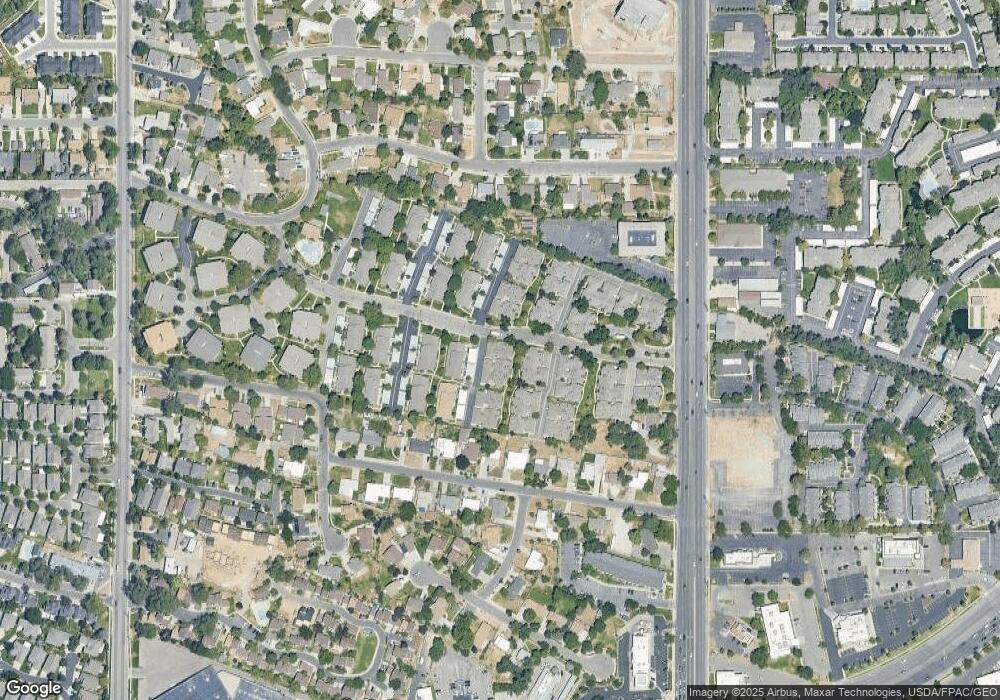

6931 S 825 E Midvale, UT 84047

Estimated Value: $453,000 - $525,000

4

Beds

3

Baths

2,160

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 6931 S 825 E, Midvale, UT 84047 and is currently estimated at $487,527, approximately $225 per square foot. 6931 S 825 E is a home located in Salt Lake County with nearby schools including Ridgecrest School, Hillcrest High School, and Midvale Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 13, 2020

Sold by

Haines James Russell and Haines James Russell

Bought by

Haines James R

Current Estimated Value

Purchase Details

Closed on

Feb 17, 2015

Sold by

James Russell Haines Family Protection T

Bought by

Haines James R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,633

Outstanding Balance

$150,811

Interest Rate

3.66%

Mortgage Type

VA

Estimated Equity

$336,716

Purchase Details

Closed on

Dec 8, 2014

Sold by

Hines James R

Bought by

James Russell Haines Family Protection T

Purchase Details

Closed on

Mar 14, 2014

Sold by

Fannie Mae

Bought by

Haines James R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,900

Interest Rate

4.25%

Mortgage Type

VA

Purchase Details

Closed on

Jan 14, 2014

Sold by

Hodges Luella S

Bought by

Federal National Mortgage Association

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,900

Interest Rate

4.25%

Mortgage Type

VA

Purchase Details

Closed on

Feb 29, 2000

Sold by

Weyland Iona

Bought by

Hodges Luella S and Hodges Everett M

Purchase Details

Closed on

Apr 15, 1996

Sold by

Cannon Mary A

Bought by

Weyland Iona

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Haines James R | -- | Wasatch Title Ins Agency Llc | |

| Haines James R | -- | Wasatch Title Ins Agency Llc | |

| James Russell Haines Family Protection T | -- | Old Republic Title So Jordan | |

| Haines James R | -- | Highland Title Agency | |

| Federal National Mortgage Association | $228,748 | Etitle Ins Agency | |

| Hodges Luella S | -- | -- | |

| Weyland Iona | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Haines James R | $197,633 | |

| Closed | Haines James R | $198,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $367 | $433,200 | $129,900 | $303,300 |

| 2024 | $367 | $428,000 | $128,400 | $299,600 |

| 2023 | $429 | $418,500 | $125,500 | $293,000 |

| 2022 | $2,007 | $422,200 | $126,600 | $295,600 |

| 2021 | $1,531 | $308,300 | $92,500 | $215,800 |

| 2020 | $1,519 | $294,100 | $88,200 | $205,900 |

| 2019 | $1,523 | $287,700 | $86,300 | $201,400 |

| 2016 | $1,203 | $234,100 | $70,200 | $163,900 |

Source: Public Records

Map

Nearby Homes

- 6948 S 855 E

- 6969 S 855 E

- 6907 S 800 E

- 6960 S 900 E

- 841 E Newbold Cir

- 937 Essex Court Way Unit 3

- 805 E Grenoble Dr

- 761 E Gables Ln

- 6965 S 700 E

- 734 E Bogart Ln Unit 108

- 6969 S Free Land Ave

- 668 E Cobblestone Ln

- 975 E 6795 S

- 970 Tuscan Park Ln

- 6888 S 670 E Unit 16

- 6886 S 670 E

- 7083 Village Place

- 6779 S Sienna Park Ln

- 6874 S 595 E Unit 66

- 595 E Betsey Cove S Unit 25

- 6931 S 825 E Unit 120

- 6935 S 825 E

- 6935 S 825 E Unit 119

- 6941 S 825 E

- 6945 S 825 E

- 6949 S 825 E

- 6949 S 825 E Unit 116

- 6938 S 855 E

- 6934 S 855 E

- 6921 S 825 E

- 6917 S 825 E Unit 26

- 6942 S 855 E

- 6932 S 825 E

- 6936 S 825 E

- 6940 S 825 E Unit 123

- 6922 S 855 E Unit 13

- 6955 S 825 E

- 6913 S 825 E

- 6913 S 825 E Unit 7-25

- 6913 S 825 E Unit 25