7015 Kettering Ln Unit 5 Suwanee, GA 30024

Estimated Value: $1,093,000 - $1,225,000

5

Beds

6

Baths

3,303

Sq Ft

$349/Sq Ft

Est. Value

About This Home

This home is located at 7015 Kettering Ln Unit 5, Suwanee, GA 30024 and is currently estimated at $1,152,366, approximately $348 per square foot. 7015 Kettering Ln Unit 5 is a home located in Forsyth County with nearby schools including Sharon Elementary School, South Forsyth Middle School, and Lambert High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 11, 2002

Sold by

Chambers Donald W and Chambers Eliane M

Bought by

Clark Clifford E and Clark Dana D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,000

Outstanding Balance

$116,200

Interest Rate

6.53%

Mortgage Type

New Conventional

Estimated Equity

$1,036,166

Purchase Details

Closed on

Feb 18, 1999

Sold by

John Willis Homes

Bought by

Chambers Donald W and Chambers Elaine M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$366,500

Interest Rate

6.84%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clark Clifford E | $525,000 | -- | |

| Chambers Donald W | $458,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Clark Clifford E | $275,000 | |

| Previous Owner | Chambers Donald W | $366,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,584 | $435,704 | $100,000 | $335,704 |

| 2024 | $1,584 | $385,484 | $80,000 | $305,484 |

| 2023 | $1,495 | $353,536 | $72,000 | $281,536 |

| 2022 | $1,557 | $248,580 | $50,000 | $198,580 |

| 2021 | $1,523 | $248,580 | $50,000 | $198,580 |

| 2020 | $1,515 | $239,852 | $50,000 | $189,852 |

| 2019 | $1,523 | $238,320 | $50,000 | $188,320 |

| 2018 | $1,527 | $227,268 | $40,000 | $187,268 |

| 2017 | $1,533 | $215,412 | $40,000 | $175,412 |

| 2016 | $1,533 | $215,412 | $40,000 | $175,412 |

| 2015 | $1,523 | $208,692 | $40,000 | $168,692 |

| 2014 | $5,051 | $194,324 | $40,000 | $154,324 |

Source: Public Records

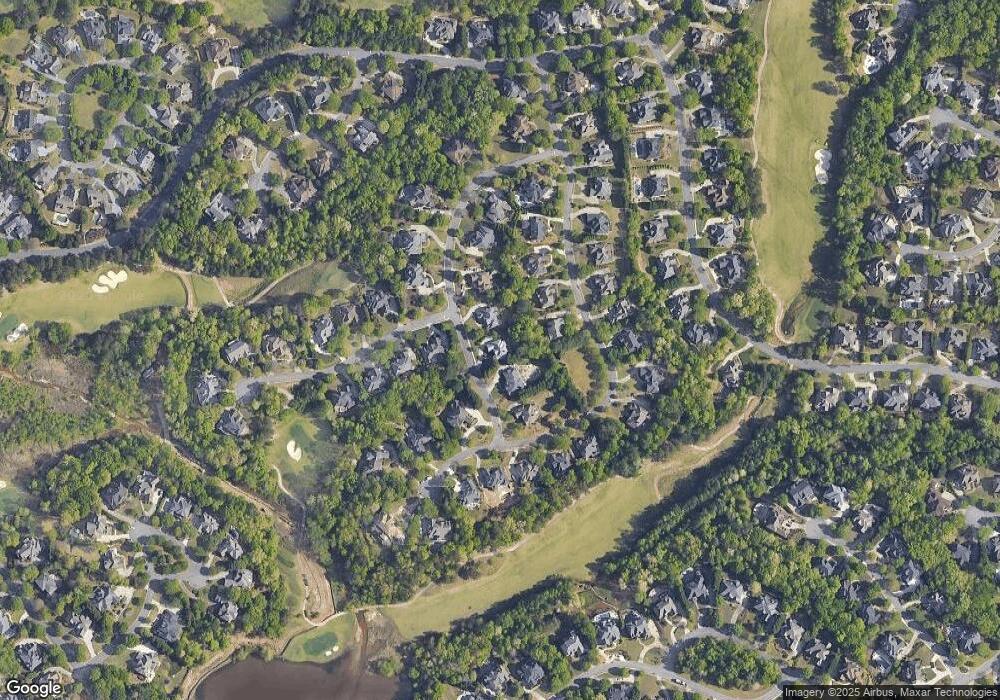

Map

Nearby Homes

- 6930 Blackthorn Ln

- 7025 Blackthorn Ln

- 5060 Brent Knoll Ln Unit 1

- 6505 Caldwell Ct

- 5995 Ettington Dr

- 7065 Laurel Oak Dr

- 6005 Oakbury Ln

- 4840 Yorkshire Ln

- 3945 Preston Oak Ln

- 6010 Somerset Ct

- 4790 Ashwell Ln

- 3440 Ronnie Ln

- 5055 Mallory Ct

- 4715 Scotney Ct

- 355 Laurel Oak Dr

- 373 Via Secco Ln

- 4815 Ashwell Ln Unit 2

- 4785 Scotney Ct

- 00 Old Atlanta Lot Rd

- 5625 Buckleigh Pointe

- 7005 Kettering Ln Unit 5

- 6960 Blackthorn Ln Unit 5

- 7015 Redcliff Ct

- 6950 Blackthorn Ln

- 6965 Kettering Ln Unit 5

- 7035 Kettering Ln

- 7110 Blackthorn Ln Unit 5

- 6980 Blackthorn Ln

- 7025 Redcliff Ct

- 6940 Blackthorn Ln

- 7025 Redciff Ct

- 6960 Kettering Ln Unit 5

- 7120 Blackthorn Ln Unit 5

- 7035 Redcliff Ct

- 6965 Blackthorn Ln Unit 5

- 6965 Blackthorn Ln

- 7030 Redcliff Ct

- 6955 Blackthorn Ln

- 7005 Blackthorn Ln

- 6975 Blackthorn Ln