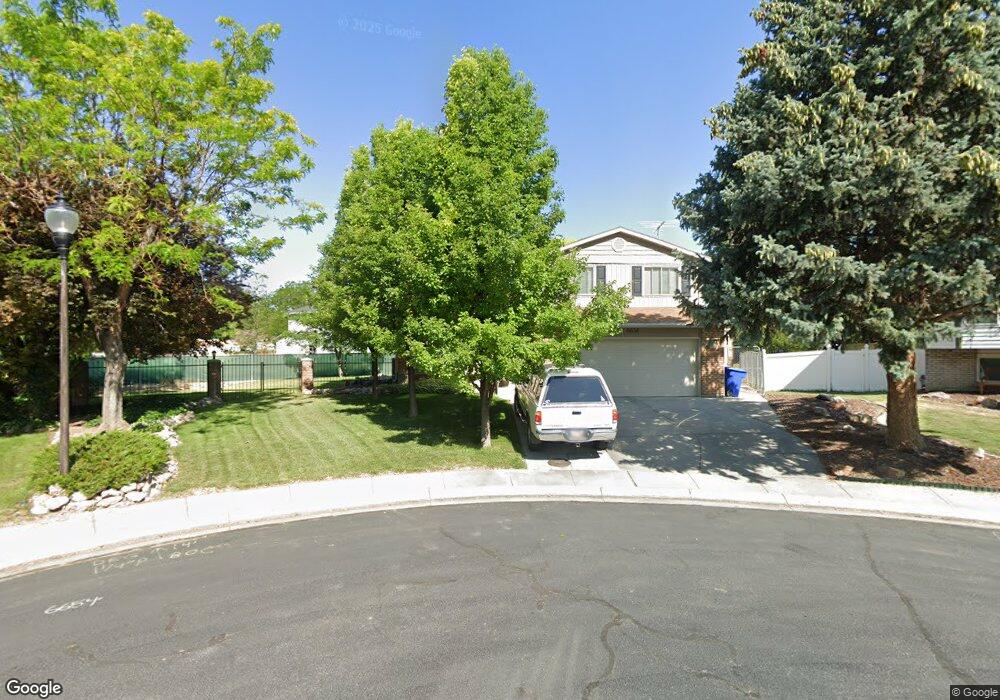

6654 S 3235 W West Jordan, UT 84084

Estimated Value: $512,672 - $543,000

3

Beds

1

Bath

1,429

Sq Ft

$365/Sq Ft

Est. Value

About This Home

This home is located at 6654 S 3235 W, West Jordan, UT 84084 and is currently estimated at $521,418, approximately $364 per square foot. 6654 S 3235 W is a home located in Salt Lake County with nearby schools including West Jordan Middle School, West Jordan High School, and Learning Tree School - Southwest.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 21, 2019

Sold by

Cooper Michael K and Cooper Jayne M

Bought by

Cooper Michael K and Cooper Melissa Jayne

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,000

Outstanding Balance

$79,025

Interest Rate

3.5%

Estimated Equity

$442,393

Purchase Details

Closed on

Jul 20, 1995

Sold by

Cooper Michael K and Cooper Jayne

Bought by

Cooper Michael K and Cooper Jayne M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,500

Interest Rate

7.62%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cooper Michael K | -- | Title One | |

| Cooper Michael K | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cooper Michael K | $172,000 | |

| Previous Owner | Cooper Michael K | $100,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $235 | $453,500 | $171,000 | $282,500 |

| 2024 | $235 | $434,600 | $163,800 | $270,800 |

| 2023 | $2,286 | $414,500 | $154,500 | $260,000 |

| 2022 | $492 | $403,900 | $151,500 | $252,400 |

| 2021 | $1,546 | $317,400 | $116,200 | $201,200 |

| 2020 | $1,016 | $281,100 | $116,200 | $164,900 |

| 2019 | $945 | $275,800 | $90,900 | $184,900 |

| 2018 | $459 | $255,000 | $87,800 | $167,200 |

| 2017 | $136 | $220,100 | $87,800 | $132,300 |

| 2016 | $1,433 | $198,700 | $87,800 | $110,900 |

| 2015 | $1,308 | $176,800 | $87,000 | $89,800 |

| 2014 | $1,283 | $170,800 | $85,300 | $85,500 |

Source: Public Records

Map

Nearby Homes

- 6672 S 3335 W

- 6453 Fremont Peak Cir

- 3226 Tysonbrook Ct

- 6512 Timpanogos Way

- 6893 S 3200 W

- 3305 W Kingsbrook Ave

- 3383 W 6880 S

- 6482 S Gold Medal Dr

- 3052 W Matterhorn Dr

- 3538 W Biathlon Cir

- 3537 W Green Springs Ln

- 8524 S Michele River Ave W Unit 109

- 3660 Ashland Cir

- 6863 S Dixie Dr

- 2683 W Carson Ln

- 1824 W 6200 S

- 6968 S 3535 W Unit 3

- 6222 S Westbrook Dr

- 6980 S 3535 W Unit 2

- 3695 Carolina Dr