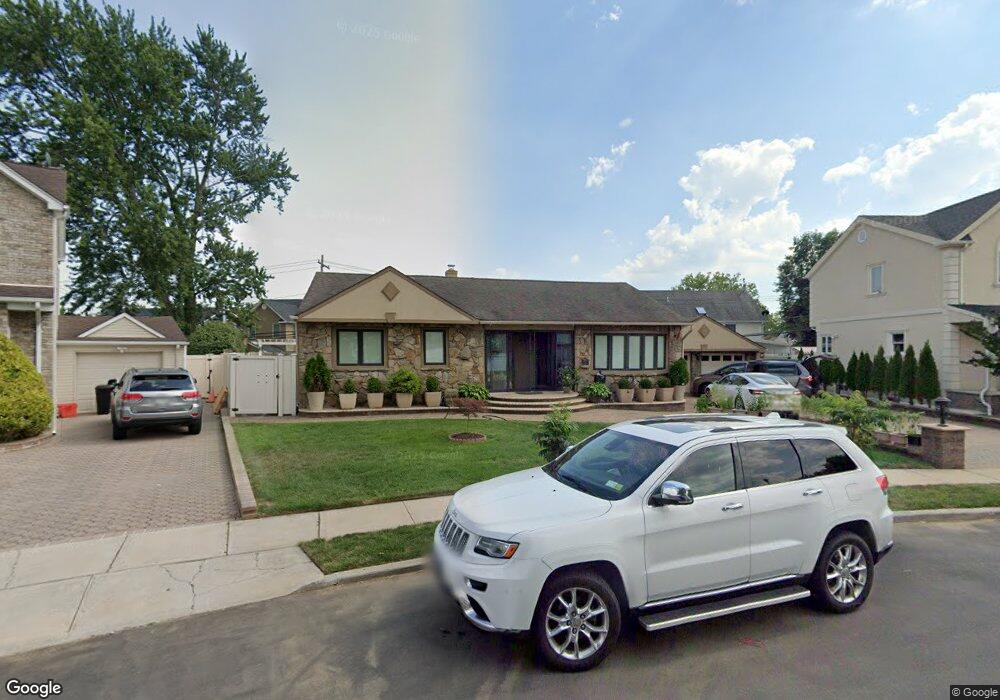

671 Patterson Ave Franklin Square, NY 11010

Estimated Value: $888,494 - $915,000

4

Beds

3

Baths

1,546

Sq Ft

$583/Sq Ft

Est. Value

About This Home

This home is located at 671 Patterson Ave, Franklin Square, NY 11010 and is currently estimated at $901,747, approximately $583 per square foot. 671 Patterson Ave is a home located in Nassau County with nearby schools including Grace Lutheran School and Hebrew Academy of Nassau County (HANC).

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 26, 2018

Sold by

Zhu Jianxin and Xia Chunfen

Bought by

Wang Ji Bin and Wang Hong Yan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$422,500

Outstanding Balance

$368,445

Interest Rate

4.5%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$533,302

Purchase Details

Closed on

Nov 3, 2017

Sold by

Giannasco Patricia

Bought by

Xia Chunfen and Zhu Jian Xin

Purchase Details

Closed on

Apr 28, 2009

Sold by

Giannasco Joseph and Giannasco Patricia

Bought by

Giannasco Patricia

Purchase Details

Closed on

Jan 30, 1997

Sold by

William Bertuzlia

Bought by

Giannasco Joseph and Giannasco Patricia

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wang Ji Bin | $650,000 | None Available | |

| Xia Chunfen | $740,000 | -- | |

| Giannasco Patricia | -- | Attorney | |

| Giannasco Joseph | $215,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wang Ji Bin | $422,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,025 | $583 | $230 | $353 |

| 2024 | $4,736 | $583 | $230 | $353 |

| 2023 | $12,299 | $583 | $230 | $353 |

| 2022 | $12,299 | $583 | $230 | $353 |

| 2021 | $15,265 | $550 | $217 | $333 |

| 2020 | $10,915 | $715 | $536 | $179 |

| 2019 | $3,924 | $715 | $513 | $202 |

| 2018 | $6,449 | $747 | $0 | $0 |

| 2017 | $6,068 | $747 | $536 | $211 |

| 2016 | $9,861 | $747 | $418 | $329 |

| 2015 | $3,734 | $789 | $441 | $348 |

| 2014 | $3,734 | $789 | $441 | $348 |

| 2013 | $4,237 | $958 | $536 | $422 |

Source: Public Records

Map

Nearby Homes

- 726 Meisser St

- 771 Maple Place

- 708 Anderson Ave

- 807 Cypress Dr

- 2 Atlas Ave

- 824 Lawrence Ct

- 816 Anderson Ave

- 1010 Hempstead Ave

- 95 Dogwood Ave

- 627 Buxton Ave

- 582 Gaynor Place

- 899 Cleveland St

- 993 Ferngate Dr

- 791 Caryl St

- 850 First Ave

- 100 Nassau Ave

- 844 Arthur St

- 853 Arthur St

- 136 Scarcliffe Dr

- 1048 Windermere Rd

- 677 Patterson Ave

- 665 Patterson Ave

- 660 Willow Rd

- 668 Willow Rd

- 654 Willow Rd

- 683 Patterson Ave

- 672 Willow Rd

- 659 Patterson Ave

- 676 Patterson Ave

- 648 Willow Rd

- 652 Patterson Ave

- 776 Dogwood Ave

- 689 Patterson Ave

- 765 Meisser St

- 678 Willow Rd

- 770 Dogwood Ave

- 653 Patterson Ave

- 792 Dogwood Ave

- 764 Dogwood Ave

- 646 Patterson Ave