680 S Beach Rd Point Roberts, WA 98281

Estimated Value: $129,000 - $605,000

2

Beds

1

Bath

891

Sq Ft

$400/Sq Ft

Est. Value

About This Home

This home is located at 680 S Beach Rd, Point Roberts, WA 98281 and is currently estimated at $356,000, approximately $399 per square foot. 680 S Beach Rd is a home located in Whatcom County with nearby schools including Point Roberts Primary School, Blaine Middle School, and Blaine High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2021

Sold by

Wickson Stephen R and Wickson Patricia L

Bought by

Vandelay Management Inc

Current Estimated Value

Purchase Details

Closed on

May 8, 2008

Sold by

Beveridge John Christopher and Beveridge Marylin Jean

Bought by

Wickson Steve and Wickson Patricia

Purchase Details

Closed on

Aug 31, 2001

Sold by

Kendrick Georgina Marie

Bought by

Beveridge J Chris and Beveridge Marylin J

Purchase Details

Closed on

Jun 29, 1999

Sold by

Beveridge J Chris and Beveridge Marylin J

Bought by

Kendrick Edward Clarence and Kendrick Georgina Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,000

Interest Rate

7.51%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vandelay Management Inc | $575,000 | Chicago Title Company Of Wa | |

| Wickson Steve | $637,780 | Whatcom Land Title | |

| Beveridge J Chris | -- | -- | |

| Kendrick Edward Clarence | $80,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kendrick Edward Clarence | $70,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $895 | $121,968 | $121,968 | -- |

| 2024 | $809 | $116,160 | $116,160 | -- |

| 2023 | $809 | $105,600 | $105,600 | $0 |

| 2022 | $264 | $82,500 | $82,500 | $0 |

| 2021 | $268 | $28,833 | $28,833 | $0 |

| 2020 | $258 | $27,200 | $27,200 | $0 |

| 2019 | $256 | $25,375 | $25,375 | $0 |

| 2018 | $280 | $24,500 | $24,500 | $0 |

| 2017 | $252 | $24,500 | $24,500 | $0 |

| 2016 | $275 | $25,000 | $25,000 | $0 |

| 2015 | $285 | $26,490 | $26,490 | $0 |

| 2014 | -- | $26,970 | $26,970 | $0 |

| 2013 | -- | $30,000 | $30,000 | $0 |

Source: Public Records

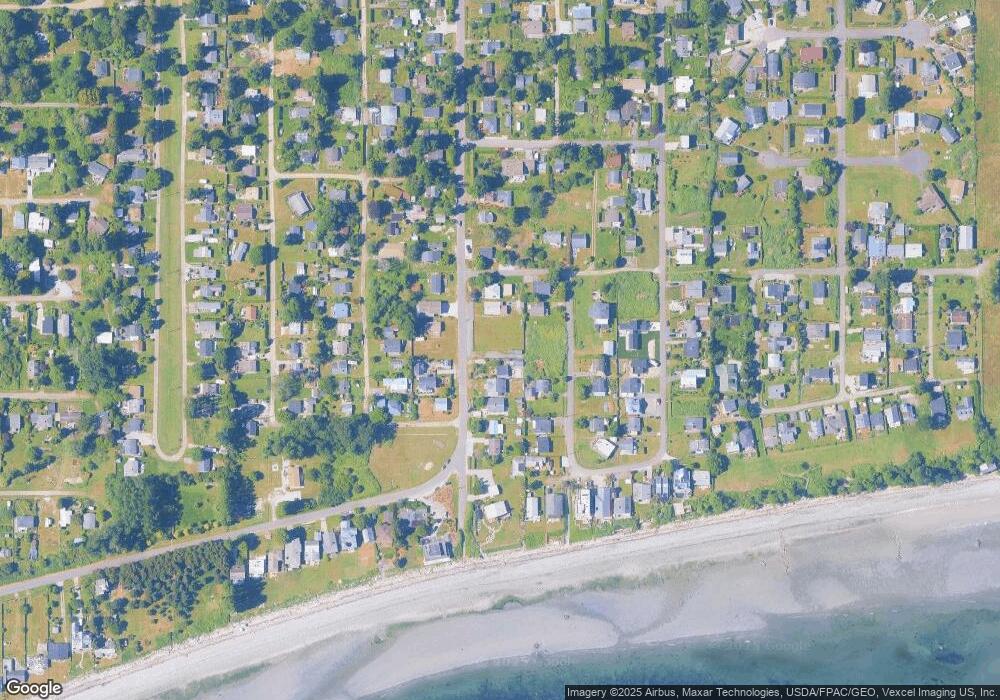

Map

Nearby Homes

- 661 Driftwood Ln

- 1881 Edwards Dr

- 1920 Patos Way

- 1940 Apa Rd

- 2045 Apa Rd

- 2242 Seabright Loop

- 1648 Harbor Seal Dr

- 2202 Seabright Loop

- 58 Seabright Loop

- 1630 Edwards Dr

- 1587 Harbor Seal Dr

- 0 Deer Rd

- 1774 Centennial Place

- 6 Weasel Run Rd

- 2138 Benson Rd

- 721 Ocean View Ct

- 1477 Edwards Dr

- 1 Mill Rd

- 2 Mill Rd

- 168 Tyee Dr