6676 S Pines Point Way West Jordan, UT 84084

Estimated Value: $346,000 - $371,000

3

Beds

3

Baths

1,256

Sq Ft

$285/Sq Ft

Est. Value

About This Home

This home is located at 6676 S Pines Point Way, West Jordan, UT 84084 and is currently estimated at $357,993, approximately $285 per square foot. 6676 S Pines Point Way is a home located in Salt Lake County with nearby schools including Oquirrh Elementary School, Joel P. Jensen Middle School, and West Jordan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 17, 2012

Sold by

Farr Michael R and Farr Chalise K

Bought by

Hedman Brian

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,105

Outstanding Balance

$88,195

Interest Rate

3.83%

Mortgage Type

New Conventional

Estimated Equity

$269,798

Purchase Details

Closed on

Apr 17, 2006

Sold by

Petersen Amy

Bought by

Farr Michael R and Farr Chalise K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$109,600

Interest Rate

7.99%

Mortgage Type

Balloon

Purchase Details

Closed on

Mar 23, 2005

Sold by

Petersen Amy

Bought by

Petersen Amy and The Amy Petersen Trust

Purchase Details

Closed on

Nov 19, 2003

Sold by

Petersen Amy

Bought by

Petersen Amy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,750

Interest Rate

4.25%

Mortgage Type

Unknown

Purchase Details

Closed on

Dec 20, 2002

Sold by

Tuscany Development Inc

Bought by

Petersen Amy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,900

Interest Rate

7%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hedman Brian | -- | Bonneville Superior Title | |

| Farr Michael R | -- | Preferred Title & Escrow Ins | |

| Petersen Amy | -- | -- | |

| Petersen Amy | -- | Preferred Title & Escrow Ins | |

| Petersen Amy | -- | Meridian Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hedman Brian | $129,105 | |

| Previous Owner | Farr Michael R | $109,600 | |

| Previous Owner | Petersen Amy | $120,750 | |

| Previous Owner | Petersen Amy | $117,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,665 | $330,400 | $99,100 | $231,300 |

| 2024 | $1,665 | $320,300 | $96,100 | $224,200 |

| 2023 | $1,688 | $306,100 | $91,800 | $214,300 |

| 2022 | $1,759 | $313,800 | $94,100 | $219,700 |

| 2021 | $1,321 | $214,500 | $64,300 | $150,200 |

| 2020 | $1,377 | $209,800 | $62,900 | $146,900 |

| 2019 | $1,312 | $196,100 | $58,800 | $137,300 |

| 2018 | $1,201 | $178,000 | $53,400 | $124,600 |

| 2017 | $1,094 | $161,500 | $48,400 | $113,100 |

| 2016 | $1,073 | $148,800 | $44,600 | $104,200 |

| 2015 | $1,048 | $141,700 | $42,500 | $99,200 |

| 2014 | $1,054 | $140,300 | $42,100 | $98,200 |

Source: Public Records

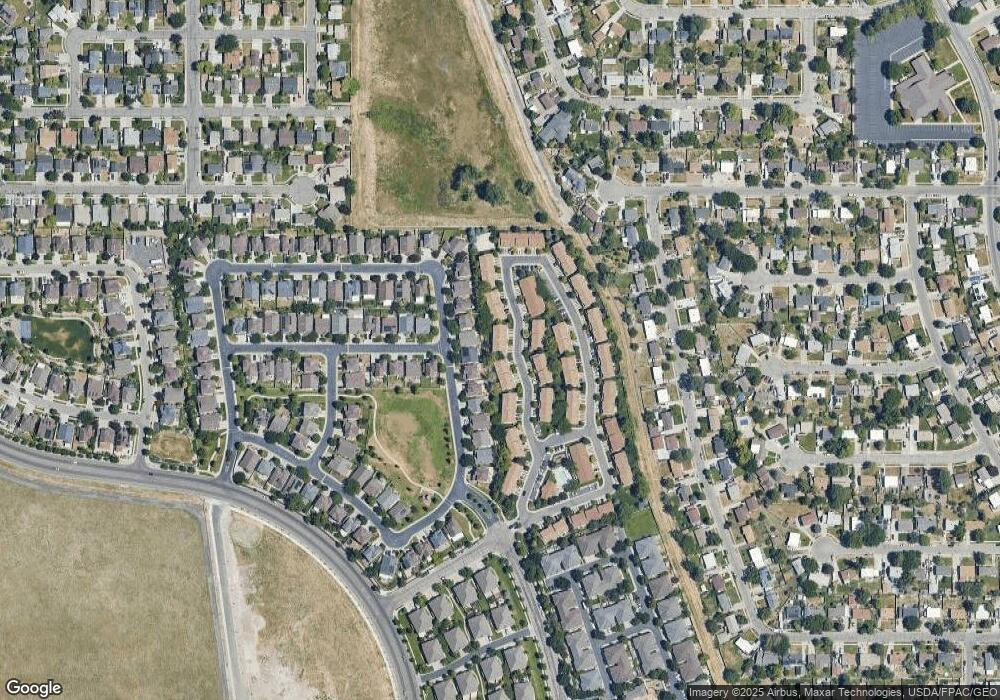

Map

Nearby Homes

- 3963 W Hollandia Ln

- 3770 W Carolina Dr

- 4164 W Millsden Ln

- 3695 Carolina Dr

- 3660 Ashland Cir

- 3896 W Atmore Rd

- 6377 Fairwind Dr

- 6978 W Terraine Rd

- 6992 W Terraine Rd

- 6330 S 4015 W

- 6968 S 3535 W Unit 3

- 6980 S 3535 W Unit 2

- 3538 W Biathlon Cir

- 3537 W Green Springs Ln

- 6482 S Gold Medal Dr

- 3978 W Marlis Cir

- 6280 Laura Jo Ln

- 6672 S 3335 W

- 3383 W 6880 S

- 4230 W Stratus St

- 6676 Pines Point Way

- 6678 Pines Point Way

- 6678 S Pines Point Way

- 6674 S Pines Point Way

- 6674 Pines Point Way

- 6672 S Pines Point Way

- 6672 Pines Point Way Unit 50

- 6684 Pines Point Way

- 6684 S Pines Point Way

- 6686 Pines Point Way

- 6686 S Pines Point Way

- 6668 Pines Point Way

- 6668 S Pines Point Way

- 6659 S Interlochin Ln

- 6651 S Interlochin Ln

- 6651 Interlochin Ln

- 6659 Interlochin Ln

- 6688 Pines Point Way

- 6664 Pines Point Way

- 6664 S Pines Point Way