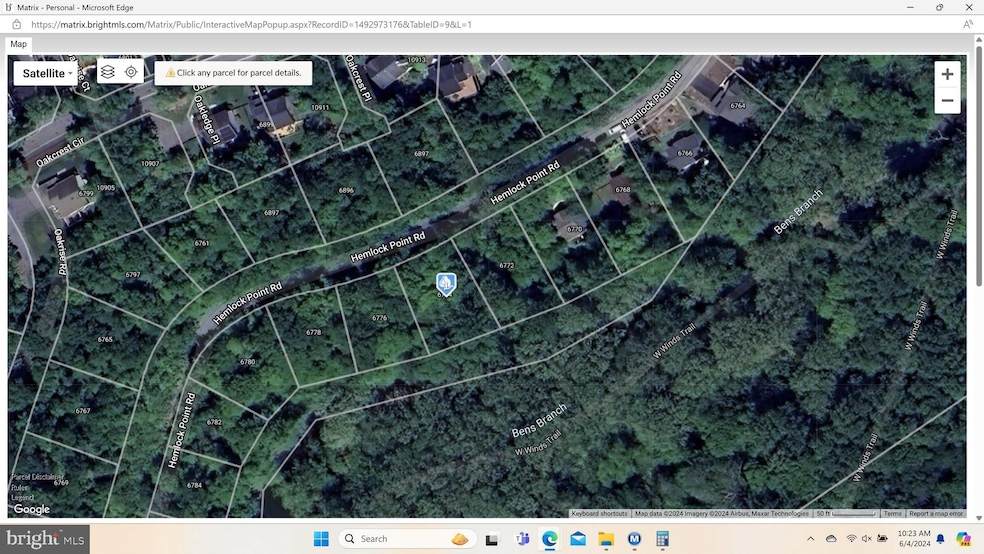

6774 Hemlock Point Rd New Market, MD 21774

Estimated payment $122/month

Total Views

58,739

0.22

Acre

$90,905

Price per Acre

9,563

Sq Ft Lot

About This Lot

building lot - 1 of 4 total - also for sale 6782, 6780, 6778 - water and sewer at the property - you can purchase one lot or two lots or three lots or all four - your choice

Property Details

Property Type

- Land

Est. Annual Taxes

- $183

Lot Details

- 9,563 Sq Ft Lot

Community Details

- No Home Owners Association

Listing and Financial Details

- Tax Lot 385

- Assessor Parcel Number 1127517714

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $182 | $21,667 | $21,667 | -- |

| 2024 | $182 | $15,000 | $15,000 | $0 |

| 2023 | $161 | $13,733 | $0 | $0 |

| 2022 | $145 | $12,467 | $0 | $0 |

| 2021 | $130 | $11,200 | $11,200 | $0 |

| 2020 | $130 | $11,200 | $11,200 | $0 |

| 2019 | $130 | $11,200 | $11,200 | $0 |

| 2018 | $131 | $11,200 | $11,200 | $0 |

| 2017 | $130 | $11,200 | $0 | $0 |

| 2016 | $350 | $11,200 | $0 | $0 |

| 2015 | $350 | $11,200 | $0 | $0 |

| 2014 | $350 | $11,200 | $0 | $0 |

Source: Public Records

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 07/29/2025 07/29/25 | Pending | -- | -- | -- |

| 04/17/2025 04/17/25 | Price Changed | $19,999 | -33.3% | -- |

| 06/04/2024 06/04/24 | For Sale | $29,999 | -- | -- |

Source: Bright MLS

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Public Action Common In Florida Clerks Tax Deed Or Tax Deeds Or Property Sold For Taxes | $7,963 | Presidential Title Llc | |

| Deed | $2,500 | -- |

Source: Public Records

Source: Bright MLS

MLS Number: MDFR2049352

APN: 27-517714

Nearby Homes

- 6778 Hemlock Point Rd

- 6780 Hemlock Point Rd

- 6782 Hemlock Point Rd

- 10920 Oakcrest Cir

- 6804 Oakledge Ct

- 10807 Forest Edge Place

- 6618 Hemlock Point Rd

- 6967 Country Club Terrace

- 6764 W Lakeridge Rd

- 10632 Old Barn Rd

- 10624 Old Barn Rd

- 6532 Twin Lake Dr

- 6721 Balmoral Overlook

- 7129 Bodkin Way

- 10617 Saponi Dr

- 6798 Balmoral Ridge

- 10708 Saponi Dr

- 7213 Bodkin Way

- 6524 Rimrock Rd

- 6776 Balmoral Ridge