7011 W 29th Ave Unit 220 Hialeah, FL 33018

Estimated Value: $270,323 - $302,000

2

Beds

2

Baths

870

Sq Ft

$325/Sq Ft

Est. Value

About This Home

This home is located at 7011 W 29th Ave Unit 220, Hialeah, FL 33018 and is currently estimated at $282,581, approximately $324 per square foot. 7011 W 29th Ave Unit 220 is a home located in Miami-Dade County with nearby schools including Ernest R. Graham K-8 Academy, Hialeah Gardens Middle School, and Hialeah Gardens Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 27, 2012

Sold by

Ensenat Alfonso

Bought by

Lao Amparo

Current Estimated Value

Purchase Details

Closed on

Oct 31, 2003

Sold by

Cruz Francisco J

Bought by

Ensenat Alfonso

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,525

Interest Rate

6%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 19, 2001

Sold by

Enrique V Sequeira M and Enrique Ysmary B

Bought by

Cruz Francisco J

Purchase Details

Closed on

Mar 20, 2000

Sold by

Afhtab and Mohammed Maria M

Bought by

Sequeira Enrique and Baro Ysmary

Purchase Details

Closed on

Jul 14, 1995

Sold by

Santos Juan M and Santos Abigail

Bought by

Mohammed Afhtab and Mohammed Maria Del Mar

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lao Amparo | -- | None Available | |

| Ensenat Alfonso | $110,000 | Victory Title Services Inc | |

| Cruz Francisco J | $88,000 | -- | |

| Sequeira Enrique | $73,700 | -- | |

| Mohammed Afhtab | $59,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ensenat Alfonso | $107,525 | |

| Previous Owner | Sequeira Enrique | $93,672 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $625 | $76,107 | -- | -- |

| 2024 | $615 | $73,963 | -- | -- |

| 2023 | $615 | $71,809 | $0 | $0 |

| 2022 | $599 | $69,718 | $0 | $0 |

| 2021 | $606 | $67,688 | $0 | $0 |

| 2020 | $603 | $66,754 | $0 | $0 |

| 2019 | $593 | $65,254 | $0 | $0 |

| 2018 | $568 | $64,038 | $0 | $0 |

| 2017 | $568 | $62,721 | $0 | $0 |

| 2016 | $573 | $61,431 | $0 | $0 |

| 2015 | $582 | $61,004 | $0 | $0 |

| 2014 | $592 | $60,520 | $0 | $0 |

Source: Public Records

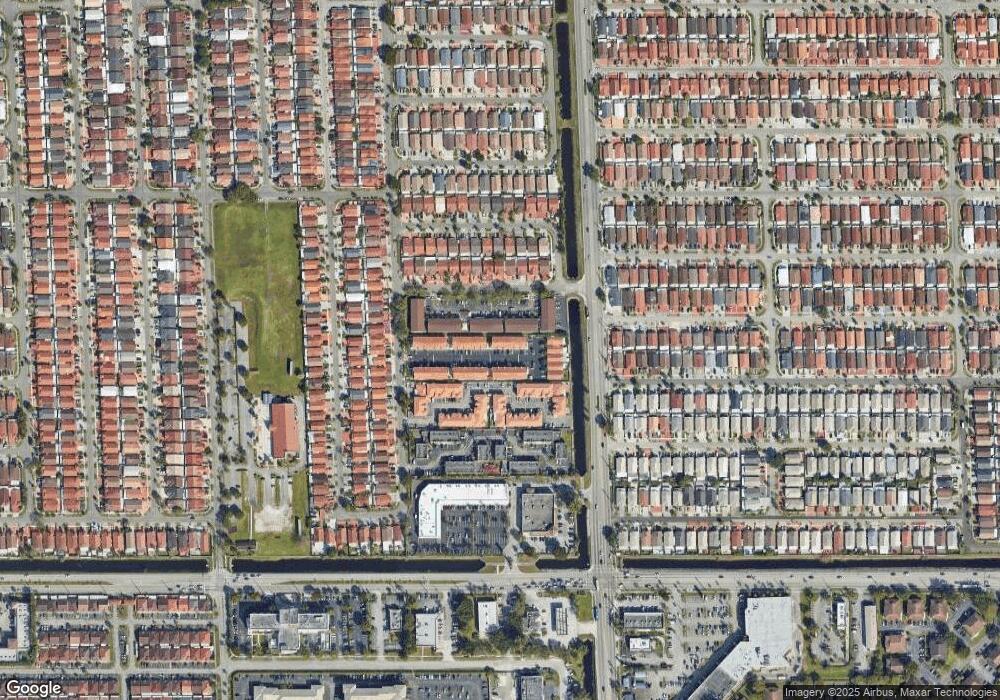

Map

Nearby Homes

- 2849 W 71st St

- 7320 W 29th Ave

- 2749 W 72nd St

- 7250 W 30th Ave

- 7328 W 29th Ln

- 8851 NW 119th St Unit 6117

- 8851 NW 119th St Unit 5222

- 8851 NW 119th St Unit 33143

- 8851 NW 119th St Unit 4303

- 2846 W 75th Terrace

- 3118 W 71st Place

- 3135 W 72nd Terrace

- 3155 W 68th Place

- 6515 W 27th Ct Unit 49-12

- 6515 W 27th Ct Unit 4913

- 6575 W 27th Ct Unit 1146

- 6545 W 27th Ct Unit 2447

- 2680 W 76th St Unit 104

- 2680 W 76th St Unit 204

- 2660 W 76th St Unit 106

- 7011 W 29th Ave Unit 122

- 7011 W 29th Ave Unit 114

- 7011 W 29th Ave Unit 218

- 7011 W 29th Ave Unit 206

- 7011 W 29th Ave Unit 226

- 7011 W 29th Ave Unit 204

- 7011 W 29th Ave Unit 103

- 7011 W 29th Ave Unit 119

- 7011 W 29th Ave Unit 109

- 7011 W 29th Ave Unit 125

- 7011 W 29th Ave Unit 117

- 7011 W 29th Ave Unit 123

- 7011 W 29th Ave Unit 228

- 7011 W 29th Ave Unit 225

- 7011 W 29th Ave Unit 201

- 7011 W 29th Ave Unit 208

- 7011 W 29th Ave Unit 222

- 7011 W 29th Ave Unit 116

- 7011 W 29th Ave Unit 128