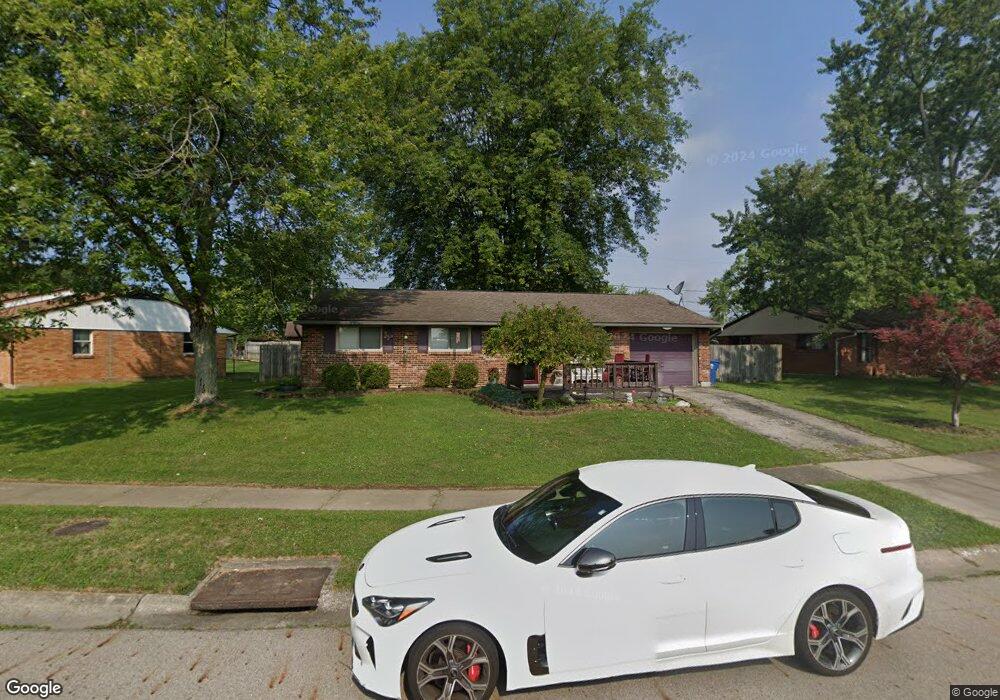

6909 Shellcross Dr Dayton, OH 45424

Estimated Value: $158,000 - $182,000

3

Beds

1

Bath

999

Sq Ft

$173/Sq Ft

Est. Value

About This Home

This home is located at 6909 Shellcross Dr, Dayton, OH 45424 and is currently estimated at $172,337, approximately $172 per square foot. 6909 Shellcross Dr is a home located in Montgomery County with nearby schools including Wayne High School and Huber Heights Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 31, 2020

Sold by

Booher Aubrey L and Walker Cameron

Bought by

Thomas Kaila and Thomas Zachary

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,917

Outstanding Balance

$99,062

Interest Rate

2.9%

Mortgage Type

FHA

Estimated Equity

$73,275

Purchase Details

Closed on

Sep 16, 2016

Sold by

Chambliss Derek A and Chambliss Chelsey L

Bought by

Booher Aubrey L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,677

Interest Rate

3.25%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 10, 2011

Sold by

Anglin Chrsitopher and Anglin Connie S

Bought by

Chambliss Derek A and Phillips Chelsey L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,921

Interest Rate

5.25%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 20, 1998

Sold by

Loraine Davis

Bought by

Anglin Christopher and Anglin Connie S

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Thomas Kaila | $115,000 | Vantage Land Title | |

| Booher Aubrey L | $73,000 | Fidelity Lawyers Title Agenc | |

| Chambliss Derek A | $82,000 | Attorney | |

| Anglin Christopher | $78,900 | -- | |

| Anglin Christopher | $78,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Thomas Kaila | $112,917 | |

| Previous Owner | Booher Aubrey L | $71,677 | |

| Previous Owner | Chambliss Derek A | $79,921 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,349 | $43,750 | $10,150 | $33,600 |

| 2024 | $2,270 | $43,750 | $10,150 | $33,600 |

| 2023 | $2,270 | $43,750 | $10,150 | $33,600 |

| 2022 | $1,975 | $30,140 | $7,000 | $23,140 |

| 2021 | $2,015 | $30,140 | $7,000 | $23,140 |

| 2020 | $2,016 | $30,140 | $7,000 | $23,140 |

| 2019 | $2,022 | $26,740 | $7,000 | $19,740 |

| 2018 | $2,029 | $26,740 | $7,000 | $19,740 |

| 2017 | $2,015 | $26,740 | $7,000 | $19,740 |

| 2016 | $1,916 | $24,750 | $7,000 | $17,750 |

| 2015 | $1,891 | $24,750 | $7,000 | $17,750 |

| 2014 | $1,891 | $24,750 | $7,000 | $17,750 |

| 2012 | -- | $26,590 | $8,750 | $17,840 |

Source: Public Records

Map

Nearby Homes

- 7621 Shalamar Dr

- 7611 Shepherdess Dr

- 6857 Pablo Dr

- 7890 Sebring Dr

- 7368 San Fernando Rd

- 6529 Larcomb Dr

- 6566 Highbury Rd

- 6429 Leawood Dr

- 7424 Chatlake Dr

- 6601 Grovehill Dr

- 7882 Harshmanville Rd

- 7302 Belle Plain Dr

- 7999 Blackshear Dr

- 6483 Highbury Rd

- 8286 Briar Ridge Ct

- 8349 Chinaberry Place

- 7371 Damascus Dr

- 7356 Natoma Place

- 6533 Millhoff Dr

- 6730 Alter Rd

- 6913 Shellcross Dr

- 6905 Shellcross Dr

- 7706 Shalamar Dr

- 7710 Shalamar Dr

- 6917 Shellcross Dr

- 6901 Shellcross Dr

- 6920 Shellcross Dr

- 6916 Shellcross Dr

- 6924 Shellcross Dr

- 7714 Shalamar Dr

- 6912 Shellcross Dr

- 6908 Shellcross Dr

- 6921 Shellcross Dr

- 6928 Shellcross Dr

- 7718 Shalamar Dr

- 6904 Shellcross Dr

- 7613 Stonecrest Dr

- 7709 Shalamar Dr

- 7619 Stonecrest Dr

- 7705 Shalamar Dr

Your Personal Tour Guide

Ask me questions while you tour the home.