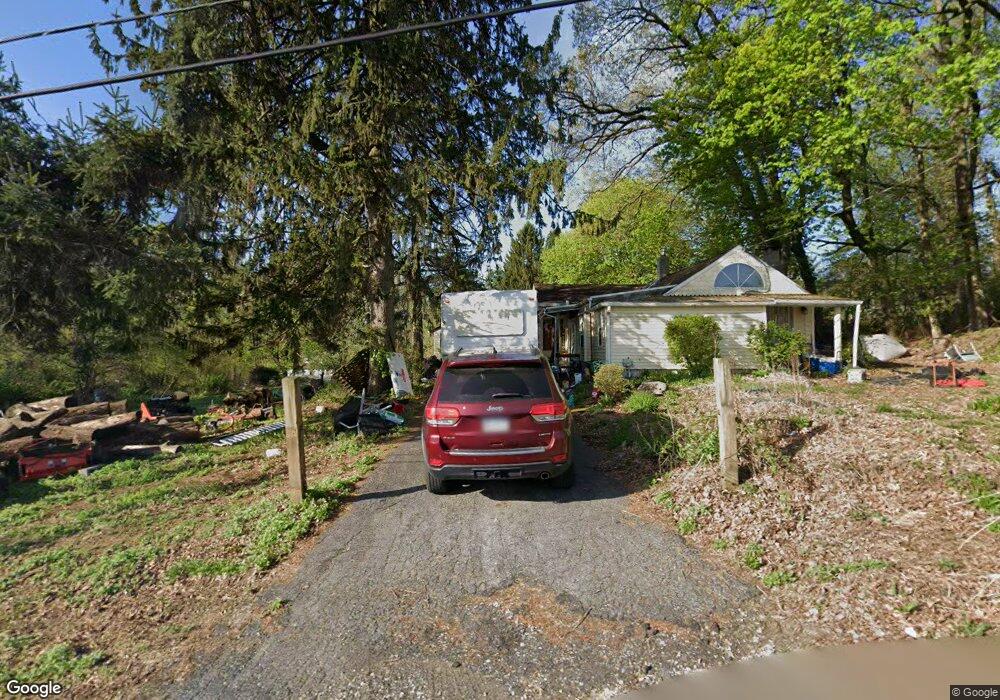

67 Alsace Ave Temple, PA 19560

Estimated Value: $260,000 - $328,000

3

Beds

2

Baths

1,236

Sq Ft

$233/Sq Ft

Est. Value

About This Home

This home is located at 67 Alsace Ave, Temple, PA 19560 and is currently estimated at $287,677, approximately $232 per square foot. 67 Alsace Ave is a home located in Berks County with nearby schools including Oley Valley Elementary School, Oley Valley Middle School, and Oley Valley Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 27, 2009

Sold by

Dimaio Bonita

Bought by

Pape Rebecca

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,920

Outstanding Balance

$109,326

Interest Rate

5.06%

Mortgage Type

FHA

Estimated Equity

$178,351

Purchase Details

Closed on

Nov 20, 2003

Sold by

Dimaio Robert H and Dimaio Bonita L

Bought by

Dimaio Bonita L

Purchase Details

Closed on

Jul 8, 2002

Sold by

Sterner Donald R and Sterner Betty A

Bought by

Dimaio Robert H and Dimaio Bonita L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,000

Interest Rate

9.99%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pape Rebecca | $170,000 | None Available | |

| Dimaio Bonita L | -- | -- | |

| Dimaio Robert H | $90,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pape Rebecca | $166,920 | |

| Previous Owner | Dimaio Robert H | $81,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $794 | $73,800 | $37,000 | $36,800 |

| 2024 | $2,965 | $73,800 | $37,000 | $36,800 |

| 2023 | $2,856 | $73,800 | $37,000 | $36,800 |

| 2022 | $2,819 | $73,800 | $37,000 | $36,800 |

| 2021 | $2,782 | $73,800 | $37,000 | $36,800 |

| 2020 | $2,738 | $73,800 | $37,000 | $36,800 |

| 2019 | $2,694 | $73,800 | $37,000 | $36,800 |

| 2018 | $2,663 | $73,800 | $37,000 | $36,800 |

| 2017 | $2,598 | $73,800 | $37,000 | $36,800 |

| 2016 | $642 | $73,800 | $37,000 | $36,800 |

| 2015 | $642 | $73,800 | $37,000 | $36,800 |

| 2014 | $605 | $73,800 | $37,000 | $36,800 |

Source: Public Records

Map

Nearby Homes

- 3211 Pricetown Rd

- 9 Hardy Ln

- 240 Spies Church Rd Unit 216

- 129 Old State Rd

- 2306 Elizabeth Ave

- 0 Old State Rd

- 1519 Friedensburg Rd

- 3284 Friedensburg Rd

- 0 Oak Ln

- 676 Barlet Rd

- 1837 Old Spring Valley Rd

- 1833 Old Spring Valley Rd

- 116 Allison Place

- 233 European Dr

- 0 Hill Rd Unit PABK2023334

- 1018 Hartman Rd

- 46 Rosalie's Way

- 1016 Josephine Dr

- 40 Rosalie's Way

- 2309 Hampden Blvd

Your Personal Tour Guide

Ask me questions while you tour the home.