6715 W 26th Dr Unit 1036 Hialeah, FL 33016

Estimated Value: $255,930 - $282,000

2

Beds

2

Baths

769

Sq Ft

$352/Sq Ft

Est. Value

About This Home

This home is located at 6715 W 26th Dr Unit 1036, Hialeah, FL 33016 and is currently estimated at $270,733, approximately $352 per square foot. 6715 W 26th Dr Unit 1036 is a home located in Miami-Dade County with nearby schools including Ernest R. Graham K-8 Academy, Miami Lakes Middle School, and Hialeah Gardens Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 13, 2021

Sold by

Rodriguez Esther M

Bought by

Montero Humberto Estrada and Balluja Belkis Perez

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,750

Interest Rate

3.14%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 8, 2005

Sold by

Martinez Odalys D

Bought by

Rodriguez Esther M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,500

Interest Rate

1.87%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Dec 4, 2001

Sold by

Felix R Lino M and Felix Gina Lino

Bought by

Martinez Odalys D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Montero Humberto Estrada | $170,000 | None Listed On Document | |

| Montero Humberto Estrada | $170,000 | Accommodation | |

| Rodriguez Esther M | $135,000 | -- | |

| Martinez Odalys D | $67,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Montero Humberto Estrada | $152,750 | |

| Previous Owner | Rodriguez Esther M | $121,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,549 | $189,002 | -- | -- |

| 2024 | $2,979 | $171,820 | -- | -- |

| 2023 | $2,979 | $156,200 | $0 | $0 |

| 2022 | $2,664 | $142,000 | $0 | $0 |

| 2021 | $1,973 | $85,446 | $0 | $0 |

| 2020 | $1,810 | $121,000 | $0 | $0 |

| 2019 | $1,729 | $121,045 | $0 | $0 |

| 2018 | $1,582 | $118,672 | $0 | $0 |

| 2017 | $1,452 | $58,363 | $0 | $0 |

| 2016 | $1,361 | $53,058 | $0 | $0 |

| 2015 | $1,221 | $48,235 | $0 | $0 |

| 2014 | $1,031 | $43,850 | $0 | $0 |

Source: Public Records

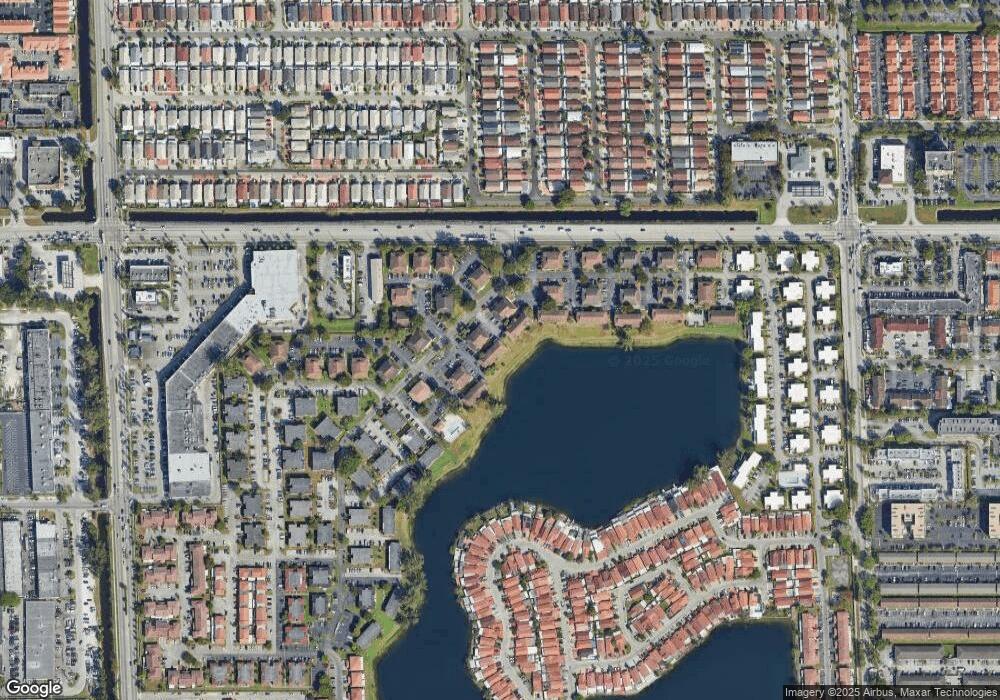

Map

Nearby Homes

- 2570 W 67th Place Unit 212

- 2635 W 67th Place Unit 1412

- 2530 W 67th Place Unit 1229

- 6545 W 27th Ct Unit 2447

- 6455 W 27th Ave Unit 44-13

- 2480 W 67th Place Unit 2312

- 6580 W 27th Ct Unit 58-21

- 2450 W 67th Place Unit 13-12

- 2614 W 65th St

- 6640 W 24th Ct Unit 25-106

- 6411 W 27th Way Unit 201

- 2377 W 66th Place Unit 204

- 2385 W 69th St Unit 2385B

- 2760 W 62nd Place Unit 203

- 2775 W 61st Place Unit 207

- 6080 W 26th Ct Unit 1019

- 6951 W 29th Ave Unit 206

- 2549 W 72nd Place

- 2531 W 60th Place Unit 10518

- 7211 W 24th Ave Unit 2304

- 6715 W 26th Dr Unit 2036

- 6715 W 26th Dr Unit 1026

- 6715 W 26th Dr Unit 2026

- 6715 W 26th Dr Unit 2046

- 6715 W 26th Dr Unit 1046

- 6715 W 26th Dr Unit 2016

- 6715 W 26th Dr Unit 1016

- 6735 W 26th Dr Unit 215

- 6735 W 26th Dr Unit 135

- 6735 W 26th Dr Unit 245

- 6735 W 26th Dr Unit 115

- 6735 W 26th Dr Unit 145

- 6735 W 26th Dr Unit 225

- 6735 W 26th Dr Unit 235

- 6735 W 26th Dr Unit 125

- 6705 W 26th Dr

- 6705 W 26th Dr Unit 217

- 6705 W 26th Dr Unit 137

- 6705 W 26th Dr Unit 237

- 6705 W 26th Dr Unit 247