67 Laurel Ridge East Hampton, CT 06424

Estimated Value: $440,528 - $459,000

3

Beds

3

Baths

1,906

Sq Ft

$236/Sq Ft

Est. Value

About This Home

This home is located at 67 Laurel Ridge, East Hampton, CT 06424 and is currently estimated at $450,382, approximately $236 per square foot. 67 Laurel Ridge is a home located in Middlesex County with nearby schools including Memorial School, Center Elementary School, and East Hampton Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 12, 2021

Sold by

Mehalick Joseph W and Mehalick Susan E

Bought by

Morrow Susan and Morrow Avraham Jesse

Current Estimated Value

Purchase Details

Closed on

Jan 12, 2010

Sold by

Shea Maureen F

Bought by

Mehalick Joseph W and Mehalick Susan E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,000

Interest Rate

4.78%

Purchase Details

Closed on

Dec 14, 2005

Sold by

Dream Dev Cape Cod Inc

Bought by

Shea John M and Shea Maureen F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,720

Interest Rate

6%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morrow Susan | $288,900 | None Available | |

| Morrow Susan | $288,900 | None Available | |

| Mehalick Joseph W | $280,000 | -- | |

| Mehalick Joseph W | $280,000 | -- | |

| Shea John M | $296,750 | -- | |

| Shea John M | $296,750 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Shea John M | $224,000 | |

| Previous Owner | Shea John M | $212,720 | |

| Previous Owner | Shea John M | $39,885 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,319 | $184,300 | $0 | $184,300 |

| 2024 | $7,011 | $184,300 | $0 | $184,300 |

| 2023 | $6,646 | $184,300 | $0 | $184,300 |

| 2022 | $6,388 | $184,300 | $0 | $184,300 |

| 2021 | $6,364 | $184,300 | $0 | $184,300 |

| 2020 | $6,495 | $195,990 | $0 | $195,990 |

| 2019 | $4,985 | $150,420 | $0 | $150,420 |

| 2018 | $4,711 | $150,420 | $0 | $150,420 |

| 2017 | $4,711 | $150,420 | $0 | $150,420 |

| 2016 | $4,428 | $150,420 | $0 | $150,420 |

| 2015 | $5,465 | $196,740 | $0 | $196,740 |

| 2014 | $4,755 | $196,740 | $0 | $196,740 |

Source: Public Records

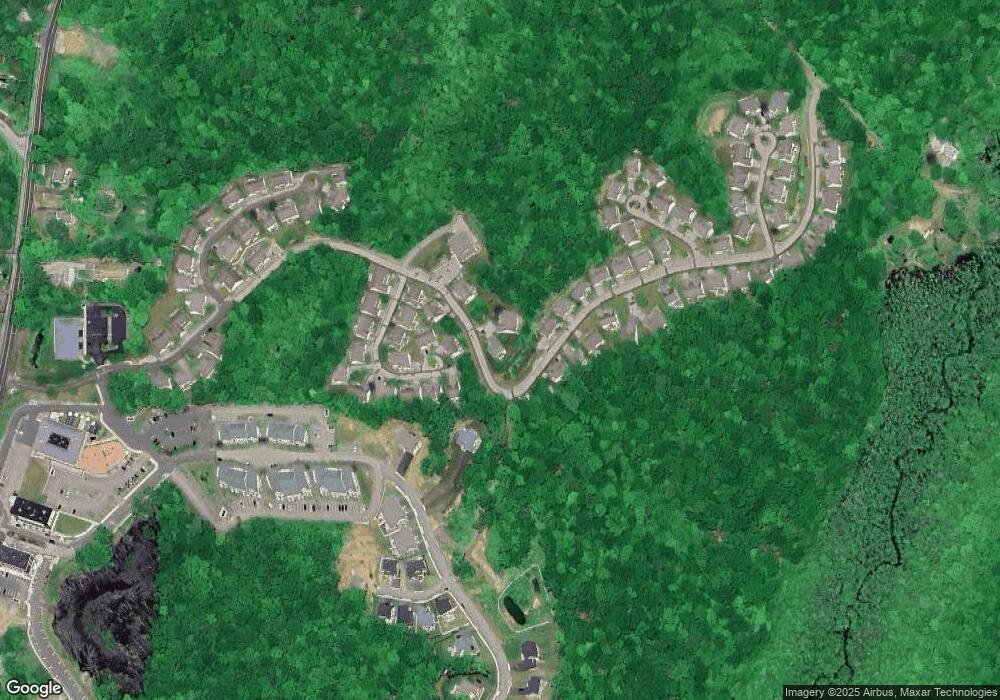

Map

Nearby Homes

- 19 Wordsworth Rd

- 0002-3 Edgewater Cir

- 00025 Edgewater Cir

- 00026 Edgewater Cir

- 00023 Edgewater Cir

- 0002-6 Edgewater Cir

- 0002-7 Edgewater Cir

- 0002-5 Edgewater Cir

- 708 Lake Vista Dr Unit 708

- 43 Oneill Ln

- 3 Orchard View Ln

- 4 Whispering Woods Rd

- 0 Island Unit 24106398

- Homesite 10 Quinns Way

- Homesite 4 Quinns Way

- 48 Flanders Rd

- 5 Quinn Rd

- 6 Lakeview St

- 2 Raymond Rd

- 8 Wells Ave

- 67 Laurel Ridge Unit 67

- Lot 45 Laurel Ridge Unit 17

- Lot 45 Laurel Ridge

- Lot 90 Laurel Ridge

- Lot 71 Laurel Ridge

- Lot 60 Laurel Ridge

- Lot 47 Laurel Ridge

- lot 86 Laurel Ridge

- 4 North Ridge

- 2 North Ridge

- 2 North Ridge Unit 2

- 80 Laurel Ridge

- 5 North Ridge

- 1 North Ridge

- 59 Laurel Ridge

- 81 Laurel Ridge

- 81 Laurel Ridge Unit 81

- 22 North Hollow

- 82 Laurel Ridge

- 20 North Hollow