unit 4

- 6611 Brigham Square Unit G97

- 6611 Brigham Square Unit G96

- 6611 Brigham Square Unit G95

- 6611 Brigham Square Unit G94

- 6611 Brigham Square Unit G93

- 6611 Brigham Square Unit 6611661

- 6611 Brigham Square Unit 6611661

- 6611 Brigham Square Unit 7

- 6611 Brigham Square Unit 1

- 6611 Brigham Square Unit 3

- 6611 Brigham Square Unit 207

- 6611 Brigham Square

- 6611 Brigham Square Unit 6