7094 Equator Ln Unit C West Jordan, UT 84084

Estimated Value: $352,000 - $368,000

3

Beds

2

Baths

1,378

Sq Ft

$262/Sq Ft

Est. Value

About This Home

This home is located at 7094 Equator Ln Unit C, West Jordan, UT 84084 and is currently estimated at $360,946, approximately $261 per square foot. 7094 Equator Ln Unit C is a home located in Salt Lake County with nearby schools including Heartland Elementary School, West Jordan Middle School, and West Jordan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 14, 2023

Sold by

Marinoni Stecky

Bought by

Kang Katherine T and Morgan Damon

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,000

Outstanding Balance

$280,299

Interest Rate

6.39%

Mortgage Type

New Conventional

Estimated Equity

$80,647

Purchase Details

Closed on

Jul 26, 2019

Sold by

Nuffer Alexis

Bought by

Marinoni Stecky

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$227,905

Interest Rate

3.82%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 27, 2015

Sold by

Okoniewski Dawid and Okoniewski Maria

Bought by

Nuffer Alexis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

3.97%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 27, 2013

Sold by

Maples Jennifer C and Maples Derek G

Bought by

Okoniewski Dawid and Okoniewski Maria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Interest Rate

2.63%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 22, 2006

Sold by

Keisel R Shane and Keisel Kacey A

Bought by

Maples Derek G and Maples Jennifer C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$29,990

Interest Rate

6.15%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Aug 25, 2004

Sold by

Etherington Matthew W and Etherington Amy

Bought by

Keisel R Shane and Keisel Kacey A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,600

Interest Rate

7.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 3, 2000

Sold by

Compass Cove Development Lc

Bought by

Etherington Matthew W and Etherington Amy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,000

Interest Rate

8.38%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kang Katherine T | -- | Inwest Title | |

| Marinoni Stecky | -- | Integrated Title Ins Svcs | |

| Nuffer Alexis | -- | Surety Title | |

| Okoniewski Dawid | -- | First American Title | |

| Maples Derek G | -- | Equity Title | |

| Keisel R Shane | -- | United Title Services | |

| Etherington Matthew W | -- | Merrill Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kang Katherine T | $288,000 | |

| Previous Owner | Marinoni Stecky | $227,905 | |

| Previous Owner | Nuffer Alexis | $140,000 | |

| Previous Owner | Okoniewski Dawid | $60,000 | |

| Previous Owner | Maples Derek G | $29,990 | |

| Previous Owner | Maples Derek G | $119,960 | |

| Previous Owner | Keisel R Shane | $107,600 | |

| Previous Owner | Etherington Matthew W | $115,000 | |

| Closed | Keisel R Shane | $26,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,835 | $341,700 | $102,500 | $239,200 |

| 2024 | $1,835 | $353,100 | $105,900 | $247,200 |

| 2023 | $1,708 | $309,700 | $92,900 | $216,800 |

| 2022 | $1,897 | $338,400 | $101,500 | $236,900 |

| 2021 | $1,426 | $231,500 | $69,400 | $162,100 |

| 2020 | $1,423 | $216,800 | $65,000 | $151,800 |

| 2019 | $1,328 | $198,500 | $59,500 | $139,000 |

| 2018 | $1,221 | $181,000 | $54,300 | $126,700 |

| 2017 | $1,136 | $167,600 | $50,300 | $117,300 |

| 2016 | $1,225 | $169,800 | $50,900 | $118,900 |

| 2015 | $1,126 | $152,200 | $45,700 | $106,500 |

| 2014 | $1,132 | $150,700 | $45,200 | $105,500 |

Source: Public Records

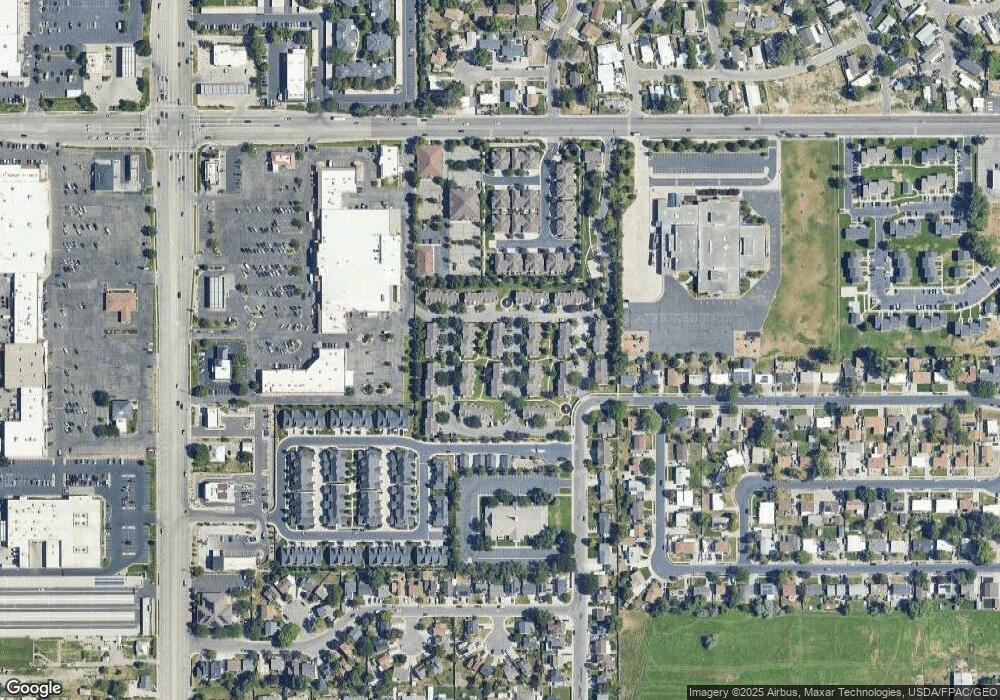

Map

Nearby Homes

- 7118 S Equator Ln Unit 14 B

- 7165 Callie Dr

- 7174 S 1380 W

- 1607 W Beamon St

- 7194 S 1380 W

- 1384 W 7290 S

- 1718 W Trey Way Unit 2

- 7279 S Kenadi Ct

- 7149 S Camelot Way

- 7150 Camelot Way

- 7108 S 1205 W

- 1951 W 7125 S

- 1235 W Athleen Dr

- 1516 W 7470 S

- 6937 S Hollow View Way

- 7340 S Seven Tree Ln Unit 76

- 6925 S Lexington Dr

- 1678 Leland Dr

- 6773 S 1300 W

- 1146 Athleen Dr

- 7094 Equator Ln Unit B

- 7094 Equator Ln Unit D

- 7094 Equator Ln Unit A

- 7094 Equator Ln Unit 7C

- 7094 Equator Ln

- 7094 S Equator Ln Unit A

- 7094 S Equator Ln

- 7094 S Equator Ln Unit 7A

- 7094 S Equator Ln Unit 7C

- 7097 S Longitude Ln

- 7097 S Longitude Ln Unit 6B

- 7097 S Longitude Ln Unit B

- 7095 Equator Ln Unit B

- 7095 Equator Ln Unit A

- 7095 Equator Ln Unit D

- 7095 Equator Ln Unit C

- 7095 Equator Ln

- 7095 S Equator Ln Unit C

- 7095 S Equator Ln

- 7095 S Equator Ln Unit B