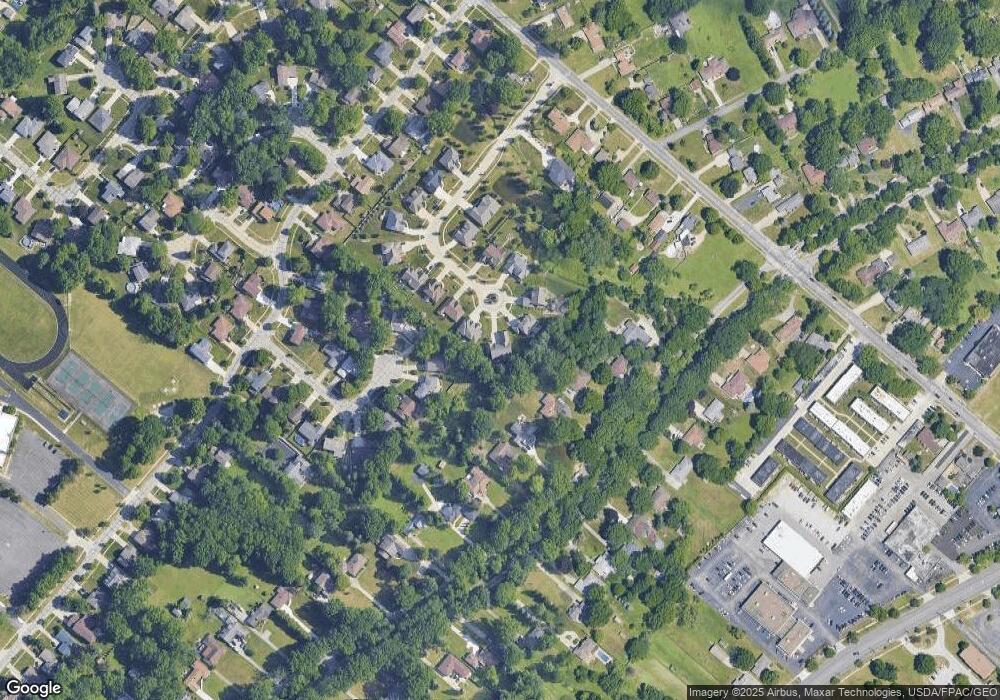

6832 Saint Andrews Ct Middleburg Heights, OH 44130

Estimated Value: $350,000 - $464,447

3

Beds

3

Baths

2,548

Sq Ft

$162/Sq Ft

Est. Value

About This Home

This home is located at 6832 Saint Andrews Ct, Middleburg Heights, OH 44130 and is currently estimated at $412,862, approximately $162 per square foot. 6832 Saint Andrews Ct is a home with nearby schools including Big Creek Elementary School, Berea-Midpark Middle School, and Berea-Midpark High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 28, 2013

Sold by

Boulder Creek Of Middleburg Llc

Bought by

Gizzi Alfred J and Pucillo Debra M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$211,409

Interest Rate

2.9%

Mortgage Type

Construction

Estimated Equity

$201,453

Purchase Details

Closed on

Oct 8, 2011

Sold by

Ruggiero Construction Co Inc

Bought by

Boulder Creek Of Middleburg Llc

Purchase Details

Closed on

Mar 14, 2008

Sold by

Kanserski Sue L

Bought by

Ruggiero Construction Co Inc

Purchase Details

Closed on

Feb 28, 2001

Sold by

Smith Linda

Bought by

Kanserski Sue L

Purchase Details

Closed on

Nov 4, 1988

Sold by

Kanserski Norman J

Bought by

Kanserski Sue L

Purchase Details

Closed on

Jan 7, 1976

Sold by

Kanserski Norman J and Kanserski Sue L

Bought by

Kanserski Norman J

Purchase Details

Closed on

Jan 1, 1975

Bought by

Kanserski Norman J and Kanserski Sue L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gizzi Alfred J | $85,500 | Maximum Title | |

| Boulder Creek Of Middleburg Llc | -- | Maximum Title | |

| Ruggiero Construction Co Inc | $165,000 | Maximum Title | |

| Kanserski Sue L | -- | -- | |

| Kanserski Sue L | -- | -- | |

| Kanserski Norman J | -- | -- | |

| Kanserski Norman J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gizzi Alfred J | $300,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,765 | $129,010 | $23,625 | $105,385 |

| 2023 | $6,672 | $105,350 | $22,330 | $83,020 |

| 2022 | $6,627 | $105,350 | $22,330 | $83,020 |

| 2021 | $6,593 | $105,350 | $22,330 | $83,020 |

| 2020 | $6,866 | $96,640 | $20,480 | $76,160 |

| 2019 | $6,669 | $276,100 | $58,500 | $217,600 |

| 2018 | $6,313 | $96,640 | $20,480 | $76,160 |

| 2017 | $6,590 | $90,090 | $13,860 | $76,230 |

| 2016 | $6,537 | $90,090 | $13,860 | $76,230 |

| 2015 | $6,096 | $90,090 | $13,860 | $76,230 |

| 2014 | $3,576 | $44,590 | $13,860 | $30,730 |

Source: Public Records

Map

Nearby Homes

- 6943 N Parkway Dr Unit H6943

- 6771 Wood Creek Dr

- 6749 Middlebrook Blvd

- 13689 Pineview Ct

- 6566 Elmdale Rd

- 15510 Sandalhaven Dr

- 15983 Galemore Dr

- 14750 Seneca Trail

- 6736 Rockridge Ct

- 6359 Middlebrook Blvd

- 6710 Woodruff Ct

- 6809 Meadow Ln

- 6736 Columbine Ct

- 15446 Sheldon Rd

- 6491 Smith Rd

- 13879 Zaremba Dr

- 16147 Ramona Dr

- 13931 Franklyn Blvd

- 6823 Fry Rd

- 13505 Old Pleasant Valley Rd

- 6829 Saint Andrews Ct

- 6830 Saint Andrews Ct

- 6827 Saint Andrews Ct

- 6828 Saint Andrews Ct

- 6904 Dogwood Cir

- 6896 Big Creek Pkwy

- 6890 Big Creek Pkwy

- 6825 Saint Andrews Ct

- 6826 Saint Andrews Ct

- 6904 Big Creek Pkwy

- 6823 Saint Andrews Ct

- 6824 Saint Andrews Ct

- 6895 Dogwood Cir

- 6895 Dogwood Cir

- 6912 Big Creek Pkwy

- 6916 Dogwood Cir

- 6882 Big Creek Pkwy

- 6821 Saint Andrews Ct

- 6876 Big Creek Pkwy

- 6920 Big Creek Pkwy