6926 S Rolling Meadows Ct Unit 202 Oak Creek, WI 53154

Estimated Value: $272,000 - $283,000

--

Bed

--

Bath

--

Sq Ft

0.27

Acres

About This Home

This home is located at 6926 S Rolling Meadows Ct Unit 202, Oak Creek, WI 53154 and is currently estimated at $277,091. 6926 S Rolling Meadows Ct Unit 202 is a home located in Milwaukee County with nearby schools including Carollton Elementary School, Oak Creek East Middle School, and Oak Creek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 13, 2015

Sold by

Hansen Lisa and Facchini Lisa

Bought by

Leschke Dawn Ann

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,464

Outstanding Balance

$108,451

Interest Rate

3.88%

Mortgage Type

FHA

Estimated Equity

$168,640

Purchase Details

Closed on

May 18, 2005

Sold by

Farchione Mark

Bought by

Facchini Lis A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,950

Interest Rate

5.91%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Oct 18, 2004

Sold by

Madden Michael V and Madden Suzanne E

Bought by

Farchione Mark and Facchini Lisa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,000

Interest Rate

5.8%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 16, 2001

Sold by

Michael Dilworth #2 Llc

Bought by

Madden Michael and Harteau Suzanne E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,600

Interest Rate

6.6%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Leschke Dawn Ann | $140,000 | Priority Title Corporation | |

| Facchini Lis A | $74,300 | -- | |

| Farchione Mark | $160,000 | -- | |

| Madden Michael | $137,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Leschke Dawn Ann | $137,464 | |

| Previous Owner | Facchini Lis A | $126,950 | |

| Previous Owner | Farchione Mark | $128,000 | |

| Previous Owner | Madden Michael | $130,600 | |

| Closed | Farchione Mark | $24,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,982 | $249,900 | $12,800 | $237,100 |

| 2023 | $3,888 | $233,600 | $12,800 | $220,800 |

| 2022 | $3,901 | $214,300 | $12,800 | $201,500 |

| 2021 | $3,679 | $187,100 | $12,000 | $175,100 |

| 2020 | $3,617 | $175,500 | $12,000 | $163,500 |

| 2019 | $3,276 | $161,300 | $12,000 | $149,300 |

| 2018 | $3,078 | $154,500 | $12,000 | $142,500 |

| 2017 | $2,971 | $144,400 | $12,000 | $132,400 |

| 2016 | $17 | $135,500 | $12,000 | $123,500 |

| 2014 | $2,286 | $106,700 | $12,000 | $94,700 |

Source: Public Records

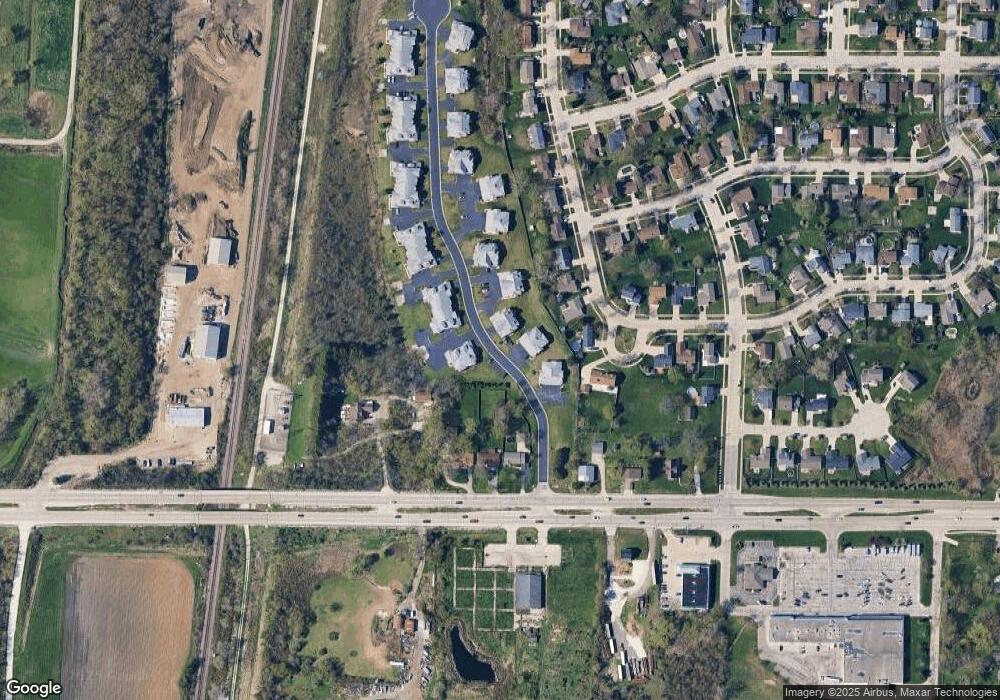

Map

Nearby Homes

- 6910 S Rolling Meadows Ct Unit 101

- 7300 S Delaine Dr

- 2227 E Excalibur Ct Unit 2227

- 7427 S Shepard Ave

- 1320 Milwaukee Ave

- 124 E Rawson Ave

- 1319 Marquette Ave

- 1301 College Ave Unit 7

- 1301 College Ave Unit 5

- 1230 Marshall Ave

- 1228 Marion Ave

- 8055 S Quincy Ave Unit 52

- 8063 S Quincy Ave Unit 51

- 7920 S Quincy Ave

- 7991 S Quincy Ave

- 7951 S Quincy Ave Unit 64

- 8023 S Quincy Ave

- 6240 S Creekside Dr Unit 2

- 1009 Elm Ave

- 3359 Sanctuary Dr Unit 17

- 6924 S Rolling Meadows Ct Unit 102

- 6922 S Rolling Meadows Ct Unit 201

- 6920 S Rolling Meadows Ct Unit 101

- 6916 S Rolling Meadows Ct Unit 202

- 6914 S Rolling Meadows Ct Unit 102

- 6912 S Rolling Meadows Ct Unit 201

- 6936 S Rolling Meadows Ct Unit 202

- 6934 S Rolling Meadows Ct Unit 102

- 6932 S Rolling Meadows Ct Unit 201

- 6930 S Rolling Meadows Ct Unit 101

- 6935 S Rolling Meadows Ct Unit 204

- 6933 S Rolling Meadows Ct Unit 104

- 6931 S Rolling Meadows Ct Unit 203

- 6929 S Rolling Meadows Ct Unit 103

- 6927 S Rolling Meadows Ct Unit 202

- 6925 S Rolling Meadows Ct Unit 102

- 6923 S Rolling Meadows Ct Unit 201

- 6921 S Rolling Meadows Ct Unit 101

- 6946 S Rolling Meadows Ct Unit 202

- 6944 S Rolling Meadows Ct Unit 102