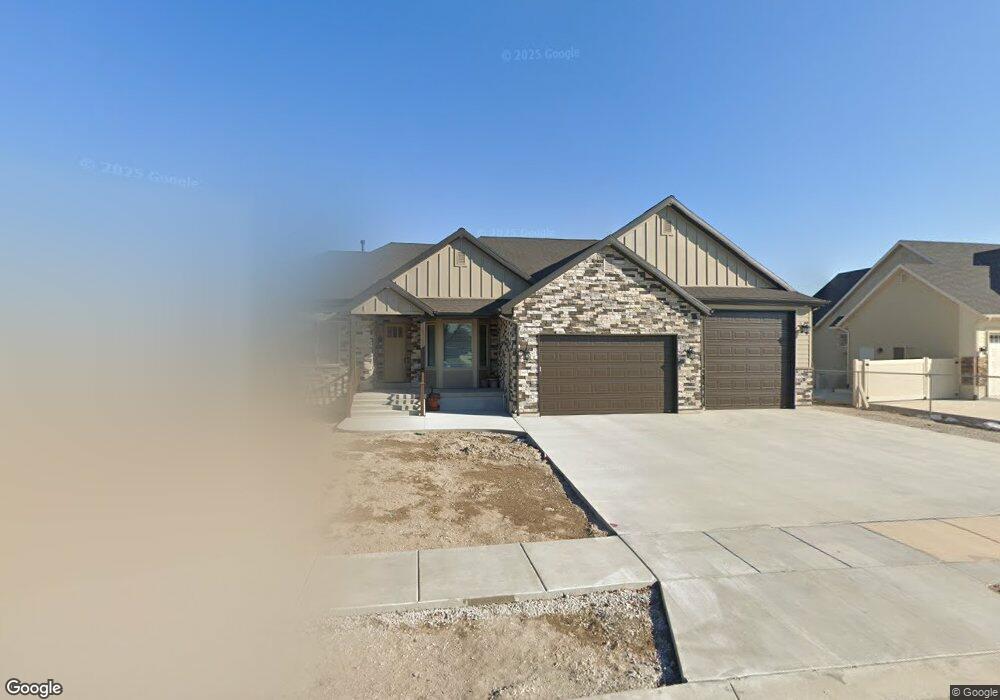

7081 S 2800 W Unit 21 West Jordan, UT 84084

--

Bed

--

Bath

--

Sq Ft

0.51

Acres

About This Home

This home is located at 7081 S 2800 W Unit 21, West Jordan, UT 84084. 7081 S 2800 W Unit 21 is a home located in Salt Lake County with nearby schools including Westland Elementary School, West Jordan Middle School, and West Jordan High School.

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History Compared to Growth

Map

Nearby Homes

- 8524 S Michele River Ave W Unit 109

- 6918 S Harvest Cir

- 2683 W Carson Ln

- 2421 W 6900 S

- 7361 S 2700 W

- 6893 S 3200 W

- 2312 W Hidden Bend Cove Unit 107

- 2510 W Jordan Meadows Ln

- 2573 Jordan Meadows Ln

- 6924 S 2160 W

- 2886 W 7550 S

- 3383 W 6880 S

- 6512 Timpanogos Way

- 7604 S Autumn Dr

- 6672 S 3335 W

- 7647 S 2500 W

- 6925 S Lexington Dr

- 6453 Fremont Peak Cir

- 1951 W 7125 S

- 7721 Sunset Cir