Estimated Value: $616,000 - $751,727

3

Beds

2

Baths

1,698

Sq Ft

$395/Sq Ft

Est. Value

About This Home

This home is located at 67025 Paradise Aly, Bend, OR 97703 and is currently estimated at $670,682, approximately $394 per square foot. 67025 Paradise Aly is a home located in Deschutes County with nearby schools including Sisters Elementary School, Sisters Middle School, and Sisters High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 1, 2016

Sold by

Slowikowski Gail M

Bought by

Kaufman Daniel P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Outstanding Balance

$39,481

Interest Rate

3.52%

Mortgage Type

Seller Take Back

Estimated Equity

$631,201

Purchase Details

Closed on

Mar 22, 2010

Sold by

The Bank Of New York Mellon

Bought by

Slowikowski Gail M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$161,820

Interest Rate

5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 5, 2009

Sold by

Ceniga George N and Ceniga Janet L

Bought by

The Bank Of New York Mellon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kaufman Daniel P | $277,000 | First American Title Co | |

| Slowikowski Gail M | $179,800 | First American Title | |

| The Bank Of New York Mellon | $216,750 | Amerititle |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kaufman Daniel P | $135,000 | |

| Previous Owner | Slowikowski Gail M | $161,820 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,582 | $241,460 | -- | -- |

| 2024 | $3,465 | $234,430 | -- | -- |

| 2023 | $3,365 | $227,610 | $0 | $0 |

| 2022 | $3,093 | $214,560 | $0 | $0 |

| 2021 | $2,955 | $208,320 | $0 | $0 |

| 2020 | $2,801 | $208,320 | $0 | $0 |

| 2019 | $2,734 | $202,260 | $0 | $0 |

| 2018 | $2,663 | $196,370 | $0 | $0 |

| 2017 | $2,570 | $190,660 | $0 | $0 |

| 2016 | $2,528 | $185,110 | $0 | $0 |

| 2015 | $2,369 | $179,720 | $0 | $0 |

| 2014 | $2,220 | $174,490 | $0 | $0 |

Source: Public Records

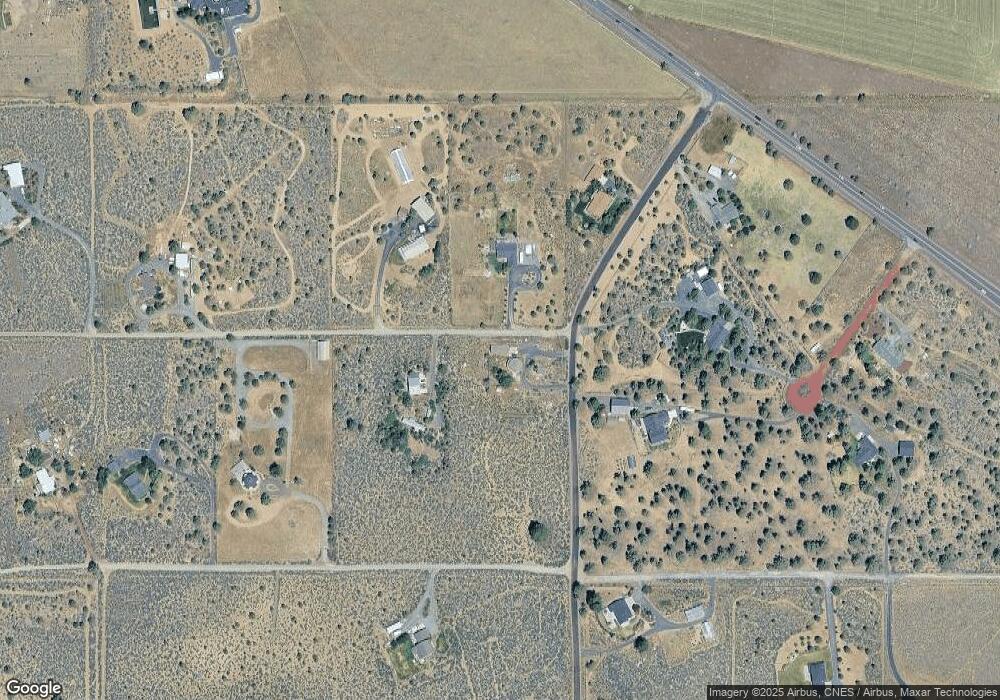

Map

Nearby Homes

- 17450 Star Thistle Ln

- 66985 Rock Island Ln

- 67216 Gist Rd

- 17644 Cascade Estates Dr

- 67480 Cloverdale Rd

- 67205 Bass Ln

- 66488 Sisemore Rd

- 67076 Sunburst St

- 67439 U S 20

- 66945 Central St

- 18025 Cascade Estates Dr

- 67134 Central St

- 18070 Cascade Estates Dr

- 16816 Ponderosa Cascade Dr

- 67133 Fryrear Rd

- 67100 Fryrear Rd

- 16830 Delicious St

- 17500 Forked Horn Rd

- 64225 Sisemore Rd

- 67500 Three Creeks Rd

- 17490 Serenity Way

- 17465 Serenity Way

- 17460 Serenity Way

- 67055 Paradise Aly

- 67045 Double r Way

- 67020 Double r Way

- 67070 Paradise Aly

- 17511 Knight Rd

- 17485 Star Thistle Ln

- 17410 Serenity Way

- 67030 Double r Way

- 0 Double r Way

- 201 Double r Way

- 67060 Double r Way

- 17549 Knight Rd

- 17400 Star Thistle Ln

- 67167 Highway 20

- 17380 Serenity Way

- 66947 Paradise Aly