6826 Silverrock Dr Unit 7-6826 New Albany, OH 43054

Central College NeighborhoodEstimated Value: $301,000 - $306,735

2

Beds

2

Baths

1,405

Sq Ft

$216/Sq Ft

Est. Value

About This Home

This home is located at 6826 Silverrock Dr Unit 7-6826, New Albany, OH 43054 and is currently estimated at $303,184, approximately $215 per square foot. 6826 Silverrock Dr Unit 7-6826 is a home located in Franklin County with nearby schools including Avalon Elementary School, Northgate Intermediate, and Woodward Park Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 14, 2022

Sold by

Jean Frey Verna and Jean Leonard J

Bought by

Manco Vincent

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$228,800

Outstanding Balance

$217,666

Interest Rate

5.25%

Mortgage Type

New Conventional

Estimated Equity

$85,518

Purchase Details

Closed on

Aug 4, 2016

Sold by

Phelps Norma E

Bought by

Frey Verna Jean and Frey Leonard J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,200

Interest Rate

3.54%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 1, 2016

Sold by

Phelps Norma E

Bought by

Frey Verna Jean and Frey Leonard J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,200

Interest Rate

3.54%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 17, 2010

Sold by

M H Murphy Development Company

Bought by

Phelps Joseph T and Phelps Norma E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Manco Vincent | $300,000 | Northwest Title | |

| Frey Verna Jean | -- | None Available | |

| Frey Verna Jean | -- | None Available | |

| Phelps Joseph T | $175,000 | Stewart Tit |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Manco Vincent | $228,800 | |

| Previous Owner | Frey Verna Jean | $142,200 | |

| Previous Owner | Frey Verna Jean | $142,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,232 | $94,290 | $16,450 | $77,840 |

| 2023 | $4,178 | $94,290 | $16,450 | $77,840 |

| 2022 | $3,233 | $62,340 | $8,750 | $53,590 |

| 2021 | $3,239 | $62,340 | $8,750 | $53,590 |

| 2020 | $3,243 | $62,340 | $8,750 | $53,590 |

| 2019 | $2,801 | $46,170 | $6,480 | $39,690 |

| 2018 | $1,397 | $46,170 | $6,480 | $39,690 |

| 2017 | $2,799 | $46,170 | $6,480 | $39,690 |

| 2016 | $2,432 | $45,470 | $7,770 | $37,700 |

| 2015 | $1,104 | $45,470 | $7,770 | $37,700 |

| 2014 | $2,214 | $45,470 | $7,770 | $37,700 |

| 2013 | $1,243 | $50,540 | $8,645 | $41,895 |

Source: Public Records

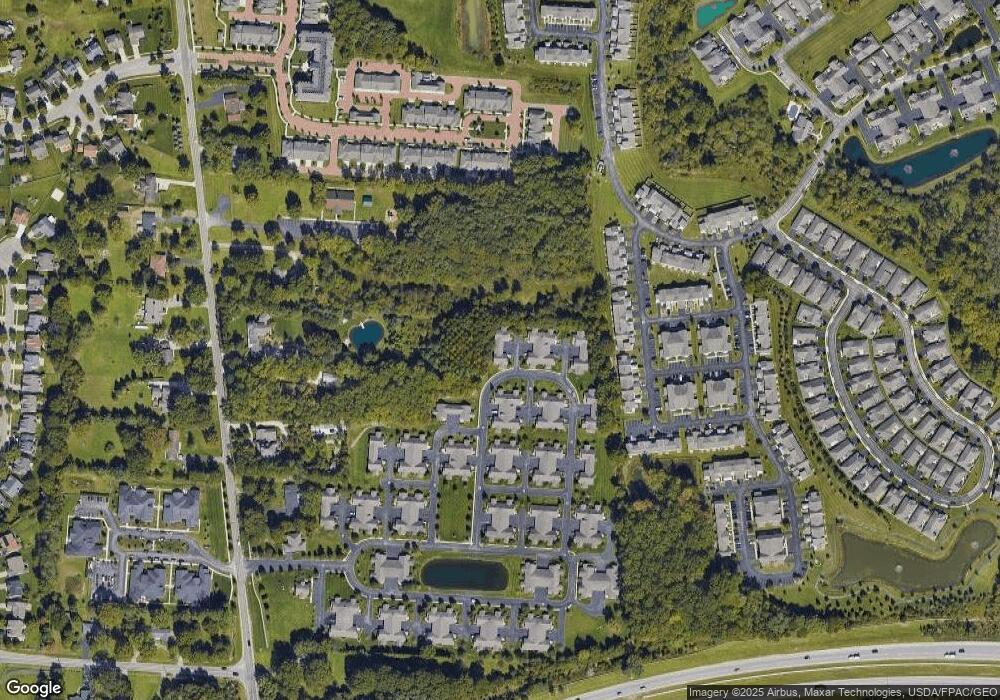

Map

Nearby Homes

- 6806 Newrock Dr

- 6789 Rolfe Ave

- 6813 Ridge Rock Dr Unit 14

- 5445 Welbourne Place Unit 25

- 5608 Apothecary Way

- 5624 Apothecary Way

- 5628 Apothecary Way

- 5556 Falco Dr

- 5664 Apothecary Way

- 6923 Rothwell St Unit 46923

- 5644 Sanibel Ct

- 6771 Bethany Dr

- 5730 Colts Gate Dr Unit 43

- 6710 Bethany Dr

- 5767 Colts Gate Dr

- 5777 Colts Gate Dr Unit 44

- 5587 Connorwill Dr

- 6501 Walnut Fork Dr Unit 6501

- 7016 Churchill Downs Dr

- 6498 Ash Rock Cir Unit 6498

- 6826 Silverrock Dr

- 6826 Silverrock Dr Unit 27-682

- 6836 Silverrock Dr Unit 6836

- 6836 Silverrock Dr Unit 28

- 6836 Silverrock Dr Unit 7-6826

- 6834 Silverrock Dr

- 6837 Silverrock Dr

- 6837 Silverrock Dr Unit BLDG 25

- 6829 Silver Rock Dr

- 6831 Silverrock Dr

- 6835 Silverrock Dr

- 6838 Silverrock Dr

- 6838 Silverrock Dr Unit 7-6826

- 6842 Silverrock Dr

- 6849 Silverrock Dr

- 6818 Newrock Dr

- 6849 Silver Rock Dr

- 6851 Silverrock Dr

- 6847 Silverrock Dr

- 6847 Silverrock Dr Unit 7-6826