6803 Dawson Rd Cincinnati, OH 45243

Estimated Value: $786,135 - $1,041,000

4

Beds

3

Baths

3,082

Sq Ft

$283/Sq Ft

Est. Value

About This Home

This home is located at 6803 Dawson Rd, Cincinnati, OH 45243 and is currently estimated at $871,534, approximately $282 per square foot. 6803 Dawson Rd is a home located in Hamilton County with nearby schools including Madeira Elementary School, Madeira Middle School, and Madeira High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 26, 2010

Sold by

Doran Marjorie K

Bought by

Dye David F and Dye Lauren D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$172,248

Interest Rate

5.05%

Mortgage Type

New Conventional

Estimated Equity

$699,286

Purchase Details

Closed on

Jul 20, 2005

Sold by

Rave Joseph A

Bought by

Doran Marjorie K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

5.68%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Aug 13, 2001

Sold by

Rave Joseph A

Bought by

Rave Joseph A and Joseph A Rave Jr Agreement Of Trust

Purchase Details

Closed on

Jan 25, 1994

Sold by

Rave Joseph A and Rave Constance S

Bought by

Rave Joseph A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dye David F | $325,000 | Attorney | |

| Doran Marjorie K | $350,000 | Tri Star Title Agency Inc | |

| Rave Joseph A | -- | -- | |

| Rave Joseph A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dye David F | $260,000 | |

| Closed | Doran Marjorie K | $125,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,840 | $217,655 | $116,477 | $101,178 |

| 2024 | $12,557 | $217,655 | $116,477 | $101,178 |

| 2023 | $12,689 | $217,655 | $116,477 | $101,178 |

| 2022 | $10,942 | $153,444 | $88,869 | $64,575 |

| 2021 | $10,741 | $153,444 | $88,869 | $64,575 |

| 2020 | $9,904 | $153,444 | $88,869 | $64,575 |

| 2019 | $10,430 | $148,975 | $86,279 | $62,696 |

| 2018 | $10,512 | $148,975 | $86,279 | $62,696 |

| 2017 | $9,991 | $148,975 | $86,279 | $62,696 |

| 2016 | $7,868 | $110,338 | $49,301 | $61,037 |

| 2015 | $7,265 | $110,338 | $49,301 | $61,037 |

| 2014 | $7,305 | $110,338 | $49,301 | $61,037 |

| 2013 | $7,795 | $113,750 | $50,827 | $62,923 |

Source: Public Records

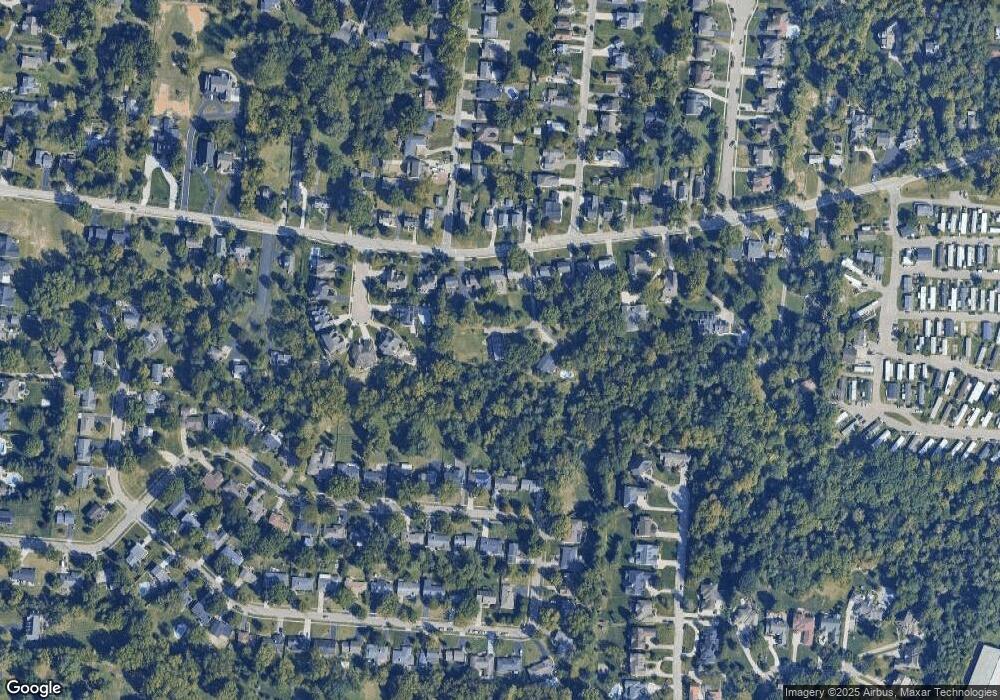

Map

Nearby Homes

- 6752 Rose Crest Ave

- 7002 Dawson Rd

- 7406 Dawson Rd

- 6441 Euclid Ave

- 7437 Madeira Pines Dr

- 7474 Dawson Rd

- 7025 Wallace Ave

- 7301 Euclid Ave

- 7317 Euclid Ave

- 5995 Crabtree Ln

- 6242 Fulsher Ln

- 7390 Hosbrook Rd

- 6300 Miami Rd

- 6041 Johnson St

- 7335 Demar Rd

- 6008 Winnetka Dr

- 7834 Laurel Ave

- 7831 Euclid Ave

- 5805 Miami Rd

- 5801 Kenwood Rd

- 6779 Dawson Rd

- 6765 Dawson Rd

- 6797 Dawson Rd

- 6751 Dawson Rd

- 6813 Dawson Rd

- 6590 Carriage Hill Ln

- 6831 Dawson Rd

- 6727 Dawson Rd

- 6582 Carriage Hill Ln

- 6568 Apache Cir

- 6845 Dawson Rd

- 6564 Apache Cir

- 6600 Carriage Hill Ln

- 6774 Dawson Rd

- 6863 Dawson Rd

- 6576 Carriage Hill Ln

- 6574 Apache Cir

- 6784 Dawson Rd

- 6794 Dawson Rd

- 6889 Dawson Rd