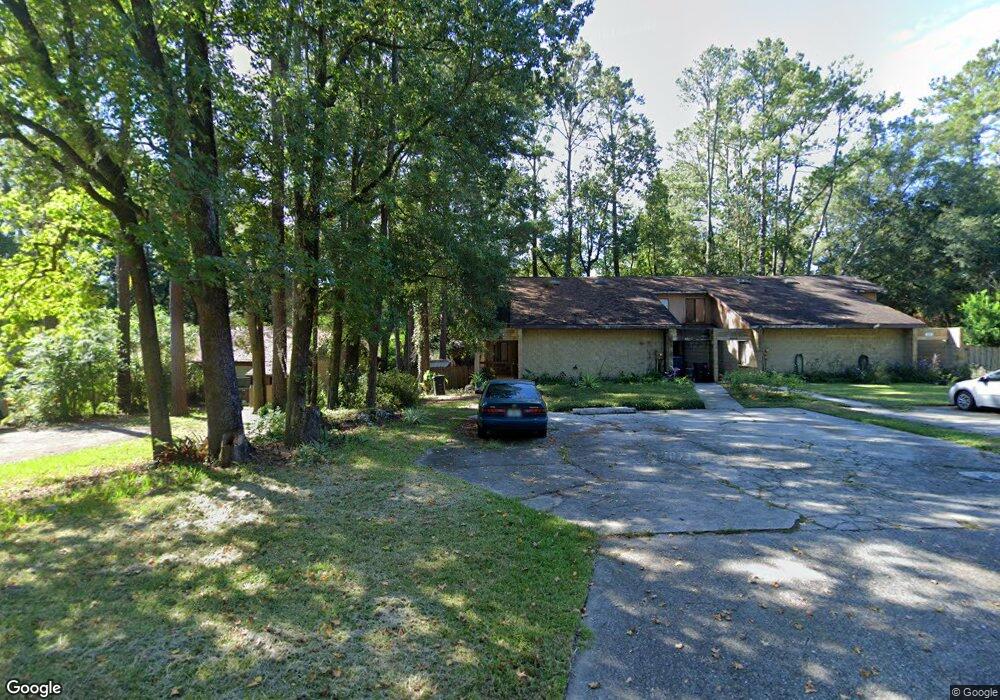

6905 SW 45th Ave Gainesville, FL 32608

Estimated Value: $157,000 - $187,000

3

Beds

2

Baths

1,351

Sq Ft

$127/Sq Ft

Est. Value

About This Home

This home is located at 6905 SW 45th Ave, Gainesville, FL 32608 and is currently estimated at $171,420, approximately $126 per square foot. 6905 SW 45th Ave is a home located in Alachua County with nearby schools including Kimball Wiles Elementary School, Kanapaha Middle School, and F.W. Buchholz High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 2, 2004

Sold by

Pozo Vivian and Dedea Amy L

Bought by

Martinez Fiamma

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,050

Outstanding Balance

$25,181

Interest Rate

6.22%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$146,239

Purchase Details

Closed on

Oct 26, 2000

Bought by

Martinez Fiamma

Purchase Details

Closed on

Aug 1, 1994

Bought by

Martinez Fiamma

Purchase Details

Closed on

Jan 1, 1986

Bought by

Martinez Fiamma

Purchase Details

Closed on

Mar 1, 1983

Bought by

Martinez Fiamma

Purchase Details

Closed on

Sep 1, 1982

Bought by

Martinez Fiamma

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Martinez Fiamma | $94,900 | -- | |

| Martinez Fiamma | $100 | -- | |

| Martinez Fiamma | $40,000 | -- | |

| Martinez Fiamma | $100 | -- | |

| Martinez Fiamma | $49,000 | -- | |

| Martinez Fiamma | $100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Martinez Fiamma | $50,050 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $956 | $45,994 | -- | -- |

| 2023 | $956 | $44,654 | $0 | $0 |

| 2022 | $896 | $43,353 | $0 | $0 |

| 2021 | $864 | $42,090 | $0 | $0 |

| 2020 | $838 | $41,509 | $0 | $0 |

| 2019 | $732 | $40,576 | $0 | $0 |

| 2018 | $706 | $39,820 | $0 | $0 |

| 2017 | $682 | $39,010 | $0 | $0 |

| 2016 | $517 | $38,210 | $0 | $0 |

| 2015 | $513 | $37,950 | $0 | $0 |

| 2014 | $525 | $37,650 | $0 | $0 |

| 2013 | -- | $37,100 | $6,000 | $31,100 |

Source: Public Records

Map

Nearby Homes

- 4704 SW 67th Terrace

- 6925 SW 46th Ave

- 4316 SW 68th Terrace

- 4224 SW 70th Terrace Unit A

- 7213 SW 44th Place

- 6622 SW 49 Place

- 4801 SW 63rd Blvd

- 5027 SW 69th St

- 5110 SW 69th St

- 8656 SW 75th St

- 3903 SW 77th St

- 7637 SW 49th Place

- 0 SW Archer Rd

- 5816 SW Archer Rd Unit 30

- 7515 SW 36th Ave

- 000 SW Archer Rd

- 3450 SW 74th Way

- 5263 SW 51st Rd

- 7604 SW 56th Ave

- 7826 SW 36th Ave

- 6907 SW 45th Ave

- 6909 SW 45th Ave

- 6815 SW 45th Ave

- 6911 SW 45th Ave

- 6813 SW 45th Ave

- 6811 SW 45th Ave

- 6904 SW 46th Ave Unit 2

- 6906 SW 46th Ave

- 6904 SW 46 Ave

- 6807 SW 45th Ave

- 6908 SW 46th Ave

- 6826 SW 46th Ave

- 6910 SW 46th Ave

- 6910 SW 46 Ave

- 6824 SW 46th Ave

- 6822 SW 46th Ave Unit 15B

- 6805 SW 45th Ave

- 6921 SW 45th Ave

- 6820 SW 46th Ave

- 6906 SW 45th Ave