Estimated Value: $211,971 - $233,000

4

Beds

1

Bath

1,484

Sq Ft

$152/Sq Ft

Est. Value

About This Home

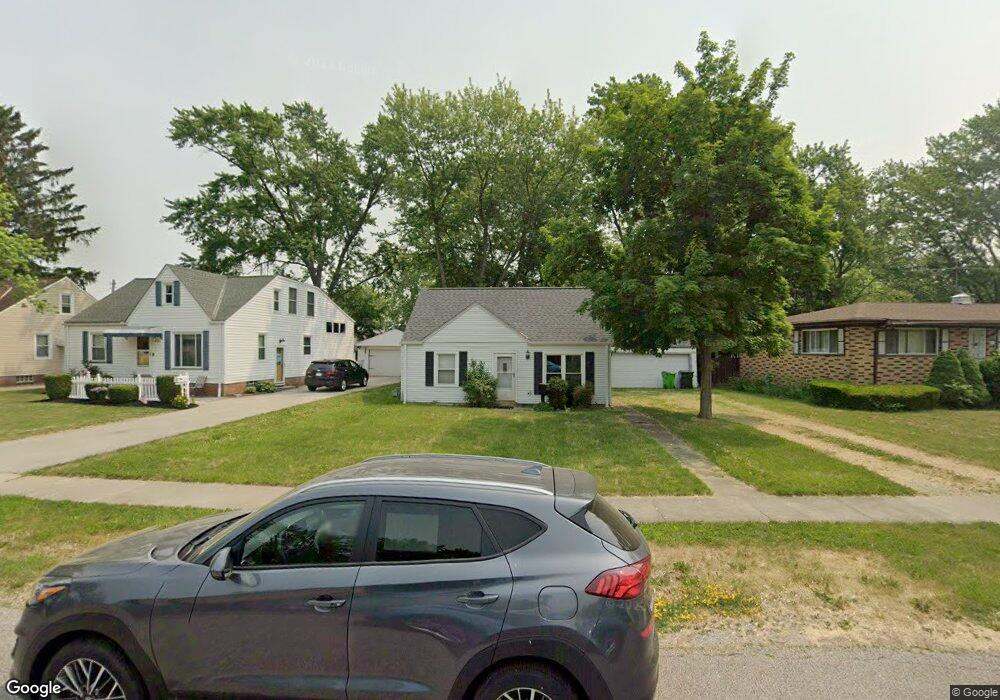

This home is located at 670 Longfellow Dr, Berea, OH 44017 and is currently estimated at $226,243, approximately $152 per square foot. 670 Longfellow Dr is a home located in Cuyahoga County with nearby schools including Grindstone Elementary School, Berea-Midpark Middle School, and Berea-Midpark High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2002

Sold by

Gordon Gary L and Gordon Michele M

Bought by

Hofer Terri J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$87,550

Outstanding Balance

$37,325

Interest Rate

6.79%

Estimated Equity

$188,918

Purchase Details

Closed on

Sep 30, 1997

Sold by

Deja Barbara

Bought by

Gordon Gary L and Gordon Michele M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,200

Interest Rate

7.63%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 14, 1989

Sold by

Leeseberg Dwight W

Bought by

Deja Barbara

Purchase Details

Closed on

Mar 23, 1988

Sold by

Leeseberg Dwight W

Bought by

Leeseberg Dwight W

Purchase Details

Closed on

Mar 9, 1987

Sold by

Leeseberg Ronald A

Bought by

Leeseberg Dwight W

Purchase Details

Closed on

Mar 14, 1985

Sold by

Leeseberg Ronald A

Bought by

Leeseberg Ronald A

Purchase Details

Closed on

Jan 1, 1975

Bought by

Leeseberg Ronald A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hofer Terri J | $103,000 | Real Living Title Agency Ltd | |

| Gordon Gary L | $85,000 | -- | |

| Deja Barbara | $62,000 | -- | |

| Leeseberg Dwight W | -- | -- | |

| Leeseberg Dwight W | $30,000 | -- | |

| Leeseberg Ronald A | -- | -- | |

| Leeseberg Ronald A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hofer Terri J | $87,550 | |

| Previous Owner | Gordon Gary L | $72,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,963 | $61,845 | $10,465 | $51,380 |

| 2023 | $3,903 | $48,650 | $9,100 | $39,550 |

| 2022 | $5,118 | $48,650 | $9,100 | $39,550 |

| 2021 | $4,342 | $48,650 | $9,100 | $39,550 |

| 2020 | $4,215 | $41,230 | $7,700 | $33,530 |

| 2019 | $4,035 | $117,800 | $22,000 | $95,800 |

| 2018 | $2,985 | $41,230 | $7,700 | $33,530 |

| 2017 | $4,015 | $39,550 | $6,510 | $33,040 |

| 2016 | $3,141 | $39,550 | $6,510 | $33,040 |

| 2015 | $2,882 | $39,550 | $6,510 | $33,040 |

| 2014 | $2,882 | $38,400 | $6,340 | $32,060 |

Source: Public Records

Map

Nearby Homes

- 725 Shakespeare Dr

- 487 Karen Dr

- 452 N Rocky River Dr

- 6574 Burton Dr

- 445 Berea St

- 428 Park Place

- 93 W 5th Ave

- 41 W 5th Ave

- 56 3rd Ave

- 379 Laurel Dr

- 446 Redwood Dr

- 20415 Brookstone Trail

- 146 Marian Ln

- 211 W Bridge St

- 160 Marian Ln Unit 6A

- 160 Stonepointe Dr

- 0 E Bagley Rd Unit 5111166

- 209 Gibson St

- 57 Riverside Dr

- 216 Kraft St

- 676 Longfellow Dr

- 671 the Burns

- 660 Longfellow Dr

- 682 Longfellow Dr

- 677 the Burns

- 683 the Burns

- 671 Longfellow Dr

- 675 Longfellow Dr

- 665 Longfellow Dr

- 215 The Mall

- 195 The Mall

- 659 Longfellow Dr

- 681 Longfellow Dr

- 229 The Mall

- 644 Longfellow Dr

- 675 Wesley Dr

- 653 Longfellow Dr

- 667 Wesley Dr

- 662 Grayton Rd

- 666 Grayton Rd

Your Personal Tour Guide

Ask me questions while you tour the home.