6770 Royal Palm Blvd Unit 104L Margate, FL 33063

Estimated Value: $117,000 - $142,000

3

Beds

2

Baths

970

Sq Ft

$133/Sq Ft

Est. Value

About This Home

This home is located at 6770 Royal Palm Blvd Unit 104L, Margate, FL 33063 and is currently estimated at $128,859, approximately $132 per square foot. 6770 Royal Palm Blvd Unit 104L is a home located in Broward County with nearby schools including Margate Elementary School, Margate Middle School, and Coconut Creek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 30, 2013

Sold by

Guzman Eduardo A and Guzman Shirley G

Bought by

Ross Mitchell

Current Estimated Value

Purchase Details

Closed on

Mar 14, 2007

Sold by

Guzman Roberto E and Guzman Eduardo A

Bought by

Guzman Eduardo A and Guzman Shirley C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

6.1%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 20, 2006

Sold by

Bolhofner Mark

Bought by

Guzman Eduardo A and Guzman Shirley C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,670

Interest Rate

6.21%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Oct 3, 2001

Sold by

Wentworth Ruth L

Bought by

Wentworth Ruth L and Wilmer Roger

Purchase Details

Closed on

Dec 1, 1980

Sold by

Available Not

Bought by

Available Not

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ross Mitchell | $34,000 | United Title Assurance Llc | |

| Guzman Eduardo A | $35,500 | Sunbelt Title Agency Cooper | |

| Guzman Eduardo A | $77,500 | Founders Title | |

| Wentworth Ruth L | $15,100 | -- | |

| Available Not | $27,429 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Guzman Eduardo A | $100,000 | |

| Previous Owner | Guzman Eduardo A | $69,670 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,608 | $50,870 | -- | -- |

| 2024 | $1,600 | $49,440 | -- | -- |

| 2023 | $1,600 | $48,000 | $0 | $0 |

| 2022 | $1,611 | $46,610 | $0 | $0 |

| 2021 | $1,601 | $45,260 | $0 | $0 |

| 2020 | $1,851 | $44,640 | $0 | $0 |

| 2019 | $699 | $43,640 | $0 | $0 |

| 2018 | $675 | $42,830 | $0 | $0 |

| 2017 | $662 | $41,950 | $0 | $0 |

| 2016 | $576 | $41,090 | $0 | $0 |

| 2015 | $583 | $40,810 | $0 | $0 |

| 2014 | $936 | $30,940 | $0 | $0 |

| 2013 | -- | $26,940 | $2,690 | $24,250 |

Source: Public Records

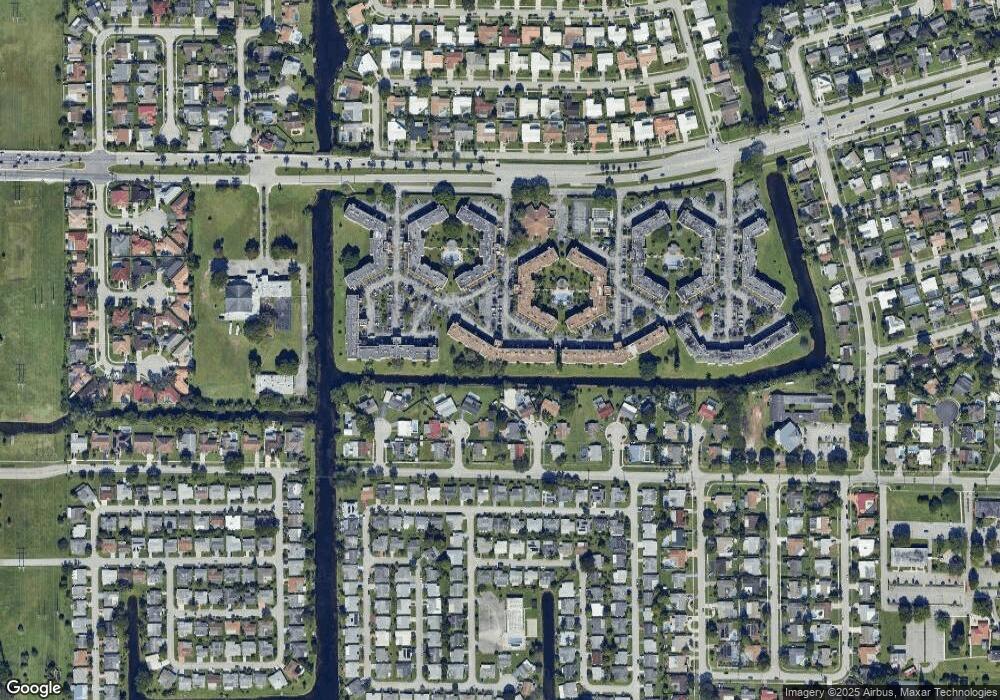

Map

Nearby Homes

- 6770 Royal Palm Blvd Unit 205L

- 6750 Royal Palm Blvd Unit 110E

- 6800 Royal Palm Blvd Unit 102F

- 6800 Royal Palm Blvd Unit 302F

- 6700 Royal Palm Blvd Unit 309D

- 6700 Royal Palm Blvd Unit 112D

- 6700 Royal Palm Blvd Unit 103D

- 6700 Royal Palm Blvd Unit 102D

- 6850 Royal Palm Blvd Unit 208G

- 6850 Royal Palm Blvd Unit 106G

- 6850 Royal Palm Blvd Unit 209G

- 6850 Royal Palm Blvd Unit 306G

- 6890 Royal Palm Blvd Unit 102H

- 6890 Royal Palm Blvd Unit 211H

- 6890 Royal Palm Blvd Unit 208H

- 6890 Royal Palm Blvd Unit 109H

- 6890 Royal Palm Blvd Unit 203H

- 6890 Royal Palm Blvd Unit 305H

- 6870 Royal Palm Blvd Unit 310M

- 6870 Royal Palm Blvd Unit 210M

- 6770 Royal Palm Blvd Unit 108-1

- 6770 Royal Palm Blvd Unit 309L

- 6770 Royal Palm Blvd Unit 202L

- 6770 Royal Palm Blvd Unit 108L

- 6770 Royal Palm Blvd Unit 311L

- 6770 Royal Palm Blvd Unit 305L

- 6770 Royal Palm Blvd Unit 208L

- 6770 Royal Palm Blvd Unit 105L

- 6770 Royal Palm Blvd Unit 307L

- 6770 Royal Palm Blvd Unit 207L

- 6770 Royal Palm Blvd Unit 201L

- 6770 Royal Palm Blvd Unit 302L

- 6770 Royal Palm Blvd Unit 308L

- 6770 Royal Palm Blvd Unit 314L

- 6770 Royal Palm Blvd Unit 111L

- 6770 Royal Palm Blvd Unit 303L

- 6770 Royal Palm Blvd Unit 212L212L

- 6770 Royal Palm Blvd Unit 210L

- 6770 Royal Palm Blvd Unit 209L

- 6770 Royal Palm Blvd Unit 203L