6623 Chapel Crossing Williamsburg, VA 23188

Centerville NeighborhoodEstimated Value: $609,000 - $736,894

4

Beds

4

Baths

2,325

Sq Ft

$296/Sq Ft

Est. Value

About This Home

This home is located at 6623 Chapel Crossing, Williamsburg, VA 23188 and is currently estimated at $688,974, approximately $296 per square foot. 6623 Chapel Crossing is a home located in James City County with nearby schools including Norge Elementary School, Toano Middle School, and Warhill High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 18, 2023

Sold by

Farneti Thomas J and Farneti Patricia A

Bought by

Farneti Thomas J and Livi Patricia

Current Estimated Value

Purchase Details

Closed on

Jul 20, 2020

Sold by

Hudson Robert P and Hudson Elva A

Bought by

Farneti Thomas J and Farneti Patricia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$315,900

Interest Rate

3%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 30, 2020

Sold by

Wauhop Ernest M and Wauhop Susan N

Bought by

Bower Linda and Linda C Bower Living Trust

Purchase Details

Closed on

Jan 6, 2017

Sold by

Hudson Robert Pendelton

Bought by

Hudson Revocable Trust

Purchase Details

Closed on

Mar 28, 2008

Sold by

Colonial Heritage

Bought by

Hudson Robert P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$399,200

Interest Rate

5.76%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Farneti Thomas J | -- | None Listed On Document | |

| Farneti Thomas J | $515,900 | None Available | |

| Bower Linda | $340,000 | Lafayette Title & Escrow Llc | |

| Hudson Revocable Trust | -- | None Available | |

| Hudson Robert P | $499,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Farneti Thomas J | $315,900 | |

| Previous Owner | Hudson Robert P | $399,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,834 | $619,800 | $127,100 | $492,700 |

| 2024 | $4,834 | $619,800 | $127,100 | $492,700 |

| 2023 | $4,834 | $507,000 | $105,200 | $401,800 |

| 2022 | $4,208 | $507,000 | $105,200 | $401,800 |

| 2021 | $3,378 | $402,200 | $95,700 | $306,500 |

| 2020 | $3,378 | $402,200 | $95,700 | $306,500 |

| 2019 | $3,296 | $392,400 | $93,800 | $298,600 |

| 2018 | $3,296 | $392,400 | $93,800 | $298,600 |

| 2017 | $3,296 | $392,400 | $93,800 | $298,600 |

| 2016 | $3,296 | $392,400 | $93,800 | $298,600 |

| 2015 | $1,623 | $386,400 | $92,000 | $294,400 |

| 2014 | $2,975 | $386,400 | $92,000 | $294,400 |

Source: Public Records

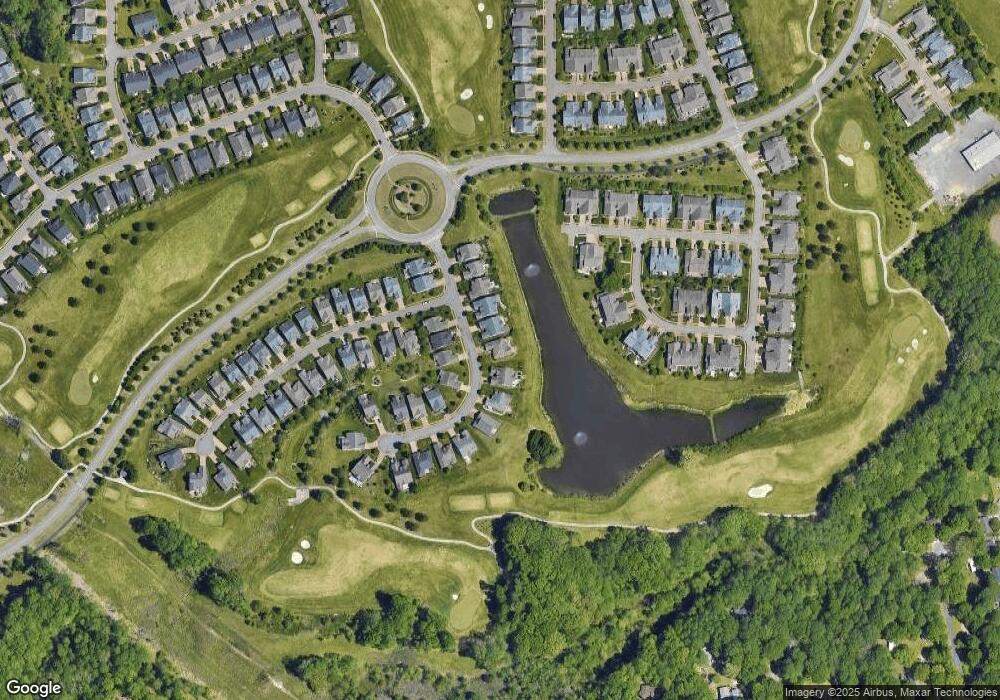

Map

Nearby Homes

- 4312 Pond St

- 6820 Tarpleys Tavern Rd

- 4304 Keaton Ln

- 6800 Tarpleys Tavern Rd

- 4227 Harrington Commons

- 6901 Chancery Ln

- 4665 Westhampton

- 4632 Noland Blvd

- 4819 House of Lords

- 6659 Rexford Ln

- 6667 Rexford Ln

- 4719 Minutemen Way

- 4229 Wedgewood Dr

- 4229 Wedgewood Dr

- 6880 Arthur Hills Dr

- 6301 Thomas Paine Dr

- 4341 Garden View

- 6623 Chapel Crossing

- 6619 Chapel Crossing

- 6619 Chapel Crossing

- 6627 Chapel Crossing

- 6627 Chapel Crossing

- 6615 Chapel Crossing

- 6615 Chapel Crossing

- 6631 Chapel Crossing

- 6631 Chapel Crossing

- 6624 Chapel Crossing

- 6624 Chapel Crossing

- 6632 Chapel Crossing

- 6632 Chapel Crossing

- 6620 Chapel Crossing

- 6620 Chapel Crossing

- 6609 Chapel Crossing

- 6609 Chapel Crossing

- 6616 Chapel Crossing

- 6616 Chapel Crossing

- 6635 Chapel Crossing