6815 Brookline Dr Unit 6815 Hialeah, FL 33015

Estimated Value: $461,810 - $513,000

3

Beds

3

Baths

2,180

Sq Ft

$218/Sq Ft

Est. Value

About This Home

This home is located at 6815 Brookline Dr Unit 6815, Hialeah, FL 33015 and is currently estimated at $475,703, approximately $218 per square foot. 6815 Brookline Dr Unit 6815 is a home located in Miami-Dade County with nearby schools including Spanish Lake Elementary School, Country Club Middle School, and American Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 25, 2016

Sold by

Morales Nestor E

Bought by

Nestor E Morales Trs

Current Estimated Value

Purchase Details

Closed on

Jan 25, 2016

Sold by

Morales Nestor E and Feliciano Nestor Morales

Bought by

Morales Nestor E

Purchase Details

Closed on

Sep 24, 2010

Sold by

Quinones Luz M

Bought by

Morales Nestor E

Purchase Details

Closed on

Mar 31, 2005

Sold by

Mulkey Linda

Bought by

Quinones Luz M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,000

Interest Rate

6%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 27, 2001

Sold by

Ronald Platt I

Bought by

Lee Lemon M

Purchase Details

Closed on

Feb 18, 1997

Sold by

Wardell Harry E and Wardell Mary Ann

Bought by

Platt Ronald and Puig Luis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,300

Interest Rate

7.7%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nestor E Morales Trs | $100 | -- | |

| Morales Nestor E | -- | Attorney | |

| Morales Nestor E | $147,000 | Premier Title & Research Inc | |

| Quinones Luz M | $235,000 | -- | |

| Lee Lemon M | $124,900 | -- | |

| Platt Ronald | $107,700 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Quinones Luz M | $188,000 | |

| Previous Owner | Platt Ronald | $102,300 | |

| Closed | Quinones Luz M | $35,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,506 | $151,285 | -- | -- |

| 2024 | $2,296 | $147,022 | -- | -- |

| 2023 | $2,296 | $142,740 | $0 | $0 |

| 2022 | $2,183 | $138,583 | $0 | $0 |

| 2021 | $2,148 | $134,547 | $0 | $0 |

| 2020 | $2,122 | $132,690 | $0 | $0 |

| 2019 | $2,074 | $129,707 | $0 | $0 |

| 2018 | $1,967 | $127,289 | $0 | $0 |

| 2017 | $1,946 | $124,671 | $0 | $0 |

| 2016 | $1,912 | $122,107 | $0 | $0 |

| 2015 | $1,930 | $121,259 | $0 | $0 |

| 2014 | -- | $120,297 | $0 | $0 |

Source: Public Records

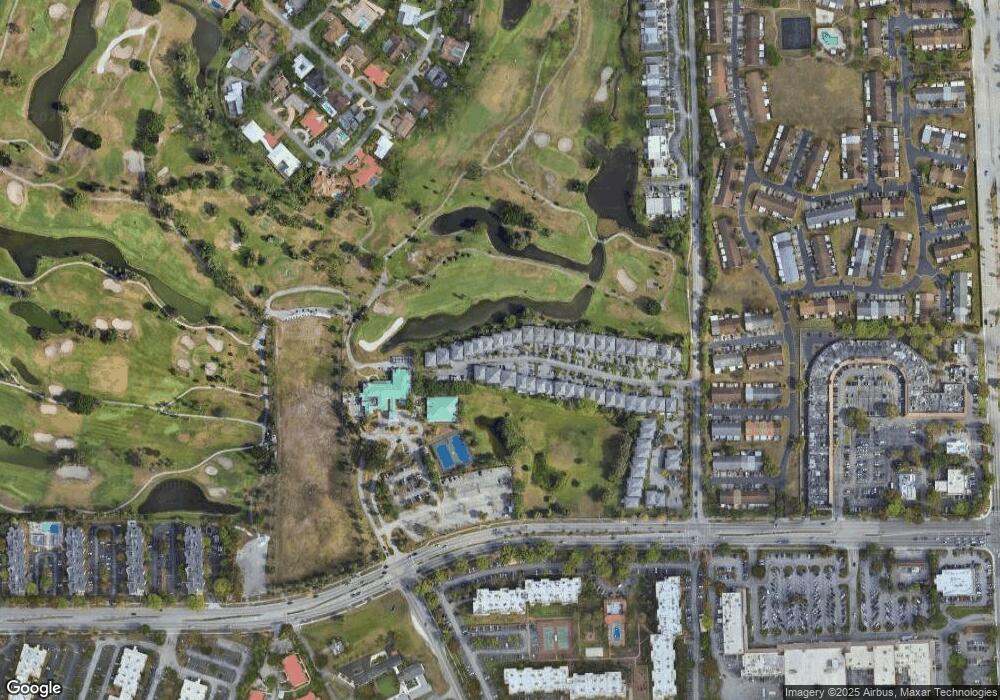

Map

Nearby Homes

- 6795 & 6793 Brookline Dr

- 6782 Brookline Dr Unit 6782

- 6707 Brookline Dr Unit 6707

- 6812 Brookline Dr Unit 6812

- 6726 NW 188th Terrace

- 6700 NW 190th St

- 18338 NW 68th Ave Unit L

- 18350 NW 68th Ave Unit F

- 18328 NW 68th Ave Unit P

- 19265 E Saint Andrews Dr

- 6955 NW 186th St Unit F301

- 19150 S Saint Andrews Dr

- 6950 Miami Gardens Dr Unit 2-411

- 6950 Miami Gardens Dr Unit 2-508

- 18352 NW 68th Ave Unit P

- 18332 NW 68th Ave Unit A

- 6950 NW 186th St Unit 2-510

- 6708 NW 193rd Terrace

- 7075 NW 186th St Unit C101

- 7075 NW 186th St Unit C409

- 6807 Brookline Dr Unit 6807

- 6825 Brookline Dr Unit 6825

- 6819 Brookline Dr Unit 6819

- 6798 Brookline Dr

- 6813 Brookline Dr Unit 6813

- 6817 Brookline Dr Unit 6817

- 6811 Brookline Dr Unit 6811

- 6823 Brookline Dr Unit 6823

- 6799 Brookline Dr Unit 6797A

- 6805 Brookline Dr Unit 6805

- 6827 Brookline Dr Unit 6827

- 6791 Brookline Dr Unit 6791

- 6804 Brookline Dr Unit 6804

- 6816 Brookline Dr Unit 6816

- 6822 Brookline Dr Unit 6822

- 6787 Brookline Dr Unit 6787

- 6829 Brookline Dr

- 6806 Brookline Dr Unit 6806

- 6810 Brookline Dr Unit 6810