6942 Esperanza Dr Castle Pines, CO 80108

Estimated Value: $1,078,537 - $1,287,000

5

Beds

5

Baths

4,734

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 6942 Esperanza Dr, Castle Pines, CO 80108 and is currently estimated at $1,177,884, approximately $248 per square foot. 6942 Esperanza Dr is a home located in Douglas County with nearby schools including Timber Trail Elementary School, Rocky Heights Middle School, and Rock Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 26, 2016

Sold by

Pardew Jon and Pardew Lesley

Bought by

Im Derek H and Kim Jasmine H

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$582,187

Outstanding Balance

$463,507

Interest Rate

3.58%

Mortgage Type

VA

Estimated Equity

$714,377

Purchase Details

Closed on

Oct 15, 2004

Sold by

Richmond American Homes Of Colorado Inc

Bought by

Pardew Jon and Pardew Lesley

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$377,482

Interest Rate

5.87%

Mortgage Type

Unknown

Purchase Details

Closed on

Feb 2, 2000

Sold by

Land Lynx

Bought by

Dr Horton Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Im Derek H | $683,000 | First American | |

| Pardew Jon | $502,500 | -- | |

| Dr Horton Inc | $8,520,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Im Derek H | $582,187 | |

| Previous Owner | Pardew Jon | $377,482 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,036 | $74,780 | $13,350 | $61,430 |

| 2023 | $7,103 | $74,780 | $13,350 | $61,430 |

| 2022 | $4,818 | $49,960 | $9,300 | $40,660 |

| 2021 | $5,008 | $49,960 | $9,300 | $40,660 |

| 2020 | $5,504 | $54,490 | $9,180 | $45,310 |

| 2019 | $5,522 | $54,490 | $9,180 | $45,310 |

| 2018 | $4,877 | $47,450 | $9,450 | $38,000 |

| 2017 | $4,581 | $47,450 | $9,450 | $38,000 |

| 2016 | $5,418 | $49,300 | $11,440 | $37,860 |

| 2015 | $6,022 | $49,300 | $11,440 | $37,860 |

| 2014 | $2,837 | $44,290 | $9,150 | $35,140 |

Source: Public Records

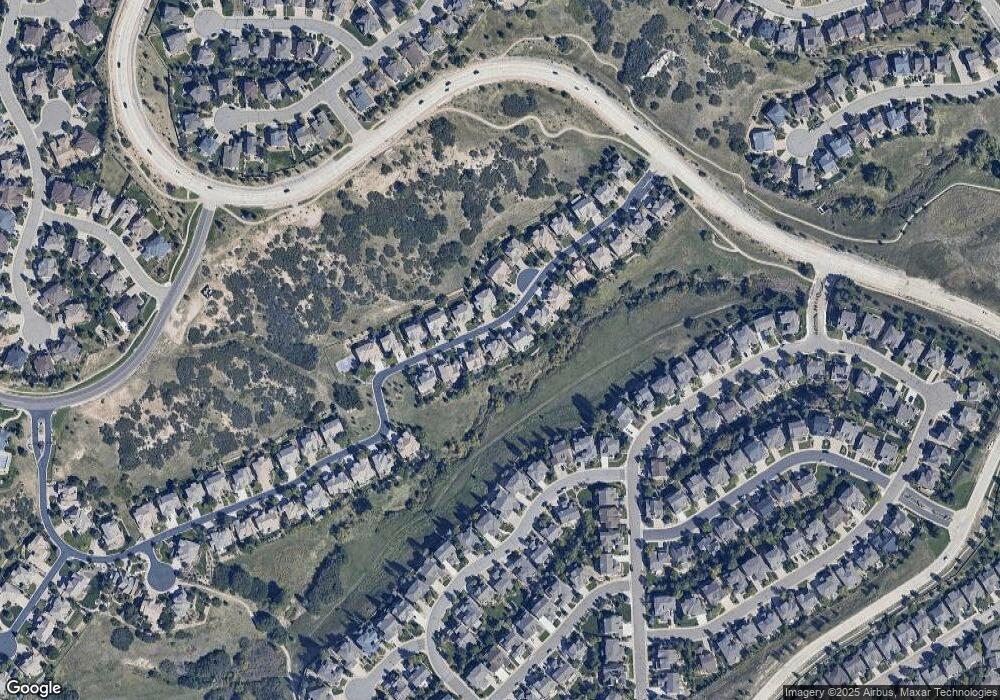

Map

Nearby Homes

- 7086 Esperanza Dr

- 6561 Ocaso Dr

- 7257 Arco Iris Ln

- 7224 Serena Dr

- 6577 Esperanza Dr

- 983 Bramblewood Dr

- 6743 Serena Ave

- 6523 Tapadero Place

- 860 Bramblewood Dr

- 12370 Tapadero Way

- 6450 Montano Place

- 8467 Brambleridge Dr

- 1038 Berganot Trail

- 8166 Wetherill Cir

- 1232 Berganot Trail

- 1118 Berganot Trail

- 1229 Berganot Trail

- 687 Briar Haven Dr

- 8392 Briar Trace Dr

- 12350 Turquoise Terrace St

- 6912 Esperanza Dr

- 6950 Esperanza Dr

- 6894 Esperanza Dr

- 6966 Esperanza Dr

- 6931 Esperanza Dr

- 6951 Esperanza Dr

- 6911 Esperanza Dr

- 6874 Esperanza Dr

- 6969 Esperanza Dr

- 6984 Esperanza Dr

- 6893 Esperanza Dr

- 6873 Esperanza Dr

- 6987 Esperanza Dr

- 7006 Esperanza Dr

- 7041 Winter Ridge Place

- 7057 Winter Ridge Place

- 7005 Esperanza Dr

- 6855 Esperanza Dr

- 6804 Esperanza Dr

- 7073 Winter Ridge Place