6734 Sigel Johns Hill Rd Newcomerstown, OH 43832

Estimated Value: $403,000 - $484,253

3

Beds

2

Baths

1,333

Sq Ft

$333/Sq Ft

Est. Value

About This Home

This home is located at 6734 Sigel Johns Hill Rd, Newcomerstown, OH 43832 and is currently estimated at $443,627, approximately $332 per square foot. 6734 Sigel Johns Hill Rd is a home located in Tuscarawas County with nearby schools including West Elementary School, East Elementary School, and Newcomerstown Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 28, 2004

Sold by

Branch David and Branch Cynthia

Bought by

Crossman David A and Crossman Vickie M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

6.06%

Mortgage Type

Unknown

Purchase Details

Closed on

Jun 20, 1996

Sold by

Jamison Walter

Bought by

Branch David and Branch Cynthia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,000

Interest Rate

8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 23, 1992

Sold by

Jamison Walter H and Jamison Hilda S

Bought by

Crossman David A and Crossman Vickie M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Crossman David A | $225,000 | -- | |

| Branch David | $110,000 | -- | |

| Crossman David A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Crossman David A | $180,000 | |

| Previous Owner | Branch David | $143,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,120 | $87,660 | $40,170 | $47,490 |

| 2023 | $2,120 | $250,460 | $114,770 | $135,690 |

| 2022 | $2,021 | $87,661 | $40,170 | $47,492 |

| 2021 | $2,616 | $86,034 | $28,907 | $57,127 |

| 2020 | $2,646 | $86,034 | $28,907 | $57,127 |

| 2019 | $2,667 | $86,034 | $28,907 | $57,127 |

| 2018 | $2,377 | $73,370 | $24,650 | $48,720 |

| 2017 | $2,378 | $73,370 | $24,650 | $48,720 |

| 2016 | $2,383 | $73,370 | $24,650 | $48,720 |

| 2014 | $2,330 | $65,930 | $18,160 | $47,770 |

| 2013 | $2,339 | $65,930 | $18,160 | $47,770 |

Source: Public Records

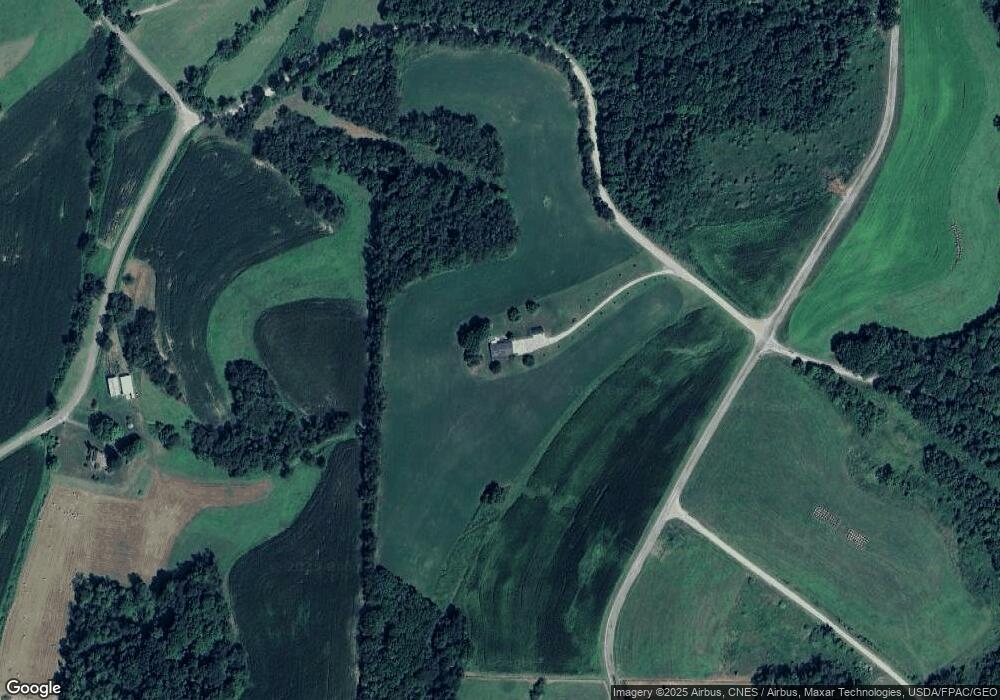

Map

Nearby Homes

- 8483 Little Buckhorn Rd

- 8263 Little Buckhorn Rd

- 8243 Little Buckhorn Rd

- 6451 Harmony Valley Rd

- 6350 Harmony Valley Rd

- 8698 Little Buckhorn Rd

- 9097 Buckhorn Rd

- 6312 Harmony Valley Rd

- 7305 Hawk Rd

- 8031 Little Buckhorn Rd

- 7522 Mount Zion Cemetery Rd

- 7945 Buckhorn Rd

- 6167 Harmony Valley Rd

- 6605 Everhart Rd

- 6443 Everhart Rd

- 0 Harmony Valley Rd SW

- 0000 Buckhorn Rd

- 0 Buckhorn Rd Unit 4180911

- 6260 Bethel Hill Rd

- 7406 Hawk Rd