6993 Degood Rd Ostrander, OH 43061

Scioto NeighborhoodEstimated Value: $298,000 - $436,000

2

Beds

1

Bath

1,950

Sq Ft

$195/Sq Ft

Est. Value

About This Home

This home is located at 6993 Degood Rd, Ostrander, OH 43061 and is currently estimated at $379,642, approximately $194 per square foot. 6993 Degood Rd is a home located in Delaware County with nearby schools including Buckeye Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 7, 2005

Sold by

Tagg Gary O and Tagg Patricia

Bought by

Lowe Jacob N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,500

Outstanding Balance

$82,642

Interest Rate

6.2%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$297,000

Purchase Details

Closed on

Dec 10, 2003

Sold by

Tagg Gary O and Tagg Patricia

Bought by

Tagg Gary O and Tagg Patricia

Purchase Details

Closed on

Oct 2, 1995

Sold by

Hellinger George A

Bought by

Tagg Gary O and Tagg Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Interest Rate

8%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lowe Jacob N | $165,000 | Lawyers Title Agency | |

| Tagg Gary O | -- | -- | |

| Tagg Gary O | $103,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lowe Jacob N | $148,500 | |

| Previous Owner | Tagg Gary O | $75,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,722 | $82,290 | $13,900 | $68,390 |

| 2023 | $2,722 | $82,290 | $13,900 | $68,390 |

| 2022 | $2,167 | $58,350 | $10,220 | $48,130 |

| 2021 | $2,108 | $58,350 | $10,220 | $48,130 |

| 2020 | $2,120 | $58,350 | $10,220 | $48,130 |

| 2019 | $2,007 | $50,370 | $8,510 | $41,860 |

| 2018 | $2,044 | $50,370 | $8,510 | $41,860 |

| 2017 | $1,924 | $48,760 | $7,700 | $41,060 |

| 2016 | $1,860 | $48,760 | $7,700 | $41,060 |

| 2015 | $1,963 | $48,760 | $7,700 | $41,060 |

| 2014 | $1,844 | $48,760 | $7,700 | $41,060 |

| 2013 | $1,844 | $46,800 | $7,700 | $39,100 |

Source: Public Records

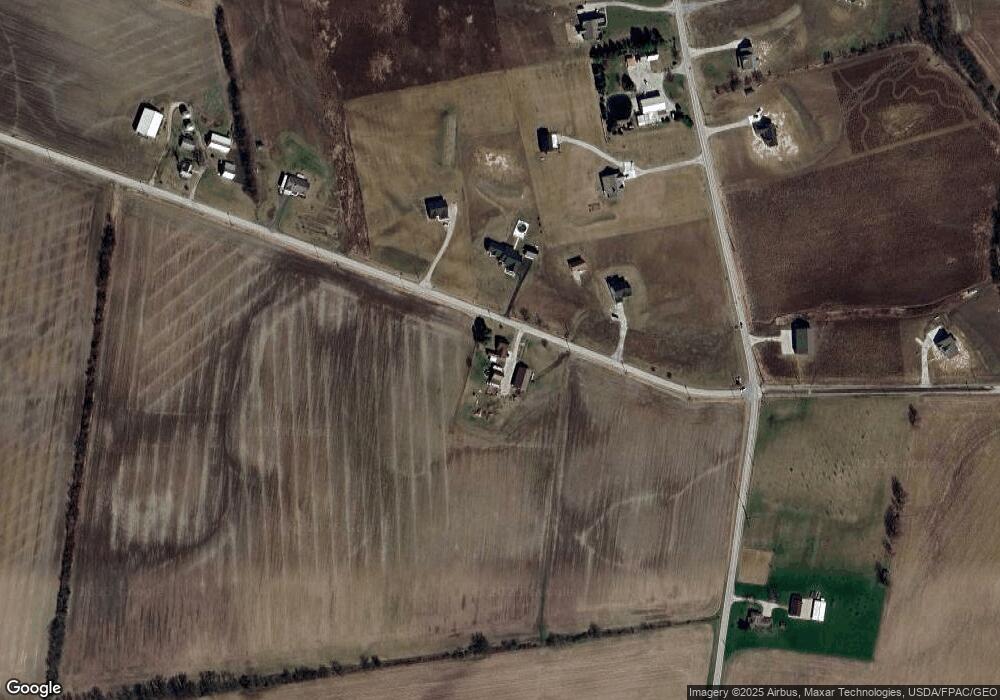

Map

Nearby Homes

- 0 Carr Rd Unit 225016840

- 0 Burnt Pond Rd Unit Tract 2

- 0 Burnt Pond Rd Unit Tract 4

- 0 Burnt Pond Rd Unit Tract 3

- 0 Burnt Pond Rd Unit Tract 5

- 6685 State Route 37 W

- 535 Brayshaw Dr

- 715 Tyler Rd

- 3480 Ostrander Rd

- 20478 Delaware County Line Rd

- 0 Delaware County Line Rd

- 231 Bluegrass Way

- 311 Ben Curtis Dr

- 1817 Lawrence Rd

- 9485 State Route 37

- 0 E High St Unit Tract 1 225034753

- 0 E High St Unit Tract 4 225034758

- 0 E High St Unit Tract 3 225034757

- 101 S Main St

- 0 Dean Rd Unit 225032132

- 6998 Degood Rd

- 7040 Degood Rd

- 6862 Degood Rd

- 6920 Degood Rd

- 944 Brindle Rd

- 0 Degood Rd Unit 9 9917116

- 0 Degood Rd Unit 14 9807177

- 0 Degood Rd Unit 15 9807174

- 0 Degood Rd Unit 10 9807181

- 0 Degood Rd Unit 7 9807162

- 0 Degood Rd Unit 9 9807180

- 0 Degood Rd Unit 8 9807165

- 0 Degood Rd Unit 12 9807170

- 0 Degood Rd Unit 13 9807172

- 0 Degood Rd Unit 11 9807166

- 0 Degood Rd Unit 2014397

- 0 Degood Rd Unit 2238178

- 0 Degood Rd Unit 221034055

- 0 Degood Rd Unit 221034054

- 0 Degood Rd Unit 221034053

Your Personal Tour Guide

Ask me questions while you tour the home.