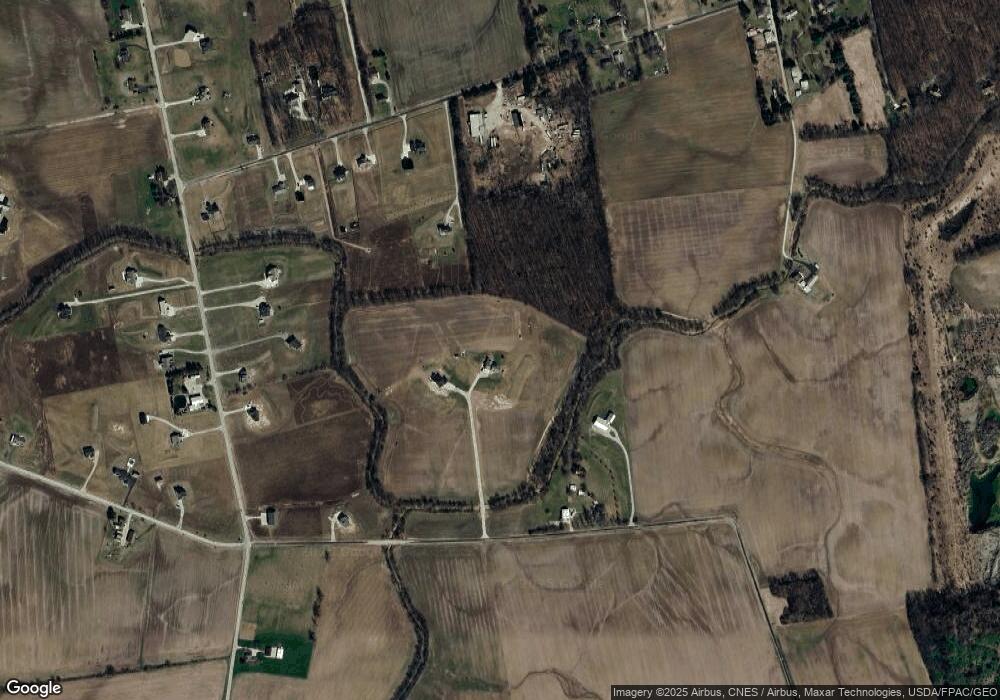

6756 Degood Rd Ostrander, OH 43061

Scioto NeighborhoodEstimated Value: $660,000 - $1,049,160

5

Beds

4

Baths

3,282

Sq Ft

$245/Sq Ft

Est. Value

About This Home

This home is located at 6756 Degood Rd, Ostrander, OH 43061 and is currently estimated at $804,790, approximately $245 per square foot. 6756 Degood Rd is a home with nearby schools including Buckeye Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 4, 2024

Sold by

Racette David F and Racette Donna J

Bought by

Goodall Brian J and Goodall Katie N

Current Estimated Value

Purchase Details

Closed on

Dec 8, 2022

Sold by

Racette Matthew R and Racette Margaret E

Bought by

Racette David F and Racette Donna J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$735,000

Interest Rate

7.08%

Mortgage Type

Construction

Purchase Details

Closed on

Jun 10, 2022

Bought by

Robert L Grant and Judith K Grant

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

5.23%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Goodall Brian J | -- | None Listed On Document | |

| Goodall Brian J | -- | None Listed On Document | |

| Racette David F | $135,000 | -- | |

| Robert L Grant | $475,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Racette David F | $735,000 | |

| Previous Owner | Robert L Grant | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,168 | $276,930 | $65,490 | $211,440 |

| 2023 | $243 | $66,820 | $66,820 | $0 |

| 2022 | $1,846 | $48,720 | $48,720 | $0 |

| 2021 | $0 | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1131 Ohio 257

- 0 Carr Rd Unit 225016840

- 631 Tyler Rd

- 0 Burnt Pond Rd Unit Tract 1

- 0 Burnt Pond Rd Unit Tract 2

- 0 Burnt Pond Rd Unit Tract 4

- 0 Burnt Pond Rd Unit Tract 3

- 0 Burnt Pond Rd Unit Tract 5

- 311 Blue Ridge Ct

- 1859 State Route 257 N

- 3480 Ostrander Rd

- 0 Delaware County Line Rd

- 0 E High St Unit Tract 1 225034753

- 0 E High St Unit Tract 4 225034758

- 0 E High St Unit Tract 3 225034757

- 101 S Main St

- 188 Huston St

- 854 S Section Line Rd

- 615 S Section Line Rd

- 0 Dean Rd Unit 225032132

- 6760 Degood Rd

- 6573 Houseman Rd

- 6676 Degood Rd

- 6625 Houseman Rd

- 6761 Houseman Rd

- 883 Brindle Rd

- 6675 Houseman Rd

- 6555 Houseman Rd

- 6729 Houseman Rd

- 6658 Degood Rd

- 895 Brindle Rd

- 6785 Houseman Rd

- 849 Brindle Rd

- 6650 Houseman Rd

- 876 Brindle Rd

- 900 Brindle Rd

- 835 Brindle Rd

- 6373 Houseman Rd

- 6175 Houseman Rd

- 6440 Houseman Rd