6672 Embassy Ct Unit E18 Maumee, OH 43537

Estimated Value: $224,000 - $247,000

2

Beds

2

Baths

1,893

Sq Ft

$122/Sq Ft

Est. Value

About This Home

This home is located at 6672 Embassy Ct Unit E18, Maumee, OH 43537 and is currently estimated at $230,944, approximately $121 per square foot. 6672 Embassy Ct Unit E18 is a home located in Lucas County with nearby schools including Holloway Elementary School, Springfield Middle School, and Springfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 9, 2001

Sold by

Kaminski Joel D and Kaminski Marjorie A

Bought by

Granzow Dennis E and Granzow Kathi A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,000

Outstanding Balance

$37,598

Interest Rate

7.18%

Estimated Equity

$193,346

Purchase Details

Closed on

Nov 27, 1998

Sold by

Archambeau Beverly A

Bought by

Kaminski Joel D and Kaminski Marjorie A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,200

Interest Rate

6.8%

Purchase Details

Closed on

Mar 29, 1995

Sold by

Sherry L Euler Trst

Bought by

Archambeau Beverly A

Purchase Details

Closed on

Sep 29, 1993

Sold by

Agen Robert W

Purchase Details

Closed on

Apr 23, 1993

Sold by

Pilliod George L and Pilliod H

Purchase Details

Closed on

Jun 3, 1988

Sold by

Conrad Sherman A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Granzow Dennis E | $192,500 | -- | |

| Kaminski Joel D | $175,000 | -- | |

| Archambeau Beverly A | $135,000 | -- | |

| -- | -- | -- | |

| -- | $122,000 | -- | |

| -- | $130,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Granzow Dennis E | $106,000 | |

| Closed | Kaminski Joel D | $131,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $83,230 | $4,270 | $78,960 |

| 2024 | $2,223 | $83,230 | $4,270 | $78,960 |

| 2023 | $3,314 | $56,840 | $3,325 | $53,515 |

| 2022 | $3,340 | $56,840 | $3,325 | $53,515 |

| 2021 | $3,089 | $56,840 | $3,325 | $53,515 |

| 2020 | $3,237 | $53,760 | $3,325 | $50,435 |

| 2019 | $3,162 | $53,760 | $3,325 | $50,435 |

| 2018 | $2,977 | $53,760 | $3,325 | $50,435 |

| 2017 | $2,820 | $46,130 | $5,005 | $41,125 |

| 2016 | $2,845 | $131,800 | $14,300 | $117,500 |

| 2015 | $2,840 | $131,800 | $14,300 | $117,500 |

| 2014 | $2,624 | $46,140 | $5,010 | $41,130 |

| 2013 | $2,624 | $46,140 | $5,010 | $41,130 |

Source: Public Records

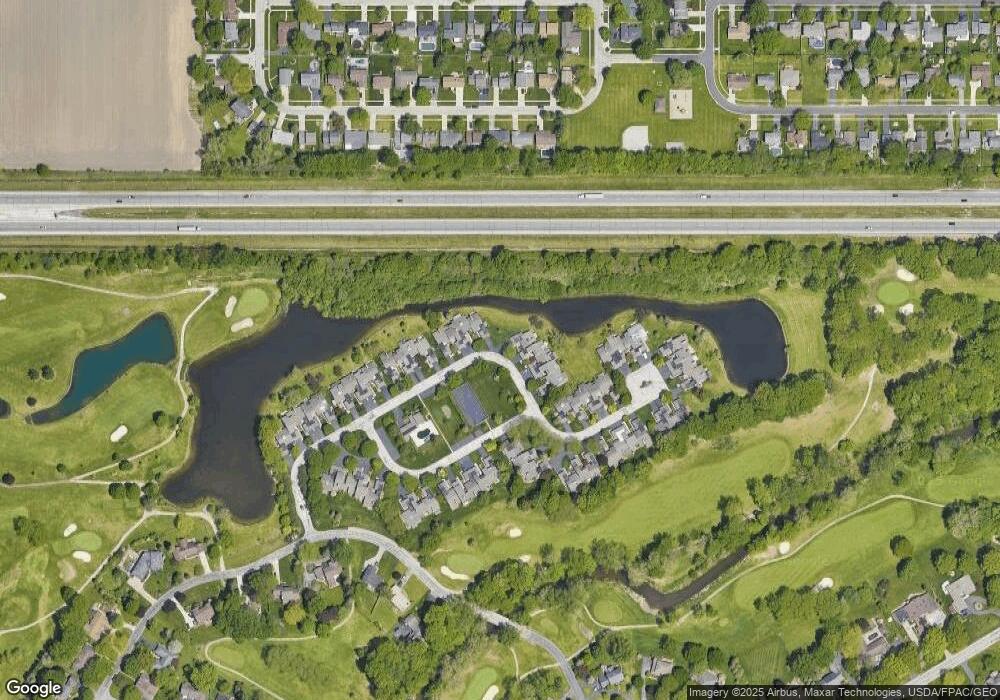

Map

Nearby Homes

- 6652 Sue Ln

- 6649 Mill Ridge Rd

- 6705 Garden Rd Unit 6705

- 6731 Garden Rd Unit 6731

- 6945 Garden Rd

- 6640 Salisbury Rd

- 6661 Brick Yard Ct

- 2822 Pleasant Hill Rd

- 6856 Morningdew Blvd

- 6418 Scarsdale Rd

- 2165 Glenacres Ct

- 2161 Longacre Ln

- 8822 Garden Rd

- 7009 Shadowcreek Dr

- 3385 Manley Rd

- 6744 W Meadows Ln

- 2437 Knights Hill Ln

- 2001 Perrysburg Holland Rd

- 3360 Stillwater Blvd

- 2324 Mill Race Ct

- 6676 Embassy Ct Unit D17

- 6670 Embassy Ct Unit E19

- 6678 Embassy Ct Unit D16

- 6668 Embassy Ct Unit E20

- 6682 Embassy Ct Unit D15

- 6655 Embassy Ct Unitl-46

- 6725 Embassy Ct Unit O60

- 6664 Embassy Ct Unit E21

- 6684 Embassy Ct Unit D14

- 6684 Embassy Ct Unit D-14

- 6660 Embassy Ct Unit E22

- 6620 Embassy Ct Unit G29

- 6690 Embassy Ct Unit C13

- 6694 Embassy Ct Unit C12

- 6659 Embassy Ct

- 6659 Embassy Ct Unit 48

- 6673 Embassy Ct Unit M49

- 6644 Embassy Ct Unit F23

- 6698 Embassy Ct Unit C10

- 6657 Embassy Ct Unit L47