7050 Inwood Park Dr Unit 125 Houston, TX 77088

Greater Inwood NeighborhoodEstimated Value: $104,000 - $143,000

3

Beds

2

Baths

1,094

Sq Ft

$117/Sq Ft

Est. Value

About This Home

This home is located at 7050 Inwood Park Dr Unit 125, Houston, TX 77088 and is currently estimated at $127,749, approximately $116 per square foot. 7050 Inwood Park Dr Unit 125 is a home located in Harris County with nearby schools including Edward a Vines EC/Pre-K/K School, Harris Elementary School, and Hoffman Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 14, 2012

Sold by

Fannie Mae

Bought by

Hunter Veralisa

Current Estimated Value

Purchase Details

Closed on

Nov 1, 2011

Sold by

Johnson Gayland and Johnson Edward

Bought by

Federal National Mortgage Association and Fannie Mae

Purchase Details

Closed on

Aug 1, 2003

Sold by

Evans Robb

Bought by

Johnson Edward and Johnson Gayland

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,925

Interest Rate

5.35%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 9, 1999

Sold by

Elzey Bennett T and Jelen Rudolf

Bought by

Tlc America Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hunter Veralisa | -- | Old Republic Title | |

| Federal National Mortgage Association | $45,465 | None Available | |

| Johnson Edward | -- | Chicago Title Insurance Co | |

| Tlc America Inc | -- | American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Johnson Edward | $48,925 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,468 | $64,687 | $7,571 | $57,116 |

| 2024 | $1,468 | $64,687 | $7,571 | $57,116 |

| 2023 | $1,468 | $67,094 | $7,571 | $59,523 |

| 2022 | $1,477 | $49,621 | $7,571 | $42,050 |

| 2021 | $1,246 | $49,621 | $7,571 | $42,050 |

| 2020 | $1,373 | $52,007 | $7,571 | $44,436 |

| 2019 | $884 | $31,933 | $7,571 | $24,362 |

| 2018 | $459 | $31,933 | $7,571 | $24,362 |

| 2017 | $847 | $31,933 | $7,571 | $24,362 |

| 2016 | $847 | $31,933 | $7,571 | $24,362 |

| 2015 | $421 | $15,809 | $7,571 | $8,238 |

| 2014 | $421 | $15,809 | $7,571 | $8,238 |

Source: Public Records

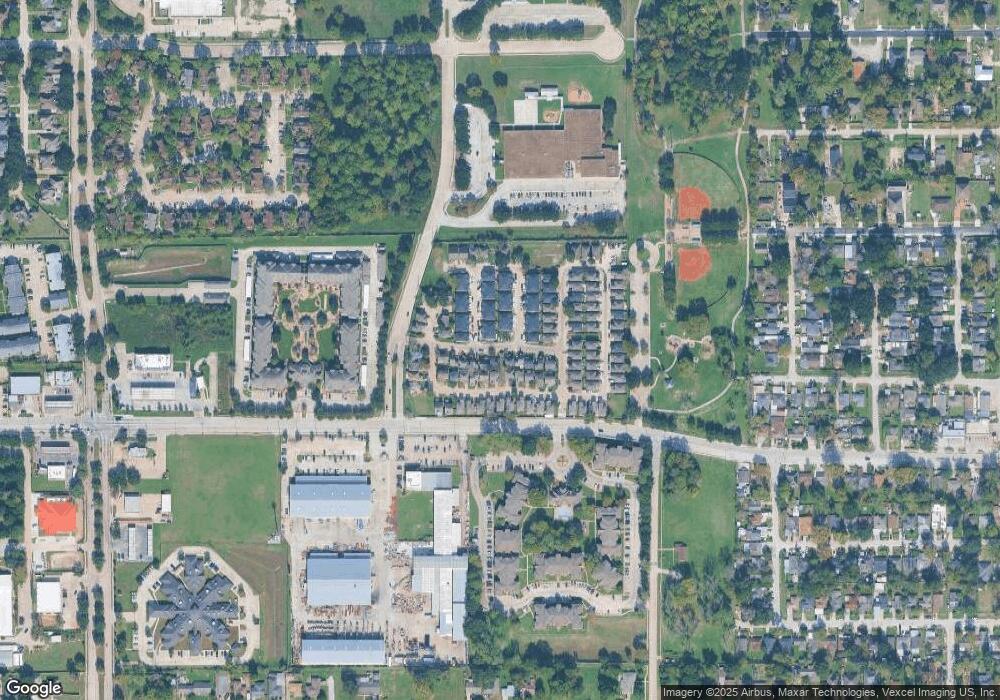

Map

Nearby Homes

- 7050 Inwood Park Dr

- 972 W Little York Rd

- 0 Areba St

- 2703 Areba St

- 2604 Areba St

- 0 Dolly Wright St Unit 24865287

- 3340 W Little York Rd

- 2622 Carmel St

- 2627 Carmel St

- 2456 Walcott Ln

- 7200 T C Jester Blvd Unit 24

- 2814 Dalview St

- 7415 Easter St

- 2475 Carmel St

- 2448 Areba St

- 7413 Easter St

- 2415 W Little York Rd Unit D

- 2418 Mayview Dr

- 2643 Dalview St

- 2639 Dalview St

- 7050 Inwood Park Dr Unit 89

- 7050 Inwood Park Dr

- 7050 Inwood Park Dr Unit 4

- 7050 Inwood Park Dr Unit 67

- 7050 Inwood Park Dr Unit 110

- 7050 Inwood Park Dr Unit 7

- 7050 Inwood Park Dr Unit 51

- 7050 Inwood Park Dr Unit 17

- 7050 Inwood Park Dr Unit 22

- 7050 Inwood Park Dr Unit 116

- 7050 Inwood Park Dr Unit 123

- 7050 Inwood Park Dr Unit 129

- 7050 Inwood Park Dr Unit 127

- 7050 Inwood Park Dr Unit 19

- 7050 Inwood Park Dr Unit 122

- 7050 Inwood Park Dr Unit 124

- 7050 Inwood Park Dr Unit 121

- 7050 Inwood Park Dr Unit 117

- 7050 Inwood Park Dr Unit 107

- 7050 Inwood Park Dr Unit 120