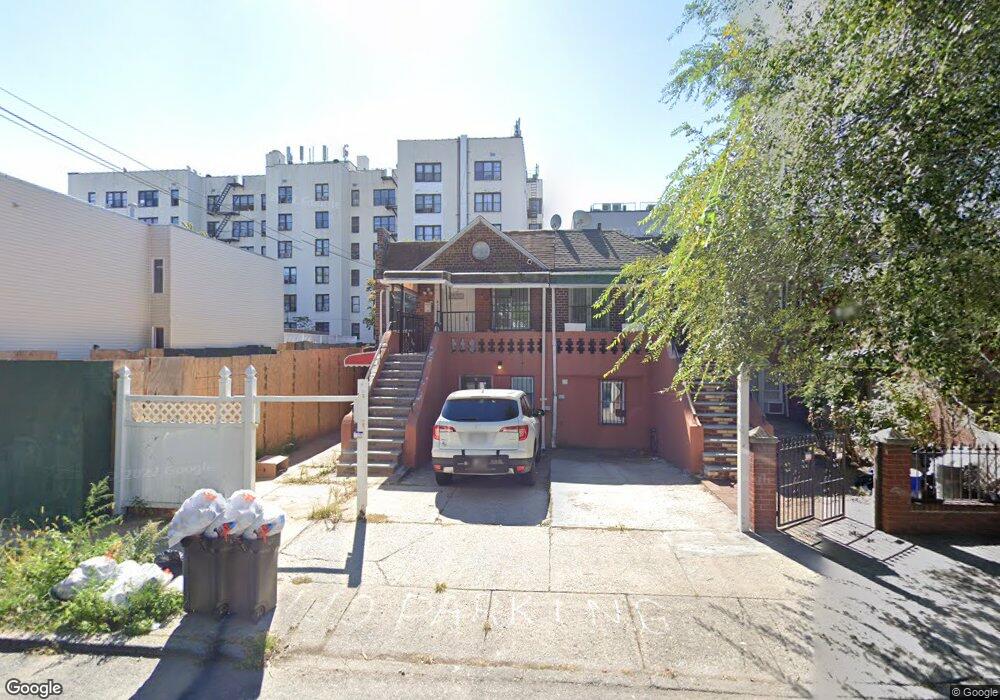

692 Rutland Rd Brooklyn, NY 11203

East Flatbush NeighborhoodEstimated Value: $705,000 - $837,000

--

Bed

--

Bath

1,334

Sq Ft

$578/Sq Ft

Est. Value

About This Home

This home is located at 692 Rutland Rd, Brooklyn, NY 11203 and is currently estimated at $770,795, approximately $577 per square foot. 692 Rutland Rd is a home located in Kings County with nearby schools including P.S. 91 The Albany Avenue School, New Heights Middle School, and Bnos Menachem School for Girls.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 19, 2019

Sold by

692 Rutland Llc

Bought by

Richler Yisroel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$686,000

Outstanding Balance

$603,503

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$167,292

Purchase Details

Closed on

Jul 16, 2019

Sold by

Miller Alvin

Bought by

692 Rutland Llc

Purchase Details

Closed on

Feb 12, 2007

Sold by

City Homes Development Inc

Bought by

Miller Alvin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,250

Interest Rate

6.23%

Purchase Details

Closed on

Sep 7, 2006

Sold by

Avanesov Rolland

Bought by

City Homes Development Inc

Purchase Details

Closed on

Jul 17, 2006

Sold by

Dukes Frank

Bought by

Avanesov Rolland

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Richler Yisroel | -- | -- | |

| Richler Yisroel | -- | -- | |

| 692 Rutland Llc | $500,000 | -- | |

| 692 Rutland Llc | $500,000 | -- | |

| Miller Alvin | $498,000 | -- | |

| Miller Alvin | $498,000 | -- | |

| City Homes Development Inc | -- | -- | |

| City Homes Development Inc | -- | -- | |

| Avanesov Rolland | -- | -- | |

| Avanesov Rolland | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Richler Yisroel | $686,000 | |

| Closed | Richler Yisroel | $686,000 | |

| Previous Owner | Miller Alvin | $121,250 | |

| Previous Owner | Miller Alvin | $363,750 | |

| Closed | Avanesov Rolland | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,449 | $49,020 | $16,560 | $32,460 |

| 2024 | $5,449 | $38,700 | $16,560 | $22,140 |

| 2023 | $5,475 | $47,160 | $16,560 | $30,600 |

| 2022 | $5,375 | $38,580 | $16,560 | $22,020 |

| 2021 | $5,346 | $30,360 | $16,560 | $13,800 |

| 2020 | $2,507 | $36,840 | $16,560 | $20,280 |

| 2019 | $4,437 | $29,280 | $16,560 | $12,720 |

| 2018 | $4,282 | $22,464 | $10,973 | $11,491 |

| 2017 | $4,274 | $22,438 | $11,796 | $10,642 |

| 2016 | $3,922 | $21,168 | $11,755 | $9,413 |

| 2015 | $2,423 | $19,970 | $12,481 | $7,489 |

| 2014 | $2,423 | $18,840 | $13,800 | $5,040 |

Source: Public Records

Map

Nearby Homes

- 112 E 45th St

- 691 Winthrop St

- 122 E 46th St

- 602 Maple St

- 704 Lefferts Ave

- 770 Lefferts Ave Unit 3R

- 10 E 43rd St Unit 4K

- 10 E 43rd St Unit 5e

- 10 E 43rd St Unit 4J

- 755 Albany Ave

- 40 E 43rd St Unit 2K

- 40 E 43rd St Unit 3B

- 31 E 43rd St

- 625 Lenox Rd

- 589 Lenox Rd

- 750 Troy Ave

- 487 Midwood St

- 556 E New York Ave

- 446 Kingston Ave Unit D9

- 680 Lenox Rd

- 690 Rutland Rd

- 690 Rutland Rd Unit 1

- 690 Rutland Rd Unit 1STFLR

- 690 Rutland Rd Unit 1STFLOOR

- 694 Rutland Rd Unit 3

- 694 Rutland Rd Unit 2

- 694 Rutland Rd

- 694 Rutland Rd Unit Building

- 688 Rutland Rd

- 698 Rutland Rd

- 698 Rutland Rd

- 698 Rutland Rd

- 684 Rutland Rd

- 682 Rutland Rd

- 700 Rutland Rd

- 680 Rutland Rd

- 739 Fenimore St Unit 1 B

- 741 Fenimore St

- 741 Fenimore St Unit 2

- 741 Fenimore St Unit 4A