664 W Aviary Way Gilbert, AZ 85233

Heritage District NeighborhoodEstimated Value: $597,000 - $644,618

--

Bed

3

Baths

2,836

Sq Ft

$219/Sq Ft

Est. Value

About This Home

This home is located at 664 W Aviary Way, Gilbert, AZ 85233 and is currently estimated at $621,155, approximately $219 per square foot. 664 W Aviary Way is a home located in Maricopa County with nearby schools including Oak Tree Elementary School, Mesquite Junior High School, and Mesquite High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 24, 2006

Sold by

Gannod Gerald C and Gannod Barbara D

Bought by

Bemis Scot A and Bemis Melissa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$284,800

Outstanding Balance

$169,545

Interest Rate

6.7%

Mortgage Type

New Conventional

Estimated Equity

$451,610

Purchase Details

Closed on

Dec 5, 2005

Sold by

Gannod Gerald C and Gannod Barbara D

Bought by

Gannod Gerald C and Gannod Barbara D

Purchase Details

Closed on

Apr 23, 1999

Sold by

Kaufman & Broad Home Sales Of Az Inc

Bought by

Gannod Gerald C and Gannod Barbara D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,150

Interest Rate

7.97%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bemis Scot A | $356,000 | Transnation Title Ins Co | |

| Gannod Gerald C | -- | -- | |

| Gannod Gerald C | $184,390 | First American Title | |

| Kaufman & Broad Home Sales Of Az Inc | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bemis Scot A | $284,800 | |

| Previous Owner | Gannod Gerald C | $175,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,184 | $29,632 | -- | -- |

| 2024 | $2,197 | $28,221 | -- | -- |

| 2023 | $2,197 | $44,860 | $8,970 | $35,890 |

| 2022 | $2,124 | $33,900 | $6,780 | $27,120 |

| 2021 | $2,237 | $32,330 | $6,460 | $25,870 |

| 2020 | $2,204 | $29,550 | $5,910 | $23,640 |

| 2019 | $2,032 | $27,600 | $5,520 | $22,080 |

| 2018 | $1,973 | $26,280 | $5,250 | $21,030 |

| 2017 | $1,906 | $24,880 | $4,970 | $19,910 |

| 2016 | $1,969 | $24,510 | $4,900 | $19,610 |

| 2015 | $1,797 | $24,280 | $4,850 | $19,430 |

Source: Public Records

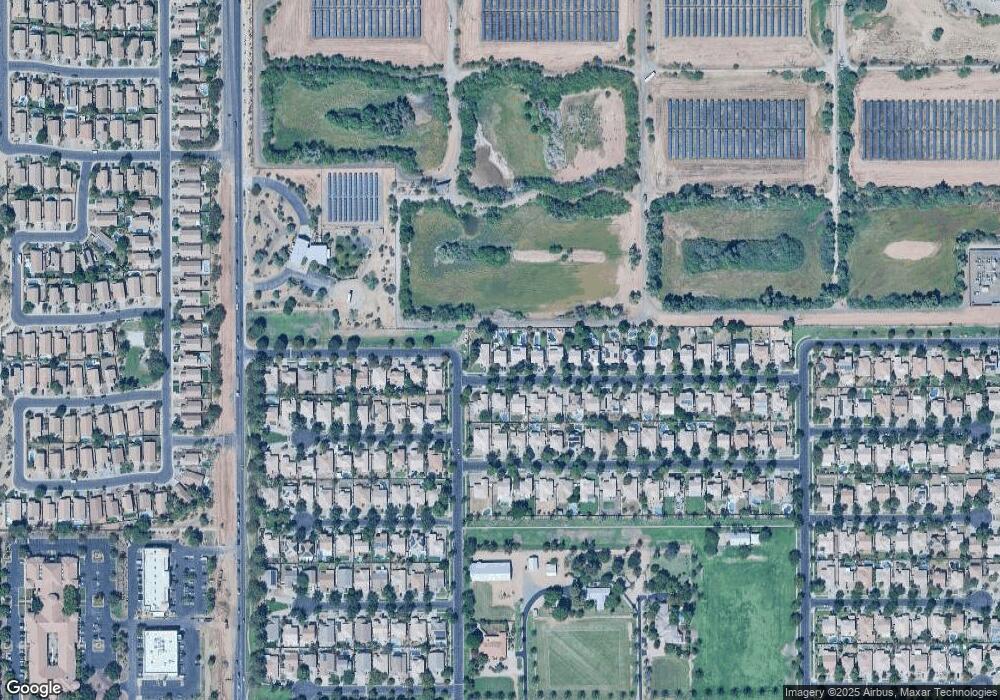

Map

Nearby Homes

- 604 W Orchard Way

- 564 W Aviary Way

- 846 W Windhaven Ave

- 455 W Orchard Way

- 444 W Fabens Ln

- 846 W Straford Ave

- 444 W Comstock Ct

- 507 W Sierra Madre Ave

- 358 W Linda Ln

- 1053 W Washington Ave

- 52 N Birch St

- 1072 W Windhaven Ave

- 955 W Laurel Ave

- 854 W Mesquite St

- 701 N Golden Key St

- 1156 W Vaughn Ave

- 897 W Pinon Ave

- 323 W Olive Ave

- 700 N Cooper Rd Unit 101-104

- 921 W Breckenridge Ave

- 654 W Aviary Way

- 674 W Aviary Way

- 644 W Aviary Way

- 665 W Aviary Way

- 655 W Aviary Way

- 675 W Aviary Way

- 645 W Aviary Way

- 695 W Aviary Way

- 624 W Aviary Way

- 635 W Aviary Way

- 705 W Aviary Way

- 694 W Orchard Way

- 664 W Orchard Way

- 654 W Orchard Way

- 674 W Orchard Way

- 625 W Aviary Way

- 614 W Aviary Way

- 644 W Orchard Way

- 704 W Orchard Way

- 715 W Aviary Way