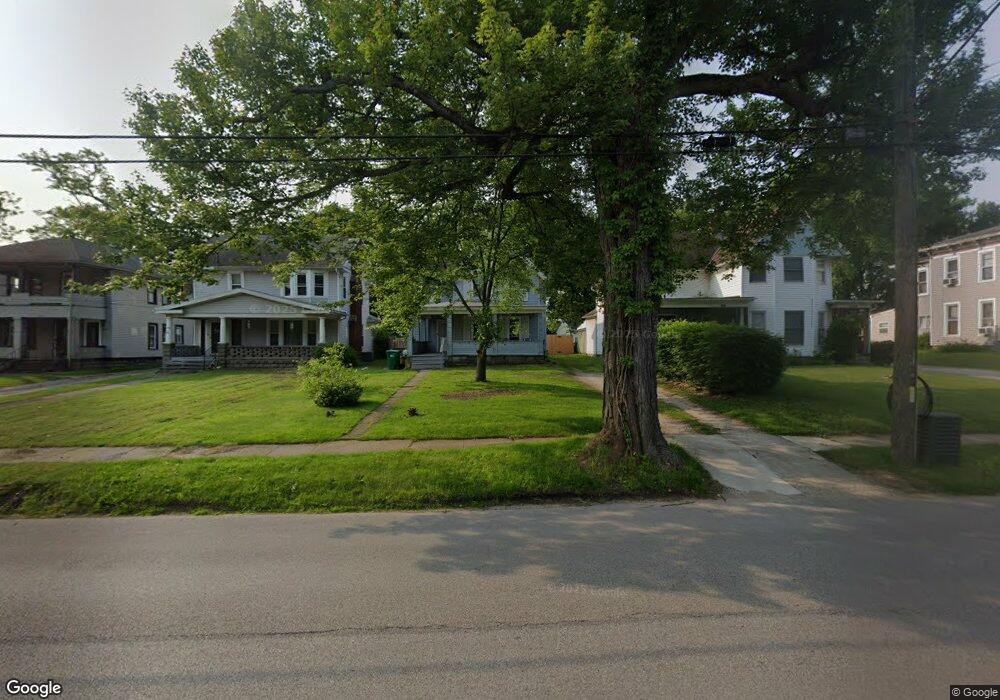

709 Main St Conneaut, OH 44030

Estimated Value: $101,047 - $134,000

4

Beds

2

Baths

1,454

Sq Ft

$78/Sq Ft

Est. Value

About This Home

This home is located at 709 Main St, Conneaut, OH 44030 and is currently estimated at $112,762, approximately $77 per square foot. 709 Main St is a home located in Ashtabula County with nearby schools including Lakeshore Primary Elementary School, Gateway Elementary School, and Conneaut Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 8, 2022

Sold by

New Memories Home Land Trust

Bought by

Macormac Ashlee N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$78,282

Interest Rate

6.33%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 15, 2020

Sold by

Brown Levonnia M

Bought by

Brighter Opportunities Llc and New Memories Home Land Trust

Purchase Details

Closed on

Feb 10, 2006

Sold by

Thayer Margaret B and Thayer Walter E

Bought by

Brown Levonnia M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

6.2%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Macormac Ashlee N | $77,500 | -- | |

| Brighter Opportunities Llc | $21,000 | None Available | |

| Brown Levonnia M | $75,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Macormac Ashlee N | $78,282 | |

| Previous Owner | Brown Levonnia M | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,583 | $21,640 | $2,630 | $19,010 |

| 2023 | $1,009 | $21,640 | $2,630 | $19,010 |

| 2022 | $894 | $16,660 | $2,030 | $14,630 |

| 2021 | $909 | $16,560 | $1,930 | $14,630 |

| 2020 | $908 | $16,560 | $1,930 | $14,630 |

| 2019 | $803 | $14,350 | $1,330 | $13,020 |

| 2018 | $766 | $14,350 | $1,330 | $13,020 |

| 2017 | $382 | $14,350 | $1,330 | $13,020 |

| 2016 | $1,022 | $20,940 | $1,930 | $19,010 |

| 2015 | $3,184 | $20,940 | $1,930 | $19,010 |

| 2014 | $1,967 | $20,940 | $1,930 | $19,010 |

| 2013 | $2,992 | $21,280 | $2,100 | $19,180 |

Source: Public Records

Map

Nearby Homes

- 247 Whitney St

- 589 Main St

- 855 Spring St Unit S9

- 536 Madison St

- 474 Sherman St

- 455 Main St

- 251 St Rt 7

- 18 Hillcrest Ct

- 429 Depot St

- 459 Mill St

- 405 Bliss Ave

- 0 Chestnut St Unit 5120761

- 375 Bliss Ave

- 536 Mill St

- 402 Broad St

- 408 Broad State Rd 7 St

- 289 Harbor St

- 386 Washington St

- 413 Harbor St

- 179 Marshall St