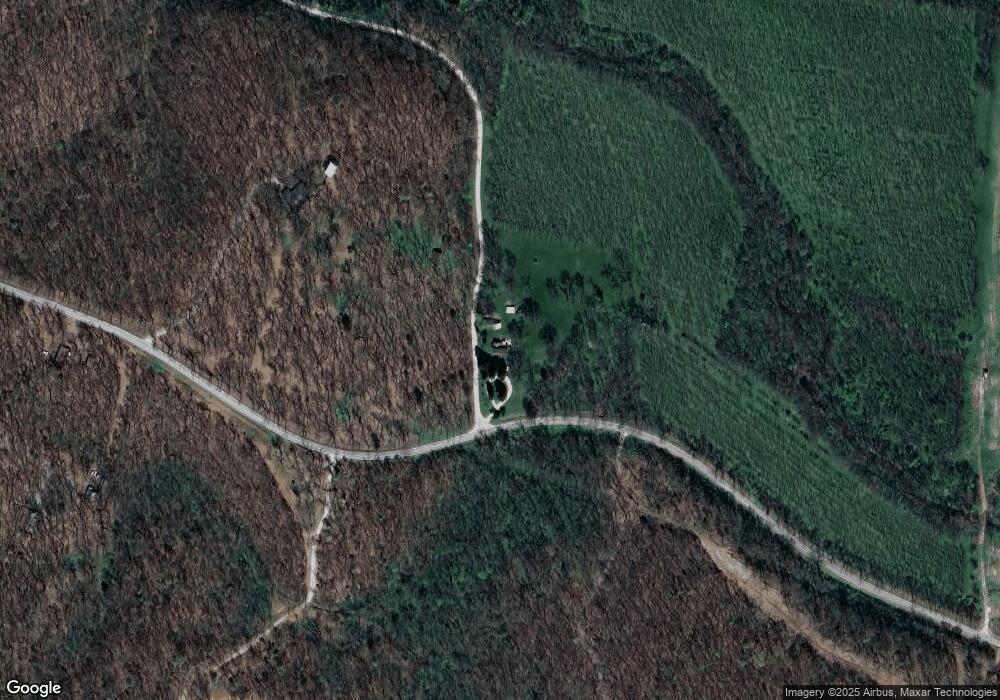

6741 Gum Rd Carthage, MO 64836

Estimated Value: $281,000

3

Beds

2

Baths

1,840

Sq Ft

$153/Sq Ft

Est. Value

About This Home

This home is located at 6741 Gum Rd, Carthage, MO 64836 and is currently estimated at $281,000, approximately $152 per square foot. 6741 Gum Rd is a home located in Jasper County with nearby schools including Wildwood Elementary School and Sarcoxie High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 16, 2022

Sold by

Kimberly Lieneman

Bought by

Kimberly Lieneman Family Trust

Current Estimated Value

Purchase Details

Closed on

Jan 20, 2010

Sold by

Secretary Of Veterans Affairs

Bought by

Lieneman Kimberly

Purchase Details

Closed on

Apr 9, 2009

Sold by

Garner Niles and Garner Kimberly

Bought by

Taylor Bean & Whitaker Mortgage Corporat

Purchase Details

Closed on

Apr 3, 2009

Sold by

Taylor Bean & Whitaker Mortgage Corporat

Bought by

Secretary Of Veteran Affairs

Purchase Details

Closed on

Nov 30, 2007

Sold by

Sanders Denver Burton and Elliott Eden Elise

Bought by

Garner Niles and Garner Kimberly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,351

Interest Rate

6.43%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kimberly Lieneman Family Trust | -- | None Listed On Document | |

| Lieneman Kimberly | -- | Fatco | |

| Taylor Bean & Whitaker Mortgage Corporat | $114,128 | None Available | |

| Secretary Of Veteran Affairs | -- | None Available | |

| Garner Niles | -- | Abbey |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Garner Niles | $139,351 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $733 | $20,190 | $1,580 | $18,610 |

| 2024 | $733 | $18,040 | $1,580 | $16,460 |

| 2023 | $733 | $18,040 | $1,580 | $16,460 |

| 2022 | $716 | $17,690 | $1,580 | $16,110 |

| 2021 | $686 | $17,690 | $1,580 | $16,110 |

| 2020 | $668 | $16,380 | $1,580 | $14,800 |

| 2019 | $670 | $16,380 | $1,580 | $14,800 |

| 2018 | $616 | $15,890 | $0 | $0 |

| 2017 | $673 | $15,890 | $0 | $0 |

| 2016 | $675 | $16,000 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 6675 County Road 80

- 6509 Glory Ln

- 6270 County Lane 84

- 5405 Hemlock Rd

- 4785 County Lane 55

- 15322 Cr-90

- 3501 State Highway 37

- 000 State Highway 37

- 3551/3501 State Highway 37

- TBD Harmony Rd

- 14910 County Road 90

- 7686 State Highway 96

- 3551 State Highway 37

- 8255 State Highway 96

- Lot 6 & 7 Indian Ridge Ln

- 9895 County Lane 93

- 10917 Gum Rd

- 7777 Cr-110

- 7777 Cr 110

- 10450 County Road 100