7005 Village Commons Way Midvale, UT 84047

Estimated Value: $576,042 - $606,000

4

Beds

3

Baths

1,602

Sq Ft

$367/Sq Ft

Est. Value

About This Home

This home is located at 7005 Village Commons Way, Midvale, UT 84047 and is currently estimated at $588,511, approximately $367 per square foot. 7005 Village Commons Way is a home located in Salt Lake County with nearby schools including East Midvale Elementary School, Hillcrest High School, and Midvale Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 11, 1998

Sold by

Best June

Bought by

Brown Daniel and Brown Dorothy J

Current Estimated Value

Purchase Details

Closed on

Jun 27, 1997

Sold by

Brinton Scott and Brinton Bonnie Jean

Bought by

Brinton Scott

Purchase Details

Closed on

Feb 26, 1997

Sold by

Best June and Mault Cory

Bought by

Best June

Purchase Details

Closed on

Nov 16, 1995

Sold by

Todd Denise L

Bought by

Christensen Denise L and Christensen W

Purchase Details

Closed on

Nov 1, 1994

Sold by

Esau Walter and Esau Lela May

Bought by

Esau Water and Esau Lela May

Purchase Details

Closed on

Sep 30, 1994

Sold by

Target Development L C

Bought by

Dannels Robert G and Dannels Georgianne

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brown Daniel | -- | Meridian Title | |

| Brinton Scott | -- | -- | |

| Best June | -- | -- | |

| Christensen Denise L | -- | -- | |

| Esau Water | -- | -- | |

| Dannels Robert G | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,427 | $595,000 | $134,800 | $460,200 |

| 2024 | $3,427 | $562,600 | $127,200 | $435,400 |

| 2023 | $3,218 | $523,600 | $120,900 | $402,700 |

| 2022 | $3,401 | $540,500 | $100,800 | $439,700 |

| 2021 | $3,034 | $412,300 | $93,000 | $319,300 |

| 2020 | $2,945 | $378,700 | $76,400 | $302,300 |

| 2019 | $2,812 | $352,300 | $72,100 | $280,200 |

| 2018 | $2,600 | $329,400 | $72,100 | $257,300 |

| 2017 | $2,472 | $301,000 | $72,100 | $228,900 |

| 2016 | $2,360 | $278,700 | $72,100 | $206,600 |

| 2015 | $2,118 | $245,800 | $70,600 | $175,200 |

| 2014 | $2,159 | $244,800 | $71,400 | $173,400 |

Source: Public Records

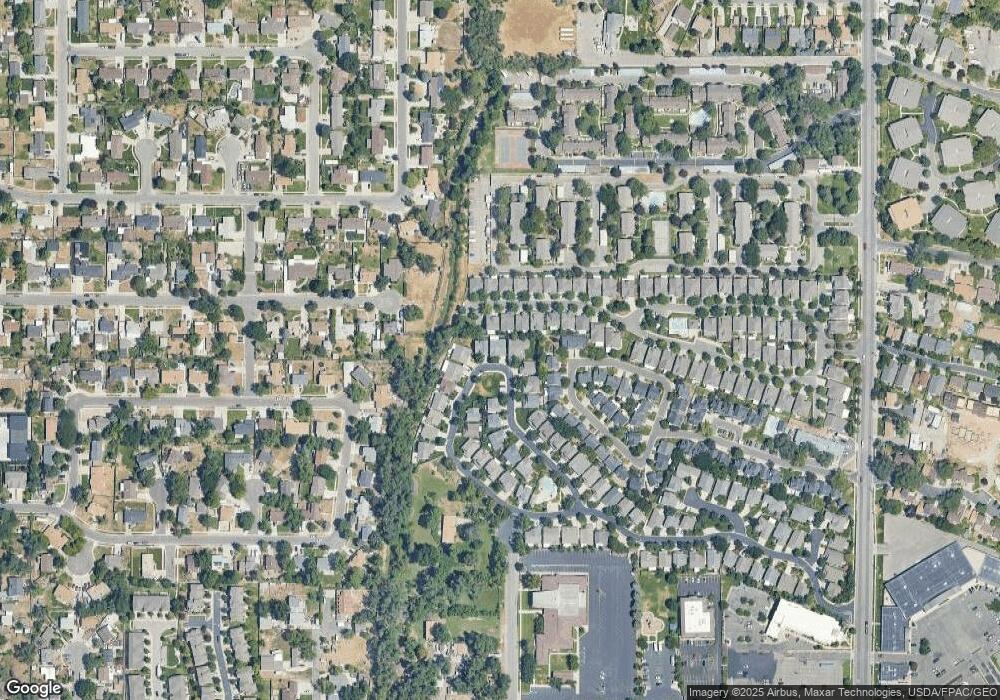

Map

Nearby Homes

- 550 E Villager Ln

- 618 E Cobblestone Ln

- 6874 S 595 E Unit 66

- 6969 S Free Land Ave

- 668 E Cobblestone Ln

- 6886 S 670 E

- 7083 Village Place

- 7170 S 420 E

- 7187 S 420 E

- 529 E 7215 S Unit 9

- 512 E Larchwood Dr

- 6890 S 725 E Unit A

- 734 E Bogart Ln Unit 108

- 6934 S 745 E Unit C

- 375 E 6815 S

- 6936 S 775 E Unit B

- 326 E 6815 S

- 761 E Gables Ln

- 7218 S Viansa Ct

- 6907 S 800 E

- 7003 S Village Commons Way

- 7003 Village Commons Way

- 7009 Village Commons Way

- 7009 S Village Commons Way

- 542 E Land Rush Dr

- 536 E Land Rush Dr

- 536 Land Rush Dr

- 542 Land Rush Dr

- 7013 Village Commons Way

- 548 Land Rush Dr

- 7013 S Village Commons Way

- 538 Villager Ln

- 554 Land Rush Dr

- 554 E Land Rush Dr

- 7019 Village Commons Way

- 542 Villager Ln

- 560 E Downing St

- 560 E Downing St Unit 27

- 560 Downing St

- 7024 Village Commons Way