7-17 Aspen Way Doylestown, PA 18901

Estimated Value: $333,646 - $399,000

2

Beds

2

Baths

610

Sq Ft

$582/Sq Ft

Est. Value

About This Home

This home is located at 7-17 Aspen Way, Doylestown, PA 18901 and is currently estimated at $354,912, approximately $581 per square foot. 7-17 Aspen Way is a home located in Bucks County with nearby schools including Doyle El School, Lenape Middle School, and Central Bucks High School-West.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2020

Sold by

Bauscher Wolfgang J

Bought by

Mcbryan Michael and Mcbryan Shelly

Current Estimated Value

Purchase Details

Closed on

Jan 7, 2015

Sold by

Richards Beverly J and Richards Thomas H

Bought by

Bauscher Wolfgang J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

3.99%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 25, 1998

Sold by

Richards Beverly Jane

Bought by

Richards Thomas Houston and Richards Beverly Jane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Interest Rate

6.98%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcbryan Michael | $208,000 | Mid Atlantic Regional Abstra | |

| Bauscher Wolfgang J | $162,500 | None Available | |

| Richards Thomas Houston | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bauscher Wolfgang J | $100,000 | |

| Previous Owner | Richards Thomas Houston | $40,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,747 | $15,520 | -- | $15,520 |

| 2024 | $2,747 | $15,520 | $0 | $15,520 |

| 2023 | $2,619 | $15,520 | $0 | $15,520 |

| 2022 | $2,590 | $15,520 | $0 | $15,520 |

| 2021 | $2,536 | $15,520 | $0 | $15,520 |

| 2020 | $2,525 | $15,520 | $0 | $15,520 |

| 2019 | $2,498 | $15,520 | $0 | $15,520 |

| 2018 | $2,490 | $15,520 | $0 | $15,520 |

| 2017 | $2,470 | $15,520 | $0 | $15,520 |

| 2016 | $2,455 | $15,520 | $0 | $15,520 |

| 2015 | -- | $15,520 | $0 | $15,520 |

| 2014 | -- | $15,520 | $0 | $15,520 |

Source: Public Records

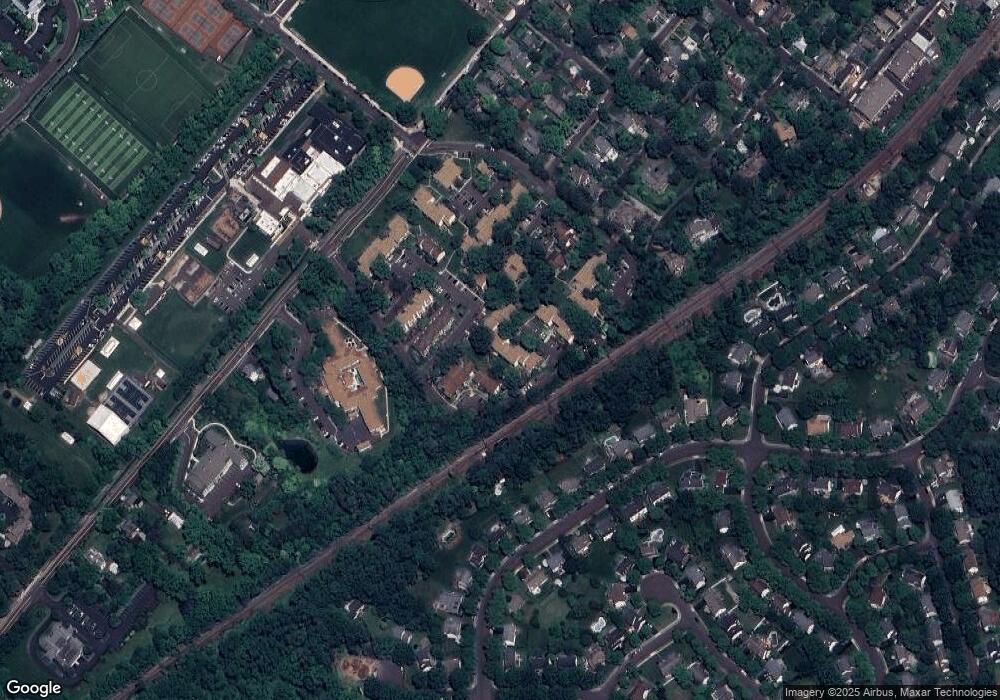

Map

Nearby Homes

- 9 Mill Creek Dr

- 259 W Ashland St

- 195 Lafayette St

- 403 S Main St Unit S201

- 37 N Clinton St

- 215 N Franklin St

- 89 Homestead Dr

- 236 Green St

- 422 Fordhook Rd

- 450 Ford Hook Rd

- 333 Dorset Ct Unit 333

- 432 Ford Hook Rd

- 78 Tower Hill Rd

- 69 E Oakland Ave

- 20 E Court St

- 110 E Ashland St

- 197 Spring Ln

- 4 Barnes Ct

- 121 Conestoga Dr

- 137 Wells Rd

- 7-17 Aspen Way Unit 717

- 7-17 Aspen Way Unit 717

- 7-5 Aspen Way

- 7-5 Aspen Way Unit 75

- 7-6 Aspen Way Unit 76

- 7-4 Aspen Way Unit 74

- 7-16 Aspen Way

- 7-3 Aspen Way Unit 73

- 7-15 Aspen Way Unit 715

- 7-15 Aspen Way Unit 515

- 7-14 Aspen Way Unit 714

- 7-14 Aspen Way

- 7-7 Aspen Way Unit 77

- 7-2 Aspen Way Unit 72

- 7-8 Aspen Way Unit 78

- 7-20 Aspen Way Unit 720

- 7-9 Aspen Way

- 3-11 Aspen Way Unit 311

- 7-1 Aspen Way Unit 71

- 7-13 Aspen Way Unit 713