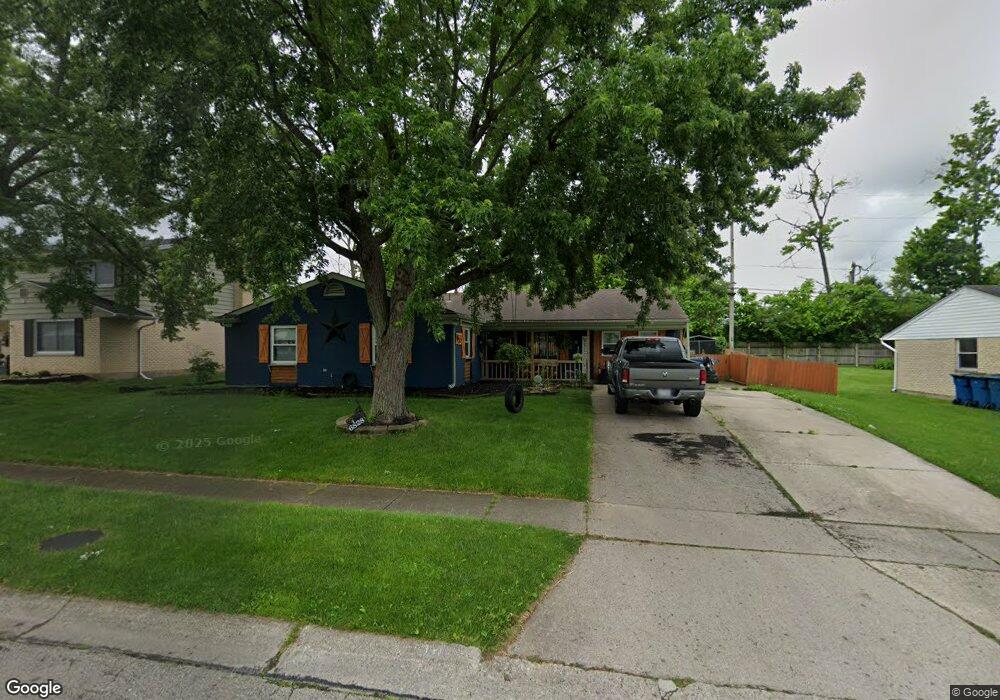

6828 Alter Rd Dayton, OH 45424

Estimated Value: $211,000 - $230,000

3

Beds

2

Baths

1,579

Sq Ft

$139/Sq Ft

Est. Value

About This Home

This home is located at 6828 Alter Rd, Dayton, OH 45424 and is currently estimated at $219,366, approximately $138 per square foot. 6828 Alter Rd is a home located in Montgomery County with nearby schools including Wayne High School and Huber Heights Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 26, 2020

Sold by

Walton Investments Corporation

Bought by

Haworth Jonathan C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,100

Outstanding Balance

$132,970

Interest Rate

3.4%

Mortgage Type

New Conventional

Estimated Equity

$86,396

Purchase Details

Closed on

Sep 7, 2016

Sold by

Dohme Andrew B

Bought by

Walton Investments Corp

Purchase Details

Closed on

Mar 13, 2007

Sold by

Maynard David L

Bought by

Dohme Andrew B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,000

Interest Rate

6.31%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 8, 2002

Sold by

Maynard David L

Bought by

Maynard Brenda J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Haworth Jonathan C | $158,000 | Home Services Title Llc | |

| Walton Investments Corp | $52,100 | None Available | |

| Dohme Andrew B | $90,000 | None Available | |

| Maynard Brenda J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Haworth Jonathan C | $150,100 | |

| Previous Owner | Dohme Andrew B | $81,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,820 | $53,880 | $10,150 | $43,730 |

| 2023 | $2,820 | $53,880 | $10,150 | $43,730 |

| 2022 | $2,471 | $37,120 | $7,000 | $30,120 |

| 2021 | $2,572 | $37,120 | $7,000 | $30,120 |

| 2020 | $2,466 | $37,120 | $7,000 | $30,120 |

| 2019 | $2,424 | $31,440 | $7,000 | $24,440 |

| 2018 | $2,433 | $31,440 | $7,000 | $24,440 |

| 2017 | $2,418 | $31,440 | $7,000 | $24,440 |

| 2016 | $2,241 | $29,140 | $7,000 | $22,140 |

| 2015 | $2,213 | $29,140 | $7,000 | $22,140 |

| 2014 | $2,213 | $29,140 | $7,000 | $22,140 |

| 2012 | -- | $32,880 | $8,750 | $24,130 |

Source: Public Records

Map

Nearby Homes

- 6717 Alter Rd

- 6811 Highbury Rd

- 6946 Hubbard Dr

- 6413 Alter Rd

- 7315 Glengate Ct

- 7061 Rio Vista Ct

- 6601 Grovehill Dr

- 7222 Brandtvista Ave

- 6605 Highbury Rd

- 6245 Longford Rd

- 6800 Cicero Ct

- 6739 Evergreen Woods Dr

- 6506 Tellea St

- 6960 Serene Place

- 7126 Mandrake Dr

- 6673 Celestine St

- 7424 Chatlake Dr

- 7515 Beldale Ave

- 7011 Safari Dr

- 7611 Shepherdess Dr