6663 S Pine Landing Way West Jordan, UT 84084

Estimated Value: $355,000 - $377,771

3

Beds

3

Baths

1,235

Sq Ft

$297/Sq Ft

Est. Value

About This Home

This home is located at 6663 S Pine Landing Way, West Jordan, UT 84084 and is currently estimated at $366,193, approximately $296 per square foot. 6663 S Pine Landing Way is a home located in Salt Lake County with nearby schools including Oquirrh Elementary School, Joel P. Jensen Middle School, and West Jordan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 8, 2021

Sold by

Warner Spencer

Bought by

Ochoa Vincent

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$347,588

Outstanding Balance

$316,968

Interest Rate

2.8%

Mortgage Type

FHA

Estimated Equity

$49,225

Purchase Details

Closed on

Jul 19, 2018

Sold by

Junnings Talia M and Junnings Matt R

Bought by

Warner Spencer

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$207,000

Interest Rate

4.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 13, 2002

Sold by

Tuscany Development Inc

Bought by

Jennings Matt R and Jennings Talia M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,130

Interest Rate

5.95%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ochoa Vincent | -- | Us Title | |

| Warner Spencer | -- | First American Title Ut | |

| Jennings Matt R | -- | Meridian Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ochoa Vincent | $347,588 | |

| Previous Owner | Warner Spencer | $207,000 | |

| Previous Owner | Jennings Matt R | $119,130 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,892 | $375,100 | $112,500 | $262,600 |

| 2024 | $1,892 | $364,000 | $109,200 | $254,800 |

| 2023 | $1,963 | $356,000 | $106,800 | $249,200 |

| 2022 | $2,043 | $364,400 | $109,300 | $255,100 |

| 2021 | $1,501 | $243,800 | $73,100 | $170,700 |

| 2020 | $1,538 | $234,400 | $70,300 | $164,100 |

| 2019 | $1,468 | $219,400 | $65,800 | $153,600 |

| 2018 | $1,278 | $189,500 | $56,800 | $132,700 |

| 2017 | $1,168 | $172,300 | $51,700 | $120,600 |

| 2016 | $1,152 | $159,700 | $47,900 | $111,800 |

| 2015 | $1,124 | $152,000 | $45,600 | $106,400 |

| 2014 | $1,131 | $150,500 | $45,100 | $105,400 |

Source: Public Records

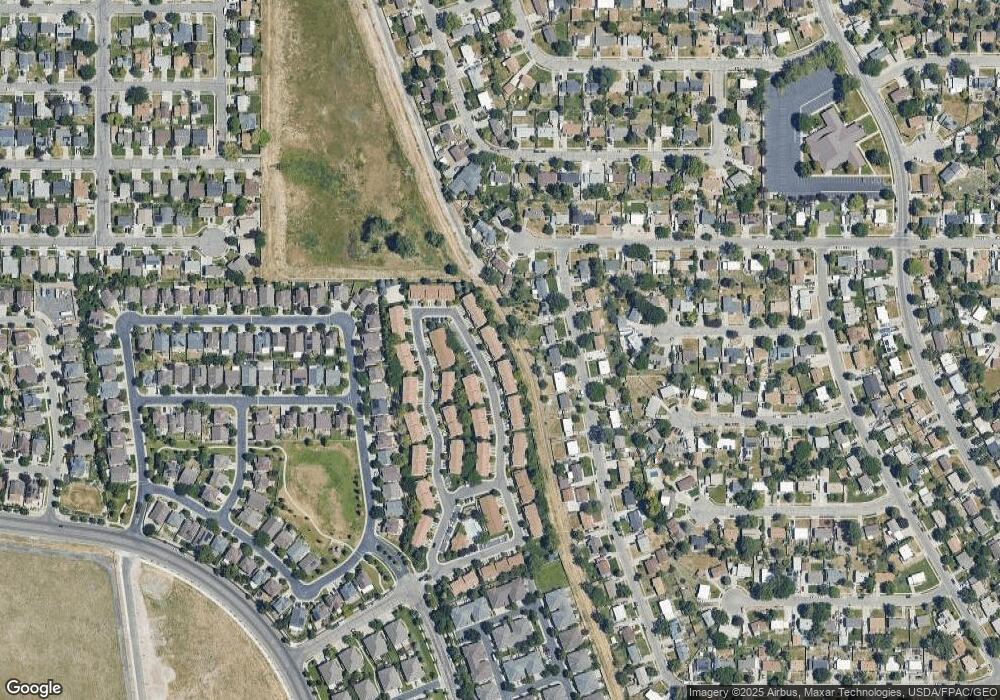

Map

Nearby Homes

- 3963 W Hollandia Ln

- 3770 W Carolina Dr

- 3896 W Atmore Rd

- 3695 Carolina Dr

- 3660 Ashland Cir

- 4164 W Millsden Ln

- 6377 Fairwind Dr

- 6330 S 4015 W

- 3538 W Biathlon Cir

- 6978 W Terraine Rd

- 6992 W Terraine Rd

- 3537 W Green Springs Ln

- 6482 S Gold Medal Dr

- 3978 W Marlis Cir

- 6280 Laura Jo Ln

- 6968 S 3535 W Unit 3

- 6980 S 3535 W Unit 2

- 6672 S 3335 W

- 3383 W 6880 S

- 4230 W Stratus St

- 6663 Pine Landing Way

- 6667 S Pine Landing Way

- 6667 Pine Landing Way

- 6661 Pine Landing Way

- 6661 S Pine Landing Way

- 6659 Pine Landing Way

- 6659 S Pine Landing Way

- 6671 Pine Landing Way

- 6653 Pine Landing Way

- 6673 Pine Landing Way Unit 74

- 6651 Pine Landing Way

- 6651 S Pine Landing Way

- 6677 Pine Landing Way

- 6677 S Pine Landing Way

- 6674 S Pine Landing Way

- 6674 Pine Landing Way Unit 88

- 6649 S Pine Landing Way

- 6649 Pine Landing Way

- 6664 Pine Landing Way

- 6679 S Pine Landing Way