Estimated Value: $52,797 - $269,000

2

Beds

1

Bath

715

Sq Ft

$197/Sq Ft

Est. Value

About This Home

This home is located at 662 Elm St, Colon, MI 49040 and is currently estimated at $140,949, approximately $197 per square foot. 662 Elm St is a home located in St. Joseph County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 6, 2022

Sold by

Kay Wheeler Susan

Bought by

Harrison Dawne

Current Estimated Value

Purchase Details

Closed on

Jun 23, 2009

Sold by

Grigsby Deo and Grigsby Katherine E

Bought by

Wheeler Donald E and Wheeler Susan K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$25,600

Interest Rate

4.86%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 18, 2008

Sold by

Boysen Linda and Nystrom Shirley

Bought by

Grigsby Deo and Grigsby Katherine E

Purchase Details

Closed on

Jun 11, 2007

Sold by

Harrington Robert R and Boysen Linda

Bought by

Nystrom Shirley and Boysen Linda

Purchase Details

Closed on

Sep 26, 2003

Sold by

Harrington Robert R

Bought by

Grigsby Deo and Grigsby Katherine E

Purchase Details

Closed on

Jan 1, 1901

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Harrison Dawne | -- | None Listed On Document | |

| Wheeler Donald E | $32,000 | Lighthouse Title Inc | |

| Grigsby Deo | $25,000 | None Available | |

| Nystrom Shirley | $3,611 | None Available | |

| Grigsby Deo | -- | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wheeler Donald E | $25,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $337 | $12,200 | $5,400 | $6,800 |

| 2024 | $290 | $11,800 | $4,900 | $6,900 |

| 2023 | $542 | $11,700 | $4,900 | $6,800 |

| 2022 | $0 | $9,200 | $4,200 | $5,000 |

| 2021 | $404 | $9,200 | $4,200 | $5,000 |

| 2020 | $121 | $8,900 | $3,500 | $5,400 |

| 2019 | $95 | $9,000 | $3,500 | $5,500 |

| 2018 | $506 | $8,900 | $3,500 | $5,400 |

| 2017 | $504 | $9,300 | $9,300 | $0 |

| 2016 | -- | $8,800 | $8,800 | $0 |

| 2015 | -- | $8,900 | $0 | $0 |

| 2014 | -- | $9,200 | $9,200 | $0 |

| 2012 | -- | $8,600 | $8,600 | $0 |

Source: Public Records

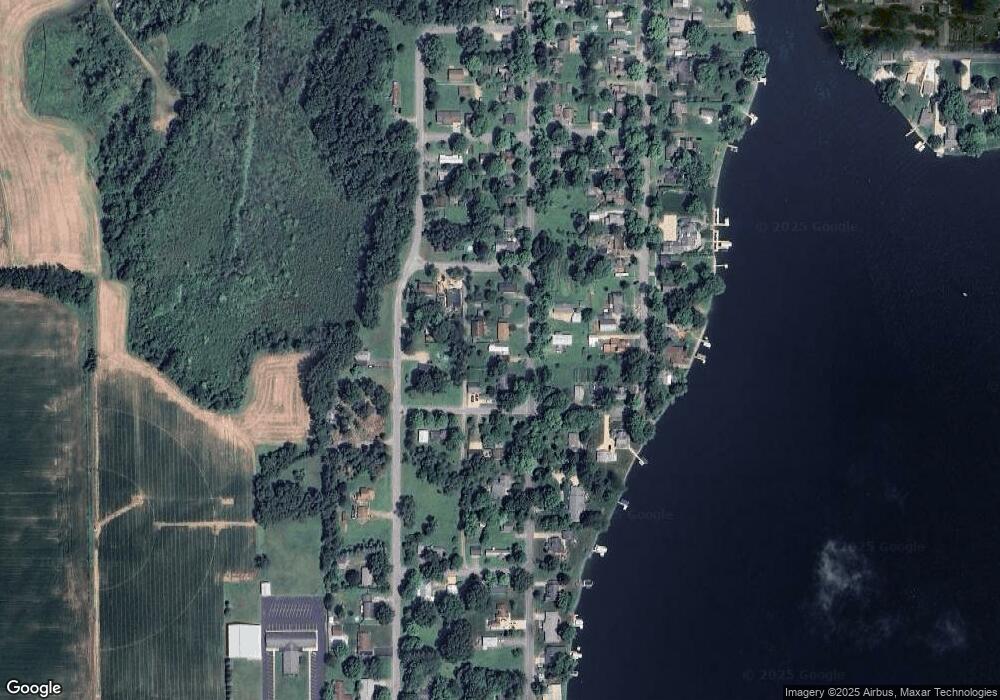

Map

Nearby Homes

- VL Bowman St

- 917 Elm St

- 210 E South St

- 229 Palmer Ave

- 448 Long Lake Rd

- 161 Palmer Ave

- 0 S Farrand Unit 25051538

- 58954 Lakeshore Dr

- 32205 James St

- 0 N Burr Oak Rd

- 31688 W Colon Rd

- 59178 Nora Dr

- 30725 Orla Engle Rd

- 60651 Bert Rd

- 55637 Bennett Rd

- 30315 Jacksonburg Rd

- 1121 Heights Dr

- VL Heights Dr

- 30879 Michigan 60

- 881 Brent Dr