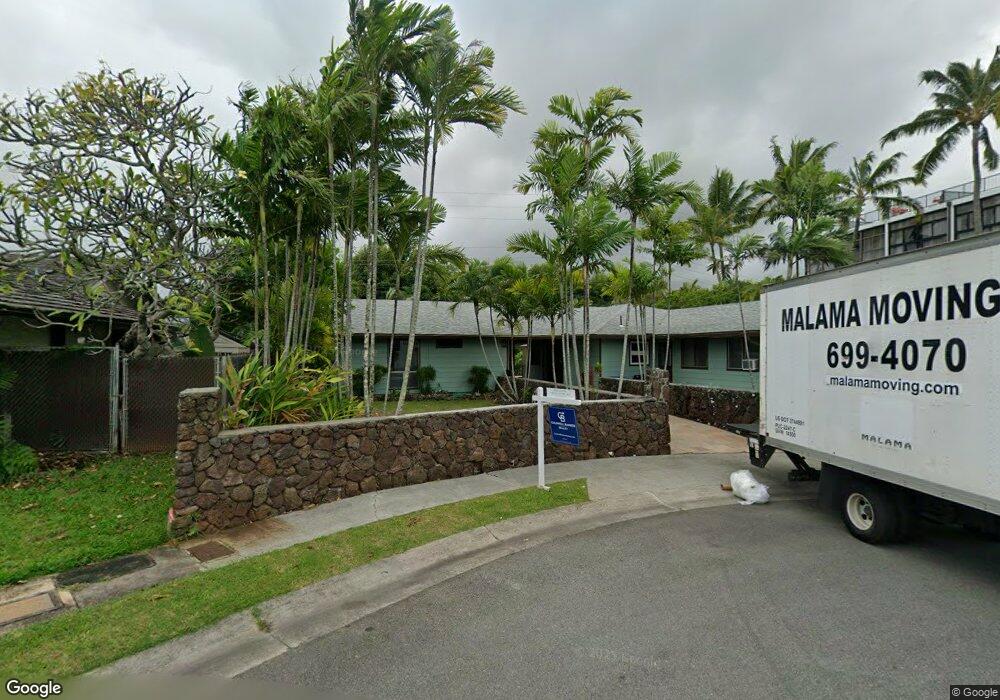

678 Auwina St Unit 4 Kailua, HI 96734

Estimated Value: $1,926,000 - $2,453,000

4

Beds

1

Bath

650

Sq Ft

$3,264/Sq Ft

Est. Value

About This Home

This home is located at 678 Auwina St Unit 4, Kailua, HI 96734 and is currently estimated at $2,121,364, approximately $3,263 per square foot. 678 Auwina St Unit 4 is a home located in Honolulu County with nearby schools including Kailua Intermediate School, Kalaheo High School, and St John Vianney Parish School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 4, 2024

Sold by

Eugenia Un Suk Lee Revocable Living Trus and Lee Eugenia Un

Bought by

Winkler George and Krasnecova Beata

Current Estimated Value

Purchase Details

Closed on

Aug 25, 2015

Sold by

Baumel Gena Lee and Lee Eugenia Un Suk

Bought by

Lee Eugenia Un Suk

Purchase Details

Closed on

Jul 8, 2009

Sold by

Baumel Lee Nat

Bought by

Baumel Lee Nat and Baumel Gena Lee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$560,000

Interest Rate

5.25%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Oct 26, 2000

Sold by

Baumel Lee N

Bought by

Baumel Lee Nat and Lee Nat Baumel Revocable Trust

Purchase Details

Closed on

Sep 22, 1999

Sold by

Pestana Brian Nicholas and Pestana Lisa Kim

Bought by

Baumel Lee N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$450,500

Interest Rate

8.09%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Winkler George | -- | Fam | |

| Lee Eugenia Un Suk | -- | None Available | |

| Lee Eugenia Un Suk | -- | None Available | |

| Baumel Lee Nat | -- | Accommodation | |

| Baumel Lee Nat | -- | -- | |

| Baumel Lee N | $530,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Baumel Lee Nat | $560,000 | |

| Previous Owner | Baumel Lee N | $450,500 | |

| Closed | Baumel Lee N | $53,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,629 | $1,998,800 | $1,599,000 | $399,800 |

| 2024 | $6,629 | $2,054,000 | $1,599,000 | $455,000 |

| 2023 | $5,705 | $1,829,900 | $1,599,000 | $230,900 |

| 2022 | $6,385 | $1,924,400 | $1,422,500 | $501,900 |

| 2021 | $5,367 | $1,633,500 | $1,049,700 | $583,800 |

| 2020 | $4,433 | $1,366,600 | $1,049,700 | $316,900 |

| 2019 | $4,502 | $1,366,200 | $1,030,100 | $336,100 |

| 2018 | $4,139 | $1,262,600 | $981,000 | $281,600 |

| 2017 | $6,607 | $1,234,100 | $892,700 | $341,400 |

| 2016 | $6,909 | $1,151,500 | $833,300 | $318,200 |

| 2015 | $3,121 | $1,011,600 | $784,300 | $227,300 |

| 2014 | $3,092 | $1,075,300 | $725,500 | $349,800 |

Source: Public Records

Map

Nearby Homes

- 1015 Aoloa Place Unit 437

- 1015 Aoloa Place Unit 218

- 1020 Aoloa Place Unit 210A

- 1020 Aoloa Place Unit 110A

- 1020 Aoloa Place Unit 311B

- 355 Aoloa St Unit P101

- 355 Aoloa St Unit M206

- 333 Aoloa St Unit 325

- 350 Aoloa St Unit B207

- 322 Aoloa St Unit 906

- 322 Aoloa St Unit 612

- 322 Aoloa St Unit 1708

- 322 Aoloa St Unit 1110

- 322 Aoloa St Unit 208

- 599 Keolu Dr Unit B

- 519 Wanaao Rd

- 279 Kakahiaka St

- 150 Kailua Rd

- 141 Kuukama St

- 14 Aulike St Unit 1006

- 678 Auwina St Unit 3

- 678 Auwina St Unit 1

- 672 Auwina St

- 668 Auwina St

- 677 Auwina St

- 673 Auwina St

- 667 Auwina St

- 662 Auwina St

- 655 Akoakoa St

- 651 Akoakoa St

- 663 Auwina St

- 1030 Aoloa Place Unit 2

- 1030 Aoloa Place Unit 6

- 1030 Aoloa Place Unit 11

- 1030 Aoloa Place Unit 6

- 1030 Aoloa Place Unit 12

- 1030 Aoloa Place Unit 1

- 1030 Aoloa Place Unit 6

- 1030 Aoloa Place Unit 5

- 1030 Aoloa Place Unit 11