6760 Ross Rd Oregonia, OH 45054

Estimated Value: $395,000 - $547,000

4

Beds

3

Baths

2,214

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 6760 Ross Rd, Oregonia, OH 45054 and is currently estimated at $490,680, approximately $221 per square foot. 6760 Ross Rd is a home located in Warren County with nearby schools including Clinton-Massie Elementary School, Clinton-Massie Middle School, and Clinton-Massie High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 3, 2012

Sold by

Claunch Ct

Bought by

Claunch Ct and Claunch Imogene

Current Estimated Value

Purchase Details

Closed on

Jul 6, 2004

Sold by

Claunch C T

Bought by

Claunch C T

Purchase Details

Closed on

Aug 29, 1988

Sold by

Amburgy Bob C and Amburgy Ona M

Bought by

Claunch & C.T. Trustee

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Claunch Ct | -- | None Available | |

| Claunch C T | -- | -- | |

| Claunch & C.T. Trustee | $14,500 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,320 | $122,750 | $47,850 | $74,900 |

| 2023 | $2,687 | $96,120 | $29,704 | $66,416 |

| 2022 | $2,648 | $96,121 | $29,705 | $66,416 |

| 2021 | $2,356 | $96,121 | $29,705 | $66,416 |

| 2020 | $2,154 | $78,148 | $24,150 | $53,998 |

| 2019 | $2,194 | $78,148 | $24,150 | $53,998 |

| 2018 | $2,266 | $78,148 | $24,150 | $53,998 |

| 2017 | $1,973 | $67,774 | $20,426 | $47,348 |

| 2016 | $2,032 | $67,774 | $20,426 | $47,348 |

| 2015 | $2,032 | $67,774 | $20,426 | $47,348 |

| 2014 | $1,960 | $64,170 | $19,920 | $44,250 |

| 2013 | $1,898 | $74,280 | $21,350 | $52,930 |

Source: Public Records

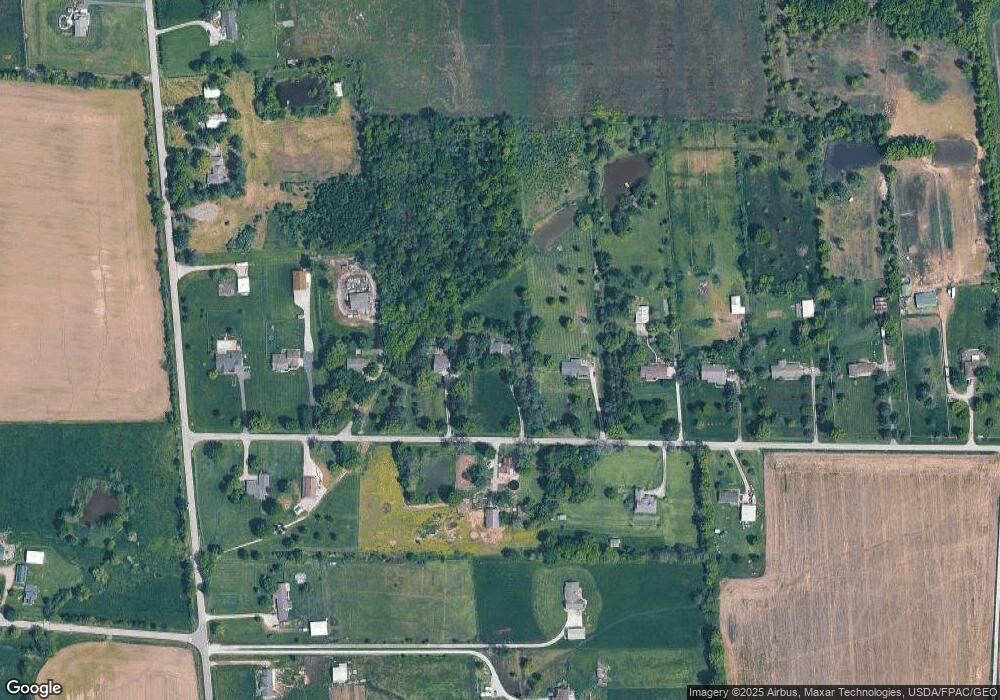

Map

Nearby Homes

- 304 High St

- 6500 Olive Branch Rd

- 6037 Oregonia Rd

- 1 Corwin Rd

- 5654 Wilmington Rd

- 6487 Flint Trail

- 702 Middleboro Rd

- 8784 Wilmington Rd

- 732 Settlemyre Rd

- 767 Settlemyre Rd

- 9029 Arrowcreek Dr

- 3276 N Waynesville Rd

- 600 Ward-Koebel Rd

- 600 Ward Koebel Rd

- 0 Wilmington Rd Unit 1856179

- 0 Wilmington Rd Unit 1856534

- 9255 Arrowcreek Dr

- Lot B Blazing Trail

- Lot C Blazing Trail

- 339 S Nixon Camp Rd