6769 Franklin Valley Rd Jackson, OH 45640

Estimated Value: $341,000 - $409,000

4

Beds

3

Baths

2,504

Sq Ft

$151/Sq Ft

Est. Value

About This Home

This home is located at 6769 Franklin Valley Rd, Jackson, OH 45640 and is currently estimated at $378,316, approximately $151 per square foot. 6769 Franklin Valley Rd is a home located in Jackson County with nearby schools including Jackson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 4, 2023

Sold by

Baisden Timmy L

Bought by

Brown Donna and Brown Nathan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$314,000

Outstanding Balance

$304,142

Interest Rate

6.13%

Mortgage Type

New Conventional

Estimated Equity

$74,174

Purchase Details

Closed on

Oct 30, 2017

Sold by

Gillialand Michael

Bought by

Baisden Brenda

Purchase Details

Closed on

Jun 16, 2017

Sold by

Gilliland Michael

Bought by

Gilliland Michael and Baisden Brenda

Purchase Details

Closed on

Oct 31, 2005

Sold by

Baisden Brenda

Bought by

Gilliland Michael

Purchase Details

Closed on

Jan 22, 1999

Bought by

Gilliland Michael

Purchase Details

Closed on

Mar 25, 1998

Bought by

Morris Kyle Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brown Donna | $314,000 | Best Title | |

| Brown Donna | $314,000 | Best Title | |

| Baisden Brenda | -- | None Available | |

| Gilliland Michael | -- | None Available | |

| Gilliland Michael | -- | None Available | |

| Gilliland Michael | $132,000 | -- | |

| Morris Kyle Inc | $12,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brown Donna | $314,000 | |

| Closed | Brown Donna | $314,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,660 | $96,940 | $8,720 | $88,220 |

| 2023 | $3,396 | $96,940 | $8,720 | $88,220 |

| 2022 | $3,669 | $76,590 | $7,510 | $69,080 |

| 2021 | $2,557 | $76,590 | $7,510 | $69,080 |

| 2020 | $2,573 | $76,590 | $7,510 | $69,080 |

| 2019 | $2,344 | $69,630 | $6,830 | $62,800 |

| 2018 | $2,254 | $69,630 | $6,830 | $62,800 |

| 2017 | $2,462 | $69,630 | $6,830 | $62,800 |

| 2016 | $2,081 | $58,210 | $6,970 | $51,240 |

| 2015 | $2,094 | $58,210 | $6,970 | $51,240 |

| 2013 | $2,027 | $56,860 | $6,970 | $49,890 |

| 2012 | $2,058 | $56,860 | $6,970 | $49,890 |

Source: Public Records

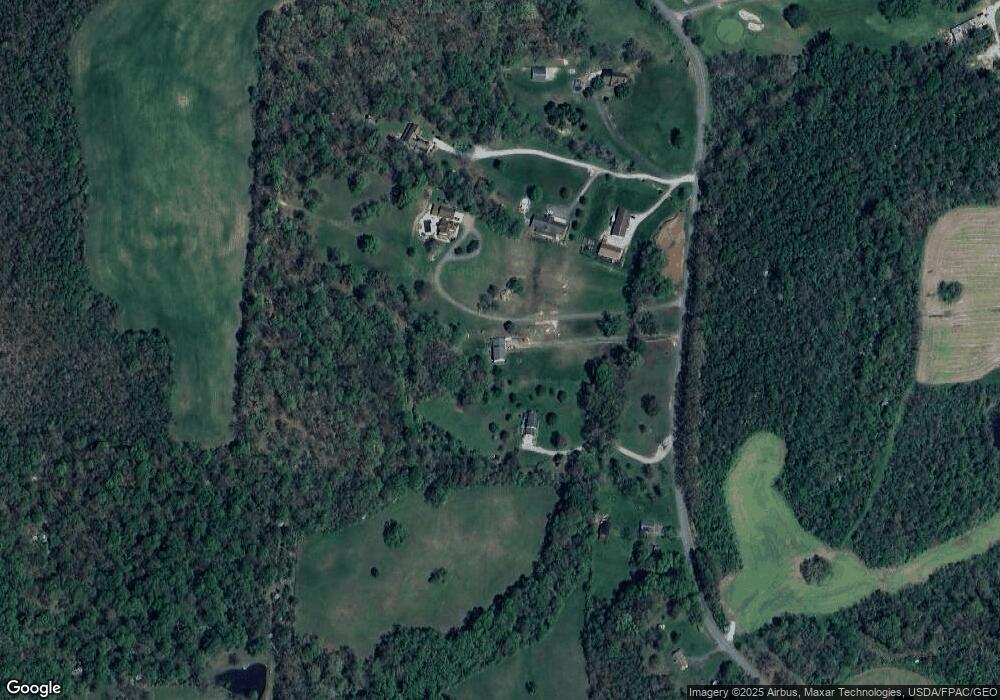

Map

Nearby Homes

- 3133 4 Mile Rd

- 627 Russ Rd

- 1656 Dever Rd

- 385 Gleandonshire Ln

- 212 Watts Colony St

- 129 Florence Ave

- 0 Standpipe Rd

- 13427 Ohio 139

- 13427 State Route 139

- 0 Main and Ballard St

- 0 Acy Ave

- 600 Acy Ave

- 992 Sternberger Rd

- 0 Keystone Furnace Rd Unit 11604343

- 1610 Erwin Rd

- 0 Industry Dr

- 366 Lewis Rd

- 563 Lewis Rd

- 41 Gay St

- 66 Grandview Ave

- 6711 Franklin Valley Rd

- 6793 Franklin Valley Rd

- 6819 Franklin Valley Rd

- 6651 Franklin Valley Rd

- 6857 Franklin Valley Rd

- 6859 Franklin Valley Rd

- 6950 Franklin Valley Rd

- 6585 Franklin Valley Rd

- 1027 Franklin Town House Rd

- 1374 Franklin Town House Rd

- 1071 Franklin Town House Rd

- 1114 Franklin Town House Rd

- 6449 Franklin Valley Rd

- 958 Franklin Town House Rd

- 867 Franklin Town House Rd

- 870 Franklin Town House Rd

- 829 Franklin Town House Rd

- 828 Franklin Town House Rd

- 6411 Franklin Valley Rd

- 6227 Franklin Valley Rd