7 Carla Cir Broomfield, CO 80020

Ridgeview Heights NeighborhoodEstimated Value: $543,771 - $556,000

2

Beds

2

Baths

1,727

Sq Ft

$318/Sq Ft

Est. Value

About This Home

This home is located at 7 Carla Cir, Broomfield, CO 80020 and is currently estimated at $549,443, approximately $318 per square foot. 7 Carla Cir is a home located in Broomfield County with nearby schools including Kohl Elementary School, Broomfield Heights Middle School, and Broomfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 1, 2024

Sold by

Joan Marie Roberts Trust and Roberts Joan M

Bought by

Roberts Joan M

Current Estimated Value

Purchase Details

Closed on

Sep 1, 2011

Sold by

Peterson Dennis and Peterson Karen

Bought by

Joan Marie Roberts Trust

Purchase Details

Closed on

Jun 3, 2005

Sold by

Onyx Properties Four Llc

Bought by

Peterson Dennis and Peterson Karen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$226,800

Interest Rate

5.79%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Mar 31, 2005

Sold by

Odonnell Thomas K and Odonnelll Dorothy M

Bought by

Onyx Properties Four Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,248

Interest Rate

5.78%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 28, 2000

Purchase Details

Closed on

Jun 20, 1994

Purchase Details

Closed on

Jul 26, 1982

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Roberts Joan M | -- | None Listed On Document | |

| Joan Marie Roberts Trust | $260,000 | First American Title Ins Co | |

| Peterson Dennis | $283,500 | Land Title Guarantee Company | |

| Onyx Properties Four Llc | $167,500 | Land Title | |

| -- | $236,200 | -- | |

| -- | $346,500 | -- | |

| -- | $1,179,800 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Peterson Dennis | $226,800 | |

| Previous Owner | Onyx Properties Four Llc | $171,248 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,493 | $36,070 | $7,660 | $28,410 |

| 2024 | $2,493 | $33,300 | $6,900 | $26,400 |

| 2023 | $2,488 | $38,370 | $7,950 | $30,420 |

| 2022 | $2,046 | $28,110 | $6,140 | $21,970 |

| 2021 | $2,704 | $28,920 | $6,320 | $22,600 |

| 2020 | $2,512 | $26,700 | $5,580 | $21,120 |

| 2019 | $2,507 | $26,880 | $5,620 | $21,260 |

| 2018 | $2,253 | $23,870 | $4,800 | $19,070 |

| 2017 | $2,219 | $26,390 | $5,310 | $21,080 |

| 2016 | $2,031 | $21,540 | $5,310 | $16,230 |

| 2015 | $1,961 | $18,230 | $5,310 | $12,920 |

| 2014 | $1,697 | $18,230 | $5,310 | $12,920 |

Source: Public Records

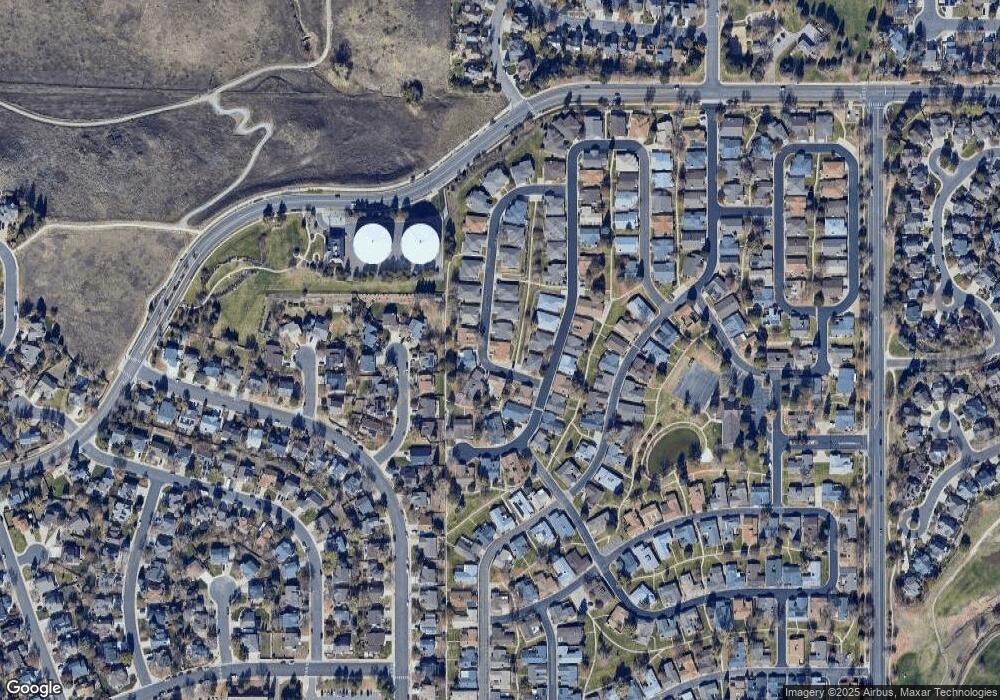

Map

Nearby Homes

- 1719 Daisy Ct

- 30 Douglas Dr N

- 14 N Douglas Dr

- 46 Douglas Dr S

- 36 Carla Way

- 1660 Emerald St

- 53 Douglas Dr S

- 267 Powderhorn Trail

- 23 Scott Dr N

- 20 Scott Dr N

- 1607 Garnet St

- 57 Scott Dr S

- 1625 Hemlock Way

- 1677 Hemlock Way

- 1606 Iris St

- 114 E 14th Ct

- 37 E 14th Place

- 1732 Peregrine Ln

- 146 Keystone Trail

- 147 Keystone Trail