6917 Benjamin Blvd Joshua, TX 76058

Estimated Value: $393,605 - $442,000

3

Beds

2

Baths

1,631

Sq Ft

$259/Sq Ft

Est. Value

About This Home

This home is located at 6917 Benjamin Blvd, Joshua, TX 76058 and is currently estimated at $422,401, approximately $258 per square foot. 6917 Benjamin Blvd is a home located in Johnson County with nearby schools including Pleasant View Elementary School, Godley Elementary School, and Godley Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 15, 2022

Sold by

Brummett Jenna Lee

Bought by

One Eyed Skunk Llc

Current Estimated Value

Purchase Details

Closed on

Nov 29, 2022

Sold by

Brummett Jenna Lee

Bought by

One Eyed Skunk Llc

Purchase Details

Closed on

Sep 18, 2020

Sold by

Moore Anabel and Moore Johnny Crispin

Bought by

Rivard Hannah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$253,200

Interest Rate

2.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 4, 2016

Sold by

Beal Bank Ssb

Bought by

Moore Anabel

Purchase Details

Closed on

Jan 5, 2016

Sold by

Arends Robert G and Arends Karen A

Bought by

Beal Bank S S B

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| One Eyed Skunk Llc | -- | Simplifile | |

| Brummett Jenna Lee | -- | -- | |

| One Eyed Skunk Llc | -- | Simplifile | |

| Brummett Jenna Lee | -- | None Listed On Document | |

| Rivard Hannah | -- | Old Republic Title | |

| Moore Anabel | -- | None Available | |

| Beal Bank S S B | $125,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rivard Hannah | $253,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,843 | $355,074 | $190,350 | $164,724 |

| 2024 | $6,203 | $355,074 | $190,350 | $164,724 |

| 2023 | $4,878 | $355,074 | $190,350 | $164,724 |

| 2022 | $6,515 | $355,074 | $190,350 | $164,724 |

| 2021 | $5,996 | $300,084 | $135,360 | $164,724 |

| 2020 | $6,194 | $313,241 | $219,960 | $93,281 |

| 2019 | $3,033 | $144,821 | $57,300 | $87,521 |

| 2018 | $3,034 | $144,821 | $57,300 | $87,521 |

| 2017 | $3,015 | $144,821 | $57,300 | $87,521 |

| 2016 | $2,810 | $134,976 | $47,455 | $87,521 |

| 2015 | $1,583 | $129,976 | $42,455 | $87,521 |

| 2014 | $1,583 | $130,553 | $42,455 | $88,098 |

Source: Public Records

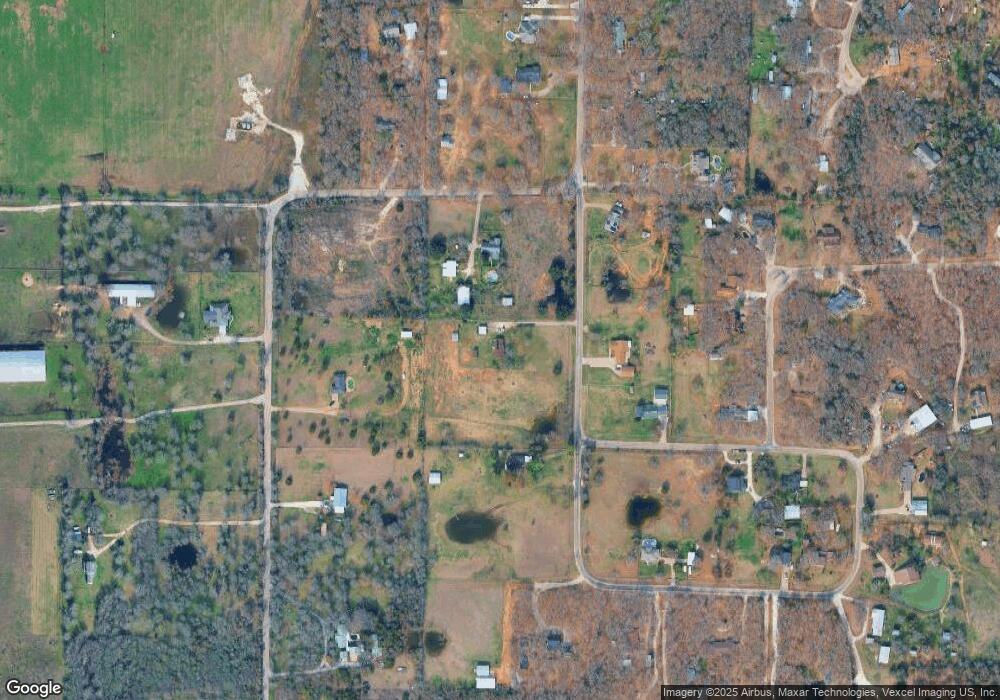

Map

Nearby Homes

- 2800 W Fm 917

- 5828 Thousand Oaks Dr

- 2312 W Fm 917

- 3095 County Road 905

- 5900 Wild Berry Trail

- 5905 Wild Berry Trail

- 3213 Elderberry Ln

- 2800 County Road 911

- TBD Trailwood

- 5900 County Road 1017

- 6916 Sundance Cir

- 1601 W Fm 917

- 6112 Wild Berry Trail

- 1637 W Fm 917

- 5909 Black Springs Ln

- 5809 Black Springs Ln

- 6490 County Road 1022

- San Angelo Plan at Silo Mills

- 4216 Furrow Bend

- 4225 Furrow Bend

- 7108 County Road 1017

- 6821 Benjamin Blvd

- 6916 Benjamin Blvd

- 6900 County Road 1017

- 2504 Mountain View Rd

- 7012 Benjamin Blvd

- 6909 Resivor Rd

- 6840 County Road 1017

- 6913 Resivor Rd

- 7045 County Road 1017

- 6917 Resivor Rd

- 2500 Mountain View Rd

- 2500 Wild Oaks Ave

- 7144 County Road 1017

- 7149 County Road 1017

- 7136 County Road 1017

- 6961 County Road 1017

- 2501 Mountain View Rd

- 6921 Resivor Rd

- 2513 Wild Oaks Ave